- Giant vendor has reported its second-quarter financials

- Its broad portfolio and the India market helped temper the US slowdown

- Nokia expects ‘macroeconomic challenges’ to impact revenues for the rest of the year, hence its recent revamp of its full year sales and margin expectations

- It’s suffering the same pressures as Ericsson, but believes these will be short-lived

Not for the first time, Nokia’s broad telecom network technology portfolio is helping it to weather an economic storm, with the giant vendor reporting second-quarter 2023 revenues of €5.7bn and an operating profit margin of 8.3%, down from 9.6% a year ago. While that sales number is 3% lower year on year, once currency exchange fluctuations are stripped out, the revenues are in line with a year ago, and right now flat year-on-year sales is creditable for a major vendor that generates a lot of business from large telcos that are tightening their purse strings. The near-term challenge is that current spending patterns are not set to change for the rest of this year: the optimistic medium- and long-term view is that ever-increasing data traffic volumes will drive ongoing investments in all parts of the communications networking sector and provide Nokia with a healthy pipeline of business.

That the second-quarter financial numbers are not worse is due largely to Nokia’s expansive product line and its global customer base – revenues from some parts of its business (IP routing and fixed broadband products, telco customers in North America) are shrinking right now but revenues from others (optical and mobile networking product lines, telcos in India and enterprise customers) are growing, and while customer spending in the US market in particular is dire right now, in India it’s booming due to the rapid pace of 5G network rollouts, and Nokia’s sales in Europe have improved. All in all, the ups and downs have largely evened themselves out.

That’s not to say the results are great – they’re just not as bad as they could have been given current network infrastructure market conditions. Large vendors, such as Nokia and Ericsson, are feeling the impact of reduced spending by Tier 1 telcos, especially in the US, and this is compounded by generally negative macroeconomic trends, as inflation lights a fire under costs, and higher interest rates squeeze capital investments in general.

That’s why, at the end of last week, Nokia cut its sales and earnings outlook for the full year, just as Ericsson was reporting a year-on-year slump in like-for-like revenues of 9% for its second quarter and warning of “weaker demand” during the second half of this year – see Ericsson, Nokia suffer from capex crunch.

Pekka Lundmark, Nokia’s CEO, added to the second-half warning proclamations in the vendor’s earnings report. “Earlier in the year I highlighted that we were starting to see signs of macroeconomic challenges along with inventory digestion impacting customer spending and this has intensified through the second quarter. In the second half, we expect these trends to continue to impact our business,” he noted. Hence the reduction in expected full year sales, which are now expected to be in the range of €23.2bn to €24.6bn – previously it had expected sales in the range of €24.6bn to €26.2bn. In addition, it has reduced the upper end of its expected operating margin rate from 14% to 13%.

It was the vendor’s Network Infrastructure unit – which comprises its fixed broadband, optical, service provider IP routing and submarine networks product lines and which overall generates more than one-third of the company’s sales – that suffered a significant year-on-year dip in revenues, down by 6% at constant currency rates to €1.98bn, with much lower IP routing and fixed broadband equipment sales dragging the numbers down.

Lundmark commented further during the vendor’s earnings webcast held on Thursday morning.

“In IP networks, we saw some weakness primarily related to CSP spending in North America,” resulting in an 11% drop in sales to €618m – financial analysts believe that much lower spending by AT&T is the main reason for this dip. “In fixed networks, we are seeing two primary effects,” noted the CEO. “Firstly, we are facing some headwinds… [in our] fixed wireless access business, which remains sensitive to a small number of customers,” while Nokia also experienced a drop in customer premises ONT (optical network terminal) devices as network operators opted to use stocks they had previously built up in their inventories rather than invest in additional units.

The vendor’s optical networking product line, meanwhile, reported a 16% year-on-year increase in like-for-like sales to €492m. “While we are seeing weakness elsewhere, our expectations for optical is one area that has actually improved since the start of the year,” noted the CEO, an interesting observation given that it comes only a couple of days after research house Dell’Oro Group highlighted the durability of the optical networking sector, where growth is expected for the coming five years.

So the impact was very specific to certain product lines, and Lundmark was quick to note that the current blips are expected to be temporary.

