Palo Alto, Shanghai, Singapore and Reading (UK) – Wednesday, 1 May 2019

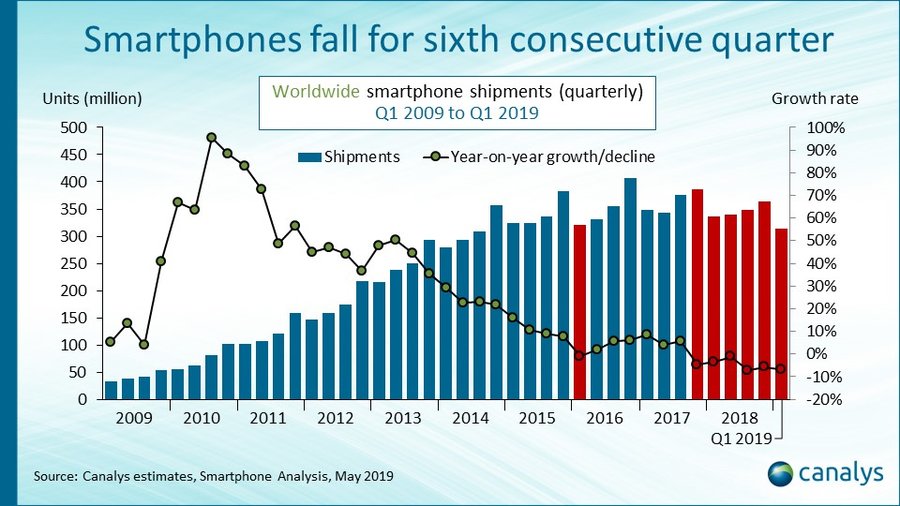

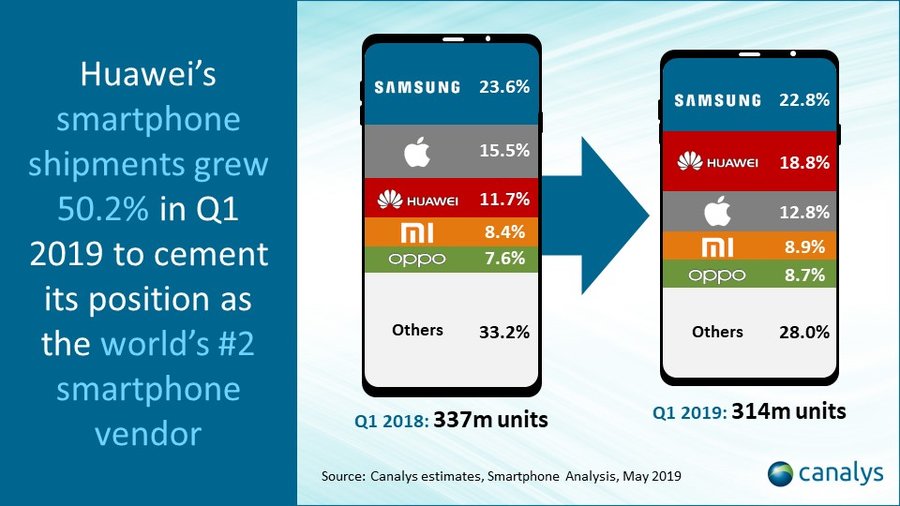

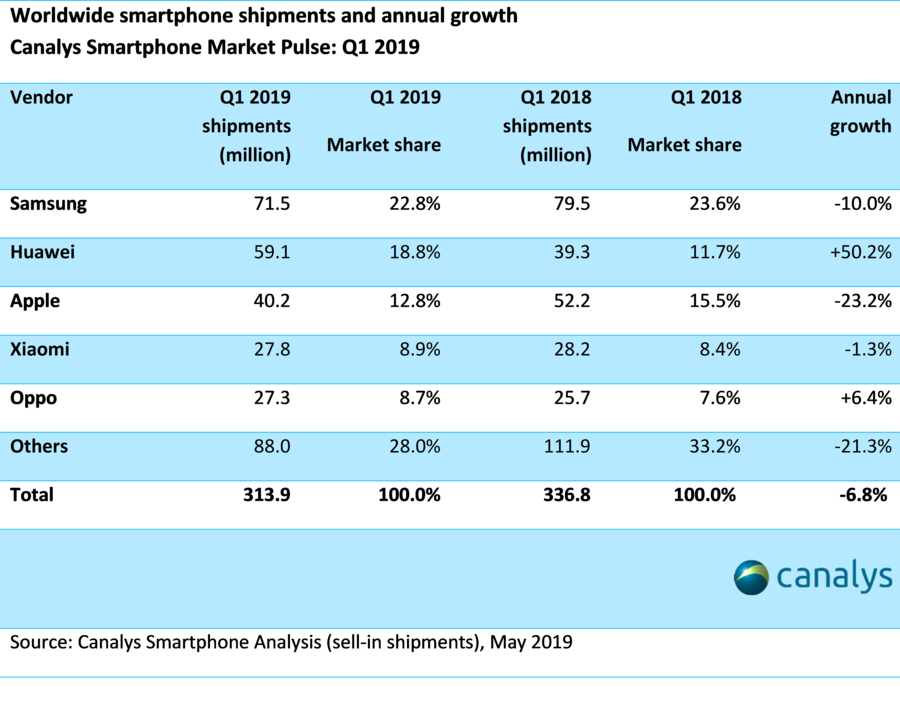

Global smartphone shipments fell 6.8% in Q1 2019, marking a sixth consecutive quarter of decline. The total number of units shipped, at 313.9 million, was the lowest in nearly five years. Samsung remained the leading vendor, but its shipments fell 10.0% to 71.5 million units. Huawei was the chief beneficiary, with a 50.2% surge to 59.1 million units. But Apple, which has so often bucked the industry trend, was the hardest hit of the big vendors. Its iPhone shipments dropped 23.2% to 40.2 million units.

“This is the largest single-quarter decline in the history of the iPhone,” said Senior Analyst Ben Stanton. “Apple’s second largest market, China, again proved tough (see Canalys press release: Huawei gains record 34% of China’s declining smartphone market). But this was far from its only problem. Shipments fell in the US as trade-in initiatives failed to offset longer consumer refresh cycles. In markets such as Europe, Apple is increasingly using discounts to prop up demand, but this is causing additional complexity for distributors, and blurring the value proposition of these ‘premium’ devices in the eyes of consumers. Apple was also hit by a tough year-on-year compare against Q1 2018, when demand for the new iPhone X spilled over from Q4 2017. However, iPhone did show signs of recovery towards the back-end of the quarter, and this momentum will carry into Q2.”

The smartphone market continues to consolidate as it shrinks, with the top five vendors’ combined worldwide market share rising from 66.8% to 72.0% over the past year.

