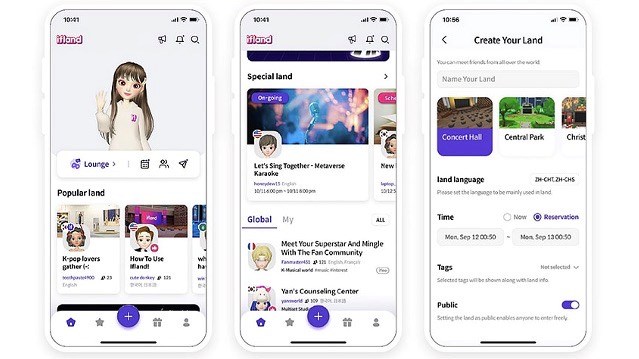

Images of ifland’s global version.

- SK Telecom takes its metaverse platform far and wide

- As Openreach puts the brakes on its UK FTTP rollout, CityFibre teams up for broader expansion

- Analysys Mason highlights telcos’ vulnerabilities

In today’s industry news roundup: SK Telecom is starting to fulfil its international metaverse ambitions; Openreach scales back its near-term UK fibre rollout plans; CityFibre finds a friend in toob; Analysys Mason says telcos are underperforming; and more!

South Korean operator SK Telecom (SKT) is demonstrating just how eager it is to become a global leader and influencer in the metaverse era. Following a launch in its domestic market in July 2021, the company announced that from today its ifland platform is available in 49 countries and territories across Europe, the Middle East, Africa, Latin America, North America and Asia. SKT wants to “shape ifland into a global leading social metaverse platform”, although (at least for now) it only supports English, Chinese and Japanese. The telco noted it will utilise K-pop music content to boost the appeal of its platform on an international stage, as well as develop tailored “attractive content” and expand the platform’s presence through partnerships with other major telcos. Currently, it is working with e& (formerly known as Etisalat Group) for collaborations in the Middle East, Africa and Asia, and with Singtel in south-east Asia. It also announced a metaverse collaboration with Deutsche Telekom earlier this year that is focused on the European market. And just a few days ago the South Korean company also partnered with Japan-based telco NTT Docomo to jointly develop content and technology for their respective metaverse services, as part of a wider collaboration move.

Belt-tightening at BT has led to a change in fibre network rollout focus at Openreach, the UK national operator’s quasi-independent fixed access network division, reports The Financial Times. According to the newspaper, which cites a letter that has been sent to suppliers, Openreach is to scale back its fibre-to-the-premises (FTTP) rollout timetable and focus on existing rather than planned deployments in order to get more “bang for its buck” as prices rise and costs increase. The letter notes that suppliers will be financially impacted as some rollouts that had previously been planned will be suspended or cancelled, which is bad news for the likes of Nokia and Adtran, as well as the many network rollout contractors used by Openreach such as Kelly Communications and Telent. Openreach CEO Clive Selley told the FT that the cutbacks will not impact the target to pass 25 million premises with a fibre broadband connection by 2026, a plan that has been costed at £12bn. He added that 9 million premises have already been passed while the work to reach another 6 million has already begun: It is the work on the rollouts that reach beyond those 15 million premises that has, for the time being, been put on hold. The move comes only weeks after BT CEO Philip Jansen announced the telco was looking to increase its cost savings target from £2.5bn to £3bn by the end of fiscal year 2025. The news that Openreach is taking a breather will no doubt be met with a smidgen of schadenfreude by the likes of CityFibre, which appears to be rolling out its wholesale fibre access network infrastructure at a rapid rate.