“Whilst we see some short-term challenges impacting the business, particularly with a softening environment for CSP spending, we remain highly confident in the opportunities ahead for our Network Infrastructure [division]. In optical, we continue to believe we are gaining market share and… we are very optimistic about the potential to continue to grow in this business. In fixed [broadband] networks, we understand there might be some concerns that we are now seeing some slowdown in sales, which is why we want to make it clear… that the decline is primarily related to fixed wireless, due to its sensitivity to a small number of customers,” stressed the CEO. “In fibre [passive optical networking equipment for fibre-to-the-premises rollouts], after two to three years of significant growth, we are now seeing some moderation in growth rates and some short-term inventory digestion. But the outlook remains strong for this business, with a number of government subsidy programmes in both the US and Europe only just starting to benefit the market,” added Lundmark.

And even though IP routing sales have declined recently, Nokia is also confident that this part of its business has a healthy future, as up until now the main focus has been on service provider edge routing, a focus that has over the past 15-plus years been highly successful, delivered billions in revenues and helped it to build a market share in the high twenties even though it is up against the likes of Cisco, Huawei and Juniper. But that business has traditionally relied on significant sales to a relatively small number of telcos, so when network operators scale back their capital expenditure (capex) it hits this line of Nokia’s business quite hard, which is why Lundmark and his team are looking to diversify the customer base. So the vendor is branching further into the core routing sector, with hyperscaler customers in mind in particular, and is aiming its carrier-grade edge routing systems at high-end enterprise users that, more and more, are demanding the same kind of scalable and secure systems that are used in telco networks.

Network Infrastructure, of course, isn’t Nokia’s biggest division in terms of sales: Its Mobile Networks unit generated second-quarter sales of €2.62bn, up by 5% at constant currency rates thanks mainly to the massive ramp in sales in India, plus a decent performance in Europe, more than compensating for the sales shortfall in North America. But as Ericsson noted recently, sales in India come with lower margins, so the mobile infrastructure business reported a decline in operating margin to 7.9% from 11.2% a year ago.

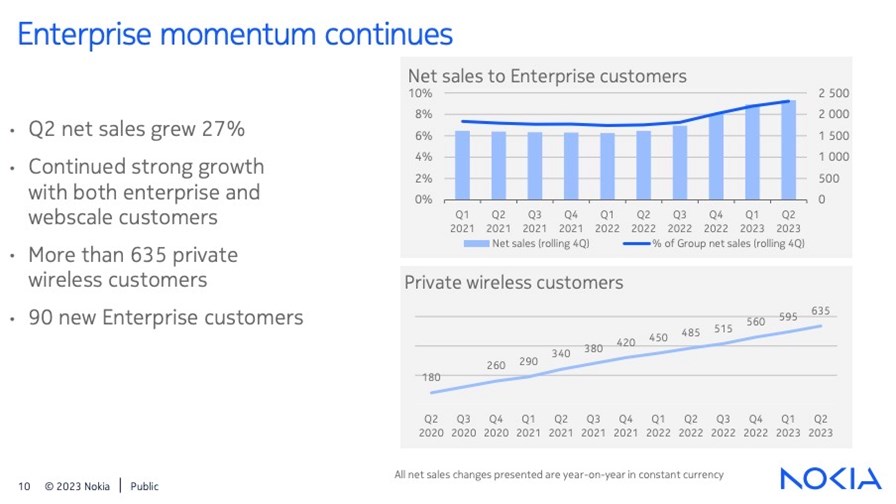

Lundmark also called out the growing sales and opportunities with enterprise customers in general, a sector that includes the hyperscalers that are primarily buying optical and IP networking products from the vendor. Nokia says its revenues from enterprise customers grew by 27% year on year in the second quarter, during which time an additional 90 customers were signed up. A long-time focus for Nokia in this particular part of the market has been the sale of private wireless network systems, and the vendor says it now has 635 customers in this sector, as the chart below shows.

Source: Nokia Q2 2023 earnings presentation.

Nokia’s share price has hardly changed today at €3.54 on the Helsinki exchange despite the lower margins and news of a challenging second half of the year, but that’s because the stock took a hit of about 5% when the vendor pre-announced its revised forecast for 2023 on 14 July. While the vendor’s management team is bullish about future growth and ongoing demand for its products, it still faces the fact that the company is valued by investors at less than €20bn, less than its annual revenues, and that’s not a sign of an attractive business with very healthy long-term prospects.

So Lundmark still has a lot to do to turn Nokia into a company that attracts investor faith and a growing valuation – some might say the increasing focus on, and sales from, the enterprise market might help, but every major vendor has exactly the same strategy. The long-term challenges for Nokia and its ilk are not insignificant.

- Ray Le Maistre, Editorial Director, TelecomTV