Source: Telecommunications Generative AI Study, AWS, September 2023

- Amazon Web Services (AWS) is keen to be the key generative AI (GenAI) platform partner for telcos

- It has conducted a survey of operators to gauge the interest in, and existing use of, GenAI

- Nearly half of all telcos are on course to be using GenAI across multiple use cases within the next two years, up from 19% now

Most telecom operators have identified the potential value of generative AI (GenAI) to their service development and operations strategies, and almost half are expected to adopted it across a number of use cases within the next two years, according to the results of a survey involving 102 telcos that was commissioned by Amazon Web Services (AWS).

The survey’s results have been analysed and compiled in an extensive report that delves into telco attitudes towards GenAI and their engagement related to 17 tested use cases across four telco domains (marketing and product, customer service, network, and IT).

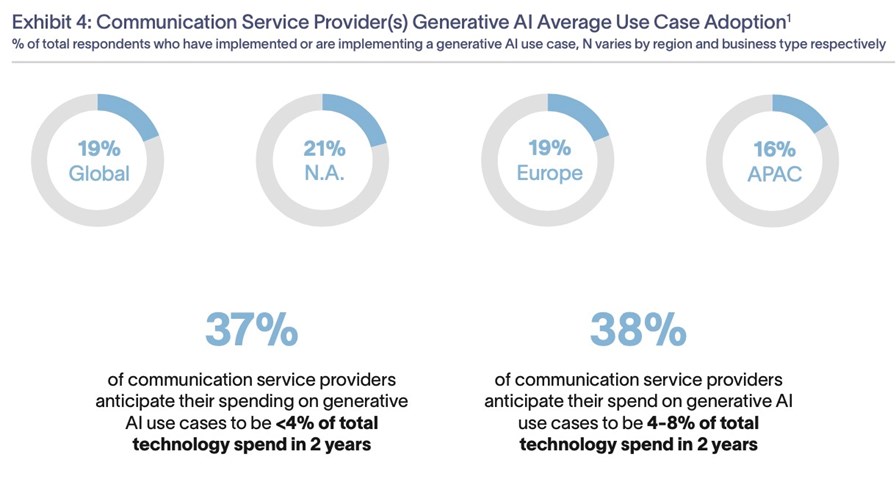

Based on the feedback from senior telco executives in North America, western Europe and Asia Pacific, adoption has been relatively swift and broad-ranging, considering that GenAI fever only started sweeping across the world late last year when ChatGPT was released into the wild. According to AWS, 19% of telcos have implemented, or are in the process of implementing a GenAI use case, though this varies depending on the region, with 21% of respondents in North America already active with GenAI applications and just 16% in Asia Pacific (see the chart above, which also suggests that a growing proportion of telco IT budgets will be targeted at GenAI use cases).

But that average figure of 19% is set to grow quickly, with use case adoption forecast to hit 34% within a year and 48% within two years.

That’s because many telcos believe GenAI enables use cases that are not currently served by existing AI applications and processes, even though the most widely deployed GenAI use case currently is the customer chatbot which, as we all know, is pervasive (though very variable in quality). The survey found that 41% of respondents believe GenAI will enable new capabilities, 23% are not yet sure (neutral) and 36% don’t see the incremental value of GenAI currently.

In terms of the telco domains in which GenAI is likely to be most used, customer service and IT look the most promising. In terms of customer case use cases, 92% of those who responded to questions about that particular domain said GenAI was either being implemented or evaluated and is highly likely to be deployed for customer chatbot applications, while 75% see it as useful for guided employee assistance in terms of knowledge management and troubleshooting.

In the IT domain, 82% are already implementing or expect to implement GenAI tools for automated code generation, debugging and testing, while 79% see it as useful for guided employee assistance and 77% for automated code documentation.

Expectations are not as high in the network domain: Here, the most likely use case is for guided employee assistance for installation, troubleshooting and maintenance, with a score of 62%, while only 55% expect to use GenAI for generative route/network design and network configuration. The highest score in the marketing and product domain was for content generation, with a score of 78%.

TelecomTV is conducting its own AI survey, but it's short, takes just three minutes to complete and will result in a free report that anyone can download from the TelecomTV website. The survey can be found here.

So how will the telcos go about using GenAI? Will they turn to industry specialists that have already developed ready-to-use foundation models or aim to develop their own (using open-source code)? Perhaps not surprisingly, more than 65% of respondents expect to use off-the-shelf models and then train them with their own data – only 15% expect to develop their own foundation model in-house, though AWS notes that further investigation of these results found that many plan in-house development for very focused and relatively small-scale implementations. The other 20% expect to use off-the-shelf models without modification.

