via Flickr © Jim Larrison (CC BY 2.0)

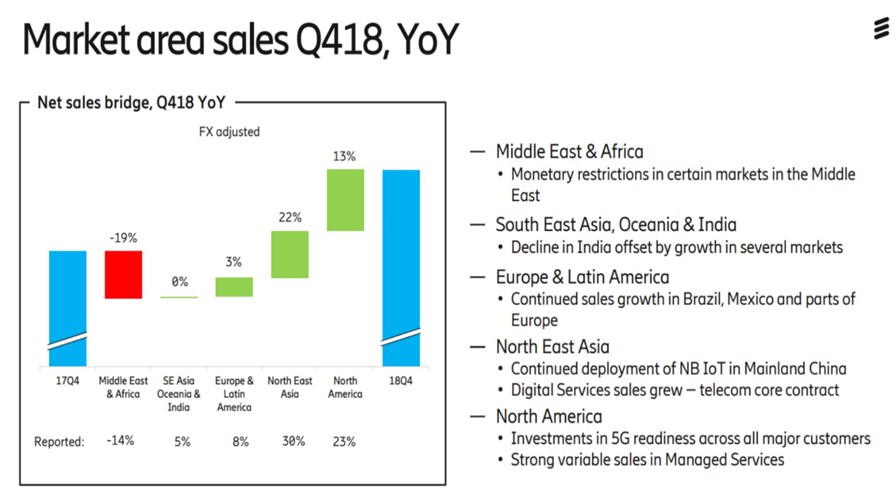

- It’s down in some regions but up in others

- It’s especially up in North America

- Ericsson prefers not to speculate, but Huawei’s troubles must have had quite a bit to do with its own good fortune

Ericsson deserves some good luck. For so long it seemed unable to put a foot right. Its various bets - on ‘everywhere TV’, digital media and IoT, for instance - were all too late or too early or too small. Even its investment in BSS failed to find traction with customers. And despite the difficulties, Ericsson still does have many telco customers.

The result? Ericsson seems to have spent the last decade and a half cutting back, ridding itself of underperforming divisions and then slashing its world-wide workforce to match.

Eventually, when no single restructuring appeared to work its magic and Ericsson’s financial performance maintained its steady downward direction, the firm bowed to the inevitable in 2017 and announced that it would concentrate on its core market. Telcos.

After all, one way or another a spending uptick (probably not ‘spree’) by the world’s telcos would happen sooner or later. Ericsson would be ready with 5G radio and network infrastructure when that time arrived.

So today it’s been explaining why that flickering in the distance is actually the light at the end of the tunnel. It’s performance this year is nothing like the start of a hockey stick curve but it is, the company claimed in the web-based results session, proof of the competitiveness of its strategy.

It says it now has a clear focus on service providers and is a stronger company as a result. It’s experienced its first top line growth since 2013; has invested significantly in R&D; has put lots of effort (and cash) into field trials and demonstrations of its technology and has been rewarded already with real growth of around 1 per cent. Even though its net income is still negative, its dividend this year is 1 Krona per share as a sign to investors of things to come.

On the ‘to do list’ is more investment in the core network and cloud native which is now accepted as the way forward for the virtualized telco cloud and is expected to prove crucial for maximising the service provider benefits of advanced 5G: you can effect 5G without a virtualized network (just), but you need a cloudified, cloud native network architecture to do things like network slicing to instantiate the advanced business services that customers are, we’re told, expecting.

So there’s been substantial growth in North America (much of it, one suspects, driven by Huawei’s absence there) a little growth in Western Europe and South America while Asia appears to have flat-lined.

Source: Ericsson

Full-year highlights

- Sales as reported increased by 3% and sales adjusted for comparable units and currency increased by 1%, with Networks growing by 3% – the first year of organic growth for Ericsson since 2013.

- Gross margin was 32.3% (23.3%). Gross margin excluding restructuring charges improved to 35.2% (25.9%), supported by cost reductions, the ramp-up of Ericsson Radio System (ERS) and the review of managed services contracts.

- Operating income was SEK 1.2 (-34.7) b. Operating income excluding restructuring charges was SEK 9.3 (-26.2) b. driven by higher gross margin and sales as well as lower operating expenses.

- Cash flow from operating activities was SEK 9.3 (9.6) b. Free cash flow excluding M&A amounted to SEK 4.3 (4.8) b. Net cash at year-end was SEK 35.9 (34.7) b.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.