- NTT Docomo has long had plans to build an international business based on its Open RAN expertise

- The Japanese operator has now unveiled the Open RAN ecosystem experience (Orex) suite of technologies and services it is offering to other network operators

- The Orex portfolio comprises tech that the operator has developed itself plus elements from multiple big name and specialist technology partners, including Nvidia

- It has deployed a version of Orex in its own 5G commercial network

As long promised, Japanese operator NTT Docomo, one of the most influential and innovative telcos in the industry, has fully launched its Open RAN ecosystem experience (Orex) portfolio to the global market in an effort to become a dominant force in the development of cloud-oriented next-generation mobile networks.

Docomo signalled its intent to build a commercial proposition based on its early Open RAN experience and offer it to other network operators around the world as long ago as February 2001, and has been working with its technology partners on the proposition since then – see NTT Docomo spearheads new 5G Open RAN Ecosystem.

Now Orex, which conforms to O-RAN Alliance specifications, has been launched to coincide with the first day of the MWC Las Vegas event, which suggests where Docomo believes it might pick up some Open RAN businesses.

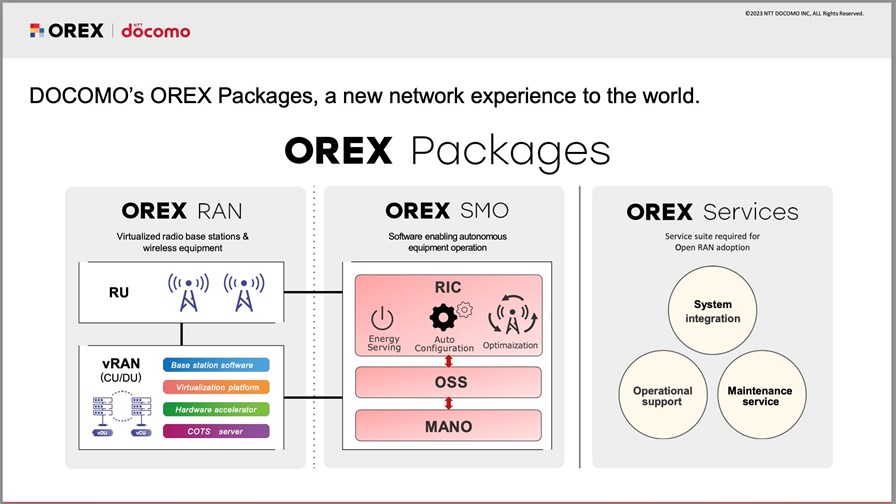

It launches with three pillars to its Orex offer: The radio access network or RAN (comprising radio unit, distributed unit and centralised unit software and hardware); the service management and orchestration, or SMO, which includes the RAN intelligent controller (RIC) platform, the OSS (operational support system) and MANO (management and orchestration) software elements; and services, including integration, operational support and maintenance services.

For the virtual RAN (vRAN) part of the RAN pillar, it currently has 13 partners – AMD, Dell Technologies, Fujitsu, Hewlett Packard Enterprise (HPE), Intel, Mavenir, NEC, NTT Data, Nvidia, Qualcomm, Red Hat, VMware and Wind River. All but one of those companies were named as Docomo’s Open RAN partners in February 2021 except for HPE, which has since joined the fold. (Note that the initial partner list included chip firm Xilinx, which is now part of AMD.)

How do those partners fit together? You can see the stack and the role the various technology collaborators play on the Orex website.

It also has a number of radio unit partners that can provide products that have already been proven to integrate with the vRAN stacks – those radio partners are Dengyo Technology, DKK Co, Fujitsu, HFR, Mavenir, NEC and Solid.

With the various vRAN and radio unit combinations, Docomo believes it has a multivendor, best-of-breed offer that will suit the needs (and spectrum assets) of most network operators globally.

Right now, though, the most interesting vRAN combination is the one that NTT Docomo is deploying into its commercial 5G network as of 22 September – that combination comprises Fujitsu’s vRAN software, Wind River’s Studio virtual infrastructure platform, accelerator and Aerial vRAN technology from Nvidia and Intel processor-based commercial off-the-shelf (COTS) servers. You can find out more in this announcement from Docomo, this press release from Fujitsu, and this release from Wind River. The deployments have just begun and the Orex solution will be used as Docomo further rolls out its 5G network.

The SMO, including the RIC platform, appears to be the result of in-house developments at the Japanese operator: Docomo certainly noted earlier in the year that it had its own RIC underway in its R&D labs.

Essentially, Docomo believes that Open RAN will be the future architecture of mobile networks. It has been deploying Open RAN systems in its 4G network for a few years already, so has plenty of experience with the way such systems perform and interoperate with a traditional telecom network. By deploying an Orex solution into its commercial 5G network, it’s essentially saying to operators around the world that this isn’t slideware – this is real technology being used in one of the most demanding network environments, so it’s already proven to work.

If that pitch sounds familiar, that’s because it’s roughly the same as the one from one of Docomo’s domestic rivals Rakuten Mobile, which has taken the technology and experience it has gained from rolling out a virtualised, cloud-native and mainly Open RAN-compliant 4G and 5G greenfield network architecture in Japan, and bundled it up and offered it to operators around the world via its Rakuten Symphony subsidiary. This has had success with a number of customers in Europe, the Middle East and North America – Symphony’s biggest project, building a greenfield Open RAN network in Germany for 5G newcomer 1&1, will be put to the test in December when 1&1 starts offering its own mobile services at scale.

Docomo isn’t starting from scratch, though. It has already been working with various operators on joint Open RAN developments, including South Korea’s KT, Vodafone Group, Dish Wireless in the US, Singtel in Singapore and Smart in the Philippines – see Open RAN community cranks up the volume at #MWC23.

There are lots of interesting avenues to explore with what Docomo is doing with OREX, but it’s certainly worth noting here that Nvidia, the AI chip developer that can hardly keep up with demand for its graphics processing unit (GPU) products right now, is once again at the heart of an innovative RAN development. It’s not that long ago that it unveiled its engagement with yet another forward-thinking Japanese operator, SoftBank, claiming at the time that it has the answers to some of the current performance challenges facing vRAN and Open RAN networks with its accelerated compute hardware – see Nvidia smells blood in the RAN.

Docomo is making some bold claims with its Orex pitch in terms of operating cost and power-consumption savings, but there’s little information or insight into the comparisons or into how valid such claims are.

What Docomo needs next, to add to its own deployment, is for another operator to show its faith in Orex and commit to an Open RAN rollout – that would really move the needle in the RAN sector.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.