- Operator support for Open RAN is growing

- Market value projections suggest significant expected investments

- Developments ripe for private, as well as public, networks

- M&A activity seems inevitable

There’s a lot of excitement around the prospects for Open RAN right now – including projections that Open RAN technology investments will hit tens of billions of dollars per year by 2026/7 – as well as ongoing scepticism that disaggregated radio access network infrastructure deployments can ‘work’ for network operators. That friction is an interesting dynamic in itself: Open RAN is arguably the most contentious of the telco industry's current religious debates.

But the market momentum behind Open RAN is undeniable – here is just a selection of the operator initiatives and deployments underway right now:

- Rakuten Mobile has launched urban area 4G commercial services in Japan using only Open RAN technology and is now building its 5G network to O-RAN specifications

- DISH is prepping a major Open RAN network build in the US.

- Telefónica has already invested in Open RAN networks in Latin America and is planning significant investments in Europe too in the coming years, with pilots in Germany, Spain and the UK (as well as Brazil) in the coming months with the “intention… to ramp up towards thousands of nodes in these markets,” wrote the operator’s CTO Enrique Blanco in this recent blog, adding that “the ambition is for open RAN to reach up to 50% of the 4G and 5G RAN growth between 2022 and 2025.”

- Deutsche Telekom is collaborating with VMware and Intel on the development of an open virtual RAN platform.

- Vodafone is on course for a rural Open RAN deployment in 2021 and an urban deployment in 2022 and has an Open RAN-based 4G site up and running in the UK with Mavenir as a key technology partner.

- Orange is putting Open RAN to work with Parallel Wireless in Africa ahead of other markets.

- Turkcell is working with Mavenir on its Open RAN deployment. Read more.

There are more examples, and more will certainly emerge in the coming months as major operators such as AT&T and Verizon continue with pilots and trials too. The Open RAN train has left the station: There are now too many major operators putting their weight behind this technology trend, and too many companies directing R&D efforts towards the needs of the Open RAN community, for it to be ignored or relegated to 'lab experiment' status. Open RAN is now too hot to ignore.

What does this mean for the broader market? Well, the crystal ball gazers at some of the leading industry research outfits believe investments in Open RAN technology will surge during the next few years. While outlay is currently quite low, the team at Dell’Oro expects a total spend on Open RAN technology during the next five years of more than $5 billion.

The team at ABI Research has looked further out, expecting Open RAN spending to top $10 billion per year by 2026/7 and hit $30 billion in 2030, and that’s just on public cellular networks: It also expects enterprise, industrial and private network investments in Open RAN technology to hit $10 billion in 2030.

That might seem bold for the enterprise/private sector, but consider how many companies invested in Citizens Broadband Radio Services (CBRS) 3.5 GHz spectrum in the recent auction in the US, which raised about $4.6 billion: While big names such as Verizon and DISH spent the most money, the FCC announced that more than 200 companies, including cable operators, ISPs, utility companies and enterprises, splashed out on licenses and it seems increasingly likely that many of the smaller organizations, and those not already in the wireless services market, will invest in standard hardware platforms and Open RAN software applications if they decide to build their own infrastructure.

And the ready availability of such applications from the equivalent of an open mobile networking app store looks to be not too far away: Part of Rakuten Mobile’s mission is to make its Open RAN developments available to the world via the Rakuten Communications Platform, a full suite of “solutions and services for the deployment of virtualized networks at speed and low cost by telecom companies and enterprises around the world, tailored for their unique needs.”

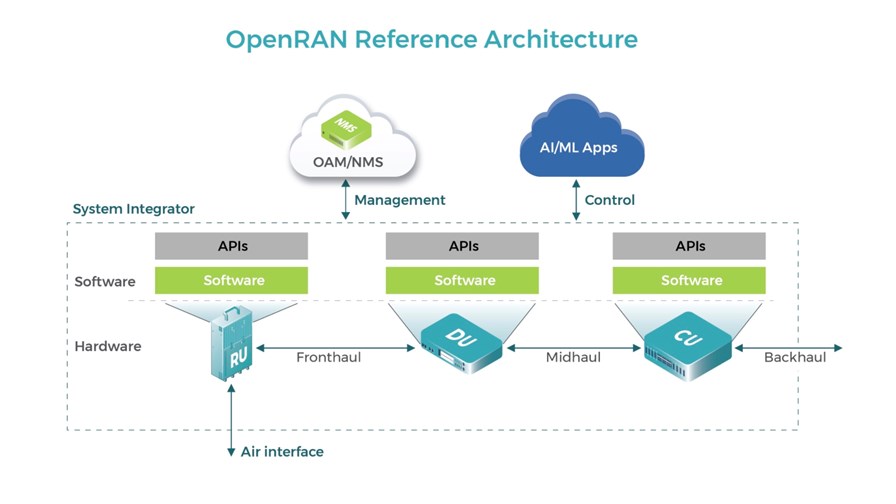

Meanwhile, specifications are being further developed by the O-RAN Alliance and the likes of the ONF (with its SD-RAN program), while the Telecom Infra Project (TIP) is working on reference designs for Open RAN products and related architecture blueprints.

Ecosystem impact

Such trends will excite the likes of Altiostar, Mavenir, Parallel Wireless and JMA Wireless, which have developed virtualized RAN software, and Open RAN-ready radio unit vendors such as Airspan, Fujitsu, NEC and Sercom, as well as the server platform vendors (think Dell, HPE, Kontron, QCT) whose hardware looks set to be widely deployed in Open RAN rollouts.

Less thrilled will be the incumbent RAN vendors – some will be more perturbed than others. Samsung is ready for the Open RAN revolution, while Nokia has been accelerating its Open RAN story and has long been a supporter of the industry groups developing the disaggregated RAN model.

Ericsson is frosty/luke warm: The Swedish giant says it will join in and provide what operators need when the time is right. Huawei is dismissive.

But if the ABI Research team is correct, then the current, dominant proprietary RAN system vendors have something to be worried about, especially if the analyst team’s projection that the value of Open RAN investments will overtake traditional RAN investments in 2028 come true.

This all points towards some likely M&A action: Larger companies will, as ever, want to swallow up the smaller, more focused players to either cut their R&D times and get some ready-made technology or mothball the developments (the latter strategy works less well in a software world…)

The virtual RAN software specialists that have spent years developing the code that is about to become so precious look the most likely targets, but the potential buyers could come from almost anywhere: Whereas the likes of Cisco, or any of the major systems integrators, might look like a reasonable fit, just as likely could be Microsoft Azure, which has already shown this year that it’s ready to splash out on communications networking software firms with its acquisitions of Metaswitch and Affirmed Networks.

The topic of Open RAN has got the TelecomTV team’s juices flowing, so much so that we’ve organized a Summit dedicated to the topic for November – watch out for the agenda and some big name speakers in the coming weeks.

In the meantime, if you’re active in the Open RAN market, or have some thoughts to share, please contact us at [email protected].

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.