Speaking of which… Here’s an interesting development in the UK’s burgeoning fibre broadband sector: CityFibre, the main wholesale fibre access network rival to Openreach, has struck a deal with regional fibre network operator toob that will not only see toob extend its network reach by using CityFibre’s increasingly extensive network in towns and cities across the UK to sell its retail broadband service, but also allow CityFibre to sell capacity on toob’s existing and future networks to its wholesale customers, a move that extends CityFibre’s network coverage in the south of England. “The technical integration of toob’s footprint is expected to be completed by summer 2023 and will provide CityFibre’s ISP partners with access to over 100,000 homes across Southampton and Camberley. toob is committed to building a network to more than a million premises across the South of England over the next 5 years, all of which will be made available to CityFibre’s ISP partners at the same service levels as CityFibre’s own network,” noted CityFibre in this announcement. The agreement “represents the UK’s first major partnership between infrastructure builders, establishing a new model of wholesale aggregation that significantly accelerates and expands the addressable footprint available to our wholesale ISP partners,” noted CityFibre CEO Greg Mesch. “For smaller fibre network builders which currently only offer their own retail broadband services across their footprint, it also establishes an opportunity to expand their retail offering, opening a lucrative wholesale revenue stream and maximising take-up over their network,” he added.

Gloomy times lie ahead for the telecoms industry, as the sector (like most others, for that matter) appears to be vulnerable to the growing pressures of global inflation, surging energy costs and the impact that higher prices might have on customer retention, according to Analysys Mason, which points out that the telco sector is already facing significant challenges associated with delivering services, creating new revenue streams and keeping shareholders happy. According to the research and consulting firm, the telco sector’s high investment costs and shrinking returns means it has underperformed compared to the general market index over the past decade, and it has some of the highest rates of capital expenditure thanks to network and infrastructure investments, particularly relating to the initial deployment of 5G, the further evolution of 5G architecture and the “prospect of 6G”, notes the Analysys Mason team. Before it all gets too depressing, though, the researchers suggest there is a potential light at the end of the tunnel. For example, operators can cut costs through automation and consuming less energy, especially if they decommission legacy networks quicker than previously planned. Telcos are also urged not to “overlook fibre,” as it is essential for fixed broadband services and for supporting the 5G services that telcos hope will drive their revenues. In addition, operators are encouraged to make private networking solutions “simpler and easier to buy” if enterprises are to be encouraged to invest in such networks, with the Analysys Mason team suggesting that a “form of opex/as-a-service pricing” would be attractive to potential users. Find out more here.

Other industry-watchers are also warning of a bleak landscape for the operator community… According to a new study from Juniper Research, mobile operators are to suffer a $2.5bn loss in 2023 in the form of missed revenue opportunities because some enterprises opt for OTT business messaging services such as Meta-owned Messenger and WhatsApp, as well as Tencent’s WeChat instead of traditional text messaging (SMS). This revenue loss represents a 20% increase from 2022, with a major portion of it (30%) accounting for promotional messages as enterprises move towards up-selling and cross-selling capabilities through rich-media marketing campaigns. However, SMS is expected to continue dominating the area, with the total number of SMS business messages sent to reach 1.7 trillion in 2023, up from 1.6 trillion in 2022. This is driven by enterprises’ aim to “capitalise on the channel’s impressive open rates and unrivalled subscriber reach”, according to the market research company. Despite the popularity of OTT apps, operator-led RCS (rich communication services) business messages are set to rise from 161 billion in 2022 to 219 billion next year. However, the report recommends that operators leave behind “the turbulent monetisation models used for SMS, as fluctuations in RCS pricing will limit enterprise adoption of operator-led rich media messaging”.

German operator Deutsche Telekom (DT) has shared the results of a 6GHz spectrum test conducted in “real” conditions, claiming that the high frequency waves are suitable for 5G in urban areas as they can “significantly increase the bandwidth and data speed” of the next-generation technology, with the potential to reach transmission rates of more than 2 Gbit/s. The company’s trial showed that the frequencies are “ideal” for mobile phone use, though 2025 is regarded as the earliest time by which such services might become available. According to DT, the “big advantage” of 6GHz is that existing radio masts can be easily expanded to support the bands within regular network modernisation. “In order to meet our customers’ increasing demand for more bandwidth with 5G, we will need more frequencies in the future. The tests have shown that the 6GHz frequencies are very well suited for this,” commented Walter Goldenits, head of technology at Telekom Germany. A decision on the potential use of 6GHz for mobile communications is expected to be taken at the World Radiocommunication Conference in November 2023. For more on Deutsche Telekom’s announcement, read the press release (in German) here.

- The staff, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.