And with speed-to-market an important factor here – competitive advantage could be lost by taking a slow and too measured approach to GenAI adoption – 44% of the telco respondents expect to make use of managed services to develop their applications using existing models. This, of course, would suit AWS, which has its own managed service called Bedrock that enables telcos to use a range of existing foundation models from specialist developers such as Cohere, stability.ai, AI21labs and Anthropic – in which Amazon has just announced an investment of up to $4bn – as well as Amazon’s own Titan large language model (LLM).

Let’s not forget also that one of Anthropic’s other investors is South Korean operator, and self-proclaimed AI company, SK Telecom, with which Anthropic is developing a LLM that is optimised for telecom operators seeking to gain operational and competitive advantage from GenAI capabilities. The resulting AI stack will be shared with the Global Telco AI Alliance, the recently formed industry group founded by Deutsche Telekom, e&, Singtel and SK Telecom – see CSP giants form Global Telco AI Alliance.

But the telcos know that making use of GenAI isn’t going to be easy: When asked whether integrating GenAI on top of existing non-GenAI applications and processes will be challenging, 61% agreed it would be, 21% were neutral and only 18% disagreed.

The challenges are significant and vary from region to region. The report’s authors note: “European CSPs are more cautious about adopting generative AI given regional data residency restrictions such as GDPR. Particularly for CSPs outside North America, present and future governmental regulation on AI usage and data restrictions and residency continues to be a key consideration. Countries such as China and the EU are tightening AI regulation and monitoring for AI, while the US and India seek a more passive approach.”

The greatest concerns are related to data security, privacy, and governance, cited by 61% of respondents, while 51% regard a lack of internal expertise to implement and manage GenAI as a concern. Just 46% of the telco survey respondents have concerns about the accuracy and reliability of GenAI output.

Then there are issues around data infrastructure and processes: For foundational models to be trained, the telcos need to know what data they can use, what they want to use, how they want to use it and where it is, and none of that is trivial. Essentially, telcos that don’t have very solid data management strategies and processes are going to struggle to make use of GenAI any time soon.

Indeed, Ishwar Parulkar, chief technologist for telecom and edge cloud at AWS, told TelecomTV that “one of the things we see is that operators with a good foundational data strategy, in terms of modernising their data platform, their databases and data lakes, are a little more advanced in their thinking about [GenAI] use cases.”

Specifically, the survey found that “data-proficient” telcos that tend to have AI centres of excellence, a pervasive use of advanced data analytics and modern data infrastructures (cloud platforms) “are outpacing others in using generative AI for use cases beyond productivity,” such as those that lead to new revenue generation.

And the arrival of the GenAI era is encouraging telcos to focus more on their data management strategies. It has put “a general focus on machine learning and data, and accelerated that journey, compared to how it was,” noted Parulkar. “Data management is the foundation” for any GenAI strategy, he added.

That is likely to result in even broader and deeper engagement between telcos and the cloud platform giants, such as AWS, and while Parulkar didn’t want to get into any specifics about GenAI engagement with the telco community, he noted that “we are engaged with pretty much all of the operators at different various levels of figuring out what they need to do.” It’s notable, though, that Japanese operator KKDI has already announced its GenAI work with AWS and it’s hard to imagine such announcements between telcos and the likes of AWS, Microsoft Azure and Google Cloud won’t become commonplace over the coming year – see KDDI to Collaborate with AWS to Bring Generative AI to Society.

Parulkar has written his own blog about the survey and resulting report, which can be read here – it also includes a link to the report, access to which requires the completion of a registration form.

As you might expect, the report concludes that GenAI is going to play a critical role in the future of telcos. “The fusion of generative AI and telecommunication isn’t just innovative; it’s imperative. Having clear answers to use case types, deployment preferences, and data dependencies, communication service providers can ready themselves for the transformative journey generative AI can enable. To thrive in this dynamic landscape, companies must embrace weaving generative AI into the fabric of their operations.”

It would be surprising if there were any telcos that, ultimately, did not embrace GenAI in a significant way.

To keep track of TelecomTV’s coverage of GenAI, and indeed AI and machine learning in general, check out the dedicated AI/ML content page on our site.

And be sure to register for TelecomTV’s upcoming DSP Leaders summit, The AI-Native Telco, which takes place on 18-19 October.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.