© Bell Labs Consulting

- IoT devices to reach 46bn units by 2020 and disrupt the way networks are managed

- Audio and video streaming will account for 80 per cent of increased 2020 traffic

- Only 81 per cent of 2020 global demand will be met by WiFi and mobile

- Operators must accelerate their path to 5G, NFV and SDN

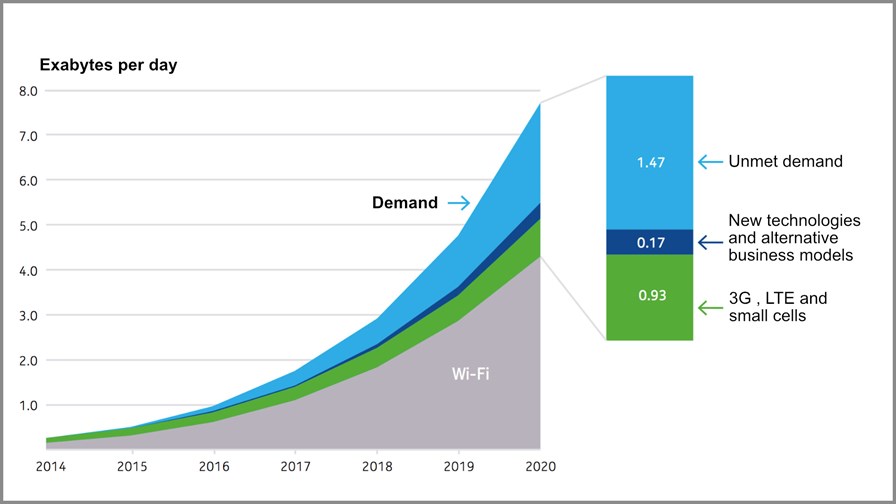

By 2020, 19 per cent of the worldwide consumption demand forecast for connectivity will not be able to be met by today’s network operators, based on current and projected economics. That’s according to a new study from Bell Labs Consulting, which uses its own research on people’s desire for digital content and services rather than extrapolating to predict future mobile traffic trends. And that’s it’s best case scenario – adopting a more disruptive model would see 25 per cent of demand being unmet by telcos.

It believes that 67 per cent of the worldwide consumption demand forecast can be met by WiFi, with another 14 per cent addressed by the current adoption rate of 3G, LTE, small cells and the emergence of new technologies such as 5G. Between now and 2020, that leaves 19 per cent. The answer, says Bell Labs, is for telcos to accelerate their path to 5G and cloud technologies, such as NFV and SDN, and adopt new business models to address the demand gap.

The emerging unknown in the network equation is the Internet of Things (IoT), with the number of IoT connected devices expected to grow from 1.6bn in 2014 to between 20 and 46bn by 2020. Of this total, cellular IoT devices will be between 1.6bn and 4.6bn in 2020, yet the overall cellular traffic generated by IoT devices will only account for 2 per cent of the total mobile traffic by 2020 until video-enabled sensors and cameras begin to predominate. Bell Labs Consulting found that audio and video streaming will be the highest contributors to the increased traffic demand in coming years, accounting for a 79 per cent total increase by 2020 – in fact, video applications in total will account for 56 per cent of demand.

However, even in the near term IoT traffic will generate a substantially higher volume of signalling traffic relative to data traffic. For example, a typical IoT device may need 2,500 transactions or connections to consume 1MB of data, while the same amount of data can be consumed in a single mobile video connection. As a result, daily network connections due to cellular IoT devices will grow by 16 to 135 times by 2020 and will be three times the connections initiated by human generated traffic.

“The next evolution of humankind will involve 'life automation', and the creation of a world in which billions of interconnected things including smart objects, cameras, robots, sensors and processes exchange real time video and data streams,” said Marcus Weldon, president of Nokia Bell Labs and CTO. “Not only with people, but with cloud-based systems that extract knowledge from this data and perform tasks to make our work and home lives more convenient and our environments more intelligent. This new digital era will produce a dramatic shift in demand, challenging mobile operators to achieve the highest performance at the lowest cost per bit while supporting extensive personalisation."

The study sought to address three key questions:

- How big is the potential demand for new services today and by how much will it grow by the year 2020 — globally and regionally?

- How much of that demand can be met by unlicensed spectrum solutions and how can mobile operators profitably deliver the remaining (high mobility, long range, high performance) services?

- How does the network have to change?

We recommend you download the report for the full facts. But it is worth covering the profitability question now, and it’s by no means an easy one. Bell Labs concludes that the potential unmet demand can be significantly reduced or eliminated by a dramatic move to next-generation technologies and architectures. However, the cost of this transition needs to be analysed on a case-by-case basis, as it is highly dependent on the current state of network infrastructure, labour costs, rights of way and local regulatory constraints, as well as the suitability of operational support systems.

Expect more work and analysis from Bell Labs and others, as operators realise that they need to push down the cost per gigabyte of delivering the massive traffic increases over the next four years – through a combination of adopting new technologies and creating new business models.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.