Nokia, Huawei, VMware lead $4B+ network automation software market: Report

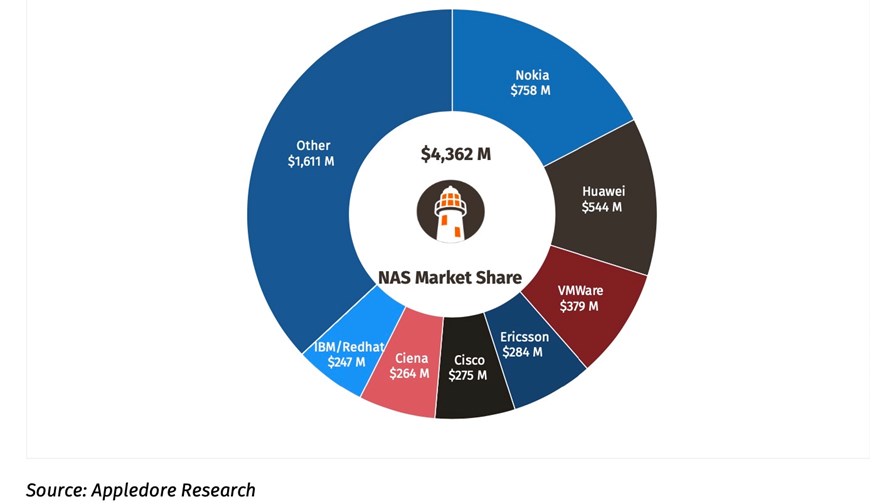

Appledore Network Automation Software Market by Supplier, 2020

- The market for network automation software is fragmented

- Appledore Research has analyzed the multiple elements and key vendors

- Nokia has the single largest market share

- But the fact that VMware holds the #3 position points to sector transformation

Nokia, Huawei and VMware were the three leading suppliers of Network Automation Software (NAS) to CSPs (communications service providers) in 2020, according to a new report from Appledore Research.

Nokia, as the chart above shows, was the market leader with a 17% share of the $4.36 billion sector, which Appledore has broken down into six key categories of software products:

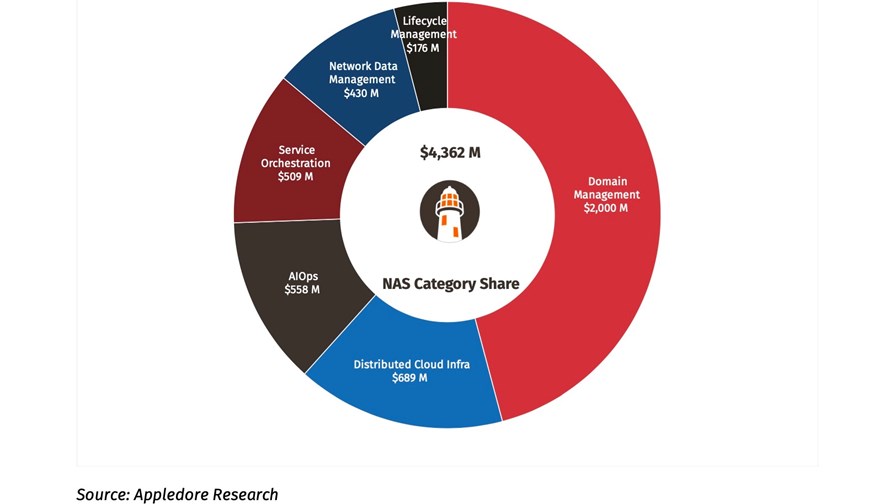

- Artificial Intelligence Operations (AIOps) – the applications that use network (and other) data to drive decisions and processes.

- Service Orchestration – end-to-end control of network services and functions.

- Domain Management – largely, the classical “network-facing” functions.

- Distributed Cloud Infrastructure Management – software used to automate and optimize network inventory, place workloads.

- Network Data Management – collection, storage, presentation of network data of all kinds.

- Component Lifecycle Management (LCM) – software for automation of test, validation, onboarding and retirement of (software-ized) network functions.

Domain Management was the largest segment in 2020, valued at about $2 billion, followed by Distributed Cloud Infrastructure Management at $689 million. (Cloud-Native Network Functions are also considered part of the NAS sector but have mostly been excluded from this particular market analysis.)

Appledore Network Automation Software Market by Category, 2020

To see which companies fall into these categories, see this Appledore blog.

This taxonomy “offers a clearer view of what CSPs are actually spending on, and to what end,” notes the Appledore team, which has decades of experience in tracking, analyzing and working in the telecoms software market. In addition, the analysis of the software market has focused on “where it is going (disaggregated), rather than where it has been (integrated functional siloes),” so providing a more relevant view of what is normally referred to as the OSS market.

They key takeaway from the report is that “automation is now the dominant driver of CSP spend on software” in a market that has been transformed by a shift towards more cloud-oriented architectures and operational efficiencies. “While RoI based on cost savings remains an important factor, it is a secondary factor in buying decisions – CSPs are more interested in how new software spend will deliver greater automation,” note the report’s authors.

That in turn is leading to a shift in procurement decision-making, and while network equipment providers (NEPs) dominate the leading market share positions, that position is under threat: That VMware is the third largest supplier, with a market share of 9% in what is a very fragmented market, is “an indicator of the structural transformation” in the sector, according to Appledore.

For the time being, though, the big NEPs dominate the high end of the market share rankings, with Ericsson, Cisco and Ciena lining up after VMware, with IBM/Red Hat taking seventh position with a 5.7% market share in 2020.

For more on the report, Leading Suppliers in Network Automation Software: A Market Transformed, check out this Appledore Research blog.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.