Huawei has been public in its aim to usurp Samsung as the world’s leading vendor by 2020. “To overtake Samsung, Huawei needs to find at least another 10 million shipments in a single quarter,” said Canalys Analyst Mo Jia. “It is not possible to take this many new customers in a single market, such as China, nor is it possible to focus only on growth markets, such as Russia and Indonesia. Huawei needs to battle on all fronts, including saturated and mature markets, such as Western Europe. Its foldable phone, the Mate X, may be making headlines, but it will not actually be significant in this battle. Instead, it hinges on Huawei’s ability to take customers in the low-to-midrange price bands (handsets priced between US$100 to US$300). These models are Huawei’s core strength, and there are between 130 and 140 million devices shipped in this price range by its competitors every quarter around the world, excluding the US.”

“But it will not be easy for Huawei,” said Research Analyst Shengtao Jin. “Samsung is now fighting back with a revamped A Series and will roll out its new low-cost M Series to more markets around the world in 2019. It is set to defend its position more aggressively, with an explicit focus on hardware. And other Chinese rivals, such as Xiaomi and Oppo, are starting to emulate Huawei’s overseas success. Xiaomi is now the dominant player in India (see Canalys press release: Vivo rockets 108% in India’s flat smartphone market in Q1 2019), while both Xiaomi and Oppo are attempting to dislodge Huawei from network operator portfolios in Europe. The smartphone market may be shrinking, but this is only serving to inject the market with more energy. It is more competitive now than it has ever been.”

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.