Picture by Gage Skidmore from flickr (https://www.flickr.com/photos/gageskidmore/)

- Rolling out broadband to under-served areas of the US is proving tough

- India’s BSNL has reportedly been given a 4G/5G procurement straightjacket

- China’s 5G infrastructure is enormous, report officials

In today’s industry news roundup: Updated network maps needed in the US to unlock a $42bn purse; India’s government makes BSNL’s recovery job harder; Chinese officials share staggering stats about the country’s 5G investments; and more!

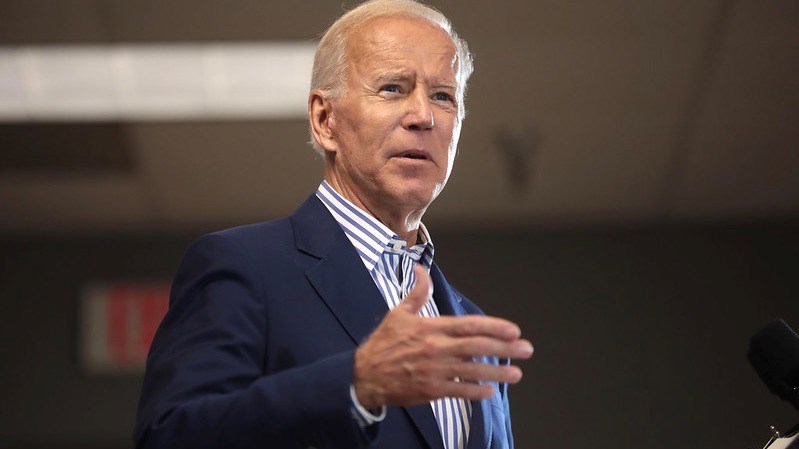

The $42.45bn plan to build out broadband access networks to remote and under-served communities in the US – under the Broadband Equity, Access, and Deployment Program that is part of the Infrastructure Investment Act signed into law by President Biden late last year – is moving at a snail’s pace due to a lack of accurate maps that show exactly where network buildouts are most required, according to a report by the Wall Street Journal. The findings are a stark reminder of just how much basic grunt work is still needed to drag the telecom sector, even in mature, developed markets such as the US, into the digital age and how new network planning and inventory tools are still needed to deal with the upgrade and extension of legacy networks.

India’s state-owned telco, BSNL, and its much smaller sister operator MTNL (which operates only in Delhi and Mumbai) have been told they should use only technology that has been developed and made in India as part of their mobile network upgrades for 4G and, ultimately, 5G, according to The Times of India. BSNL was recently given a government lifeline in the form of a “revival package” worth more than $20bn and a merger partner in the form of fibre network operator Bharat Broadband Network Ltd (BBNL). Now, it seems, the Indian government has also handed BSNL a procurement straightjacket that, while clearly well intentioned and in the spirit of encouraging local innovation and (potentially) national security, will only render it even less competitive with its privately owned rivals Reliance Jio, Bharti Airtel and Vodafone Idea.

China’s mobile operators have, between them, invested 400bn yuan (CNY) ($59.3bn) in their 5G radio access networks (RAN) and, as of the end of June, had reportedly deployed 1.85 million 5G base stations, according to statistics shared by officials during the 2022 World 5G Convention in Harbin last week. The China Daily reported that the total level of investment in 5G is expected to hit CNY1.2tn ($178bn) by 2025, by which time China’s operators are expected to have deployed 3.64 million 5G base stations. By contrast, mobile operators in the US had reportedly deployed more than 100,000 by mid-2021, according to S&P Global Market Intelligence. Investments in China's 5G RAN infrastructure have coincided with a ramp in Chinese consumer mobile data usage, from 7.8 Gbytes per month in 2019 to 14.9 Gbytes per month in 2022. China Mobile, the country’s largest operator, currently boasts 970 million mobile customers, of which 511 million have signed up for 5G packages and of which 263 million are already connected to the operator’s 5G network, according to statistics shared in the operator's recent financial report.

It seems the judicial force is with the US Federal Communications Commission (FCC). A US-based court has reportedly rejected an appeal against the authority’s decision from 2020 to reallocate 60% of the 5.9GHz band spectrum that was assigned to vehicle-to-vehicle (V2V) communication towards supporting the use of wireless devices. This is a major blow to the automobile industry: It was granted the spectrum in 1999 to develop technology that aims to improve safety on the road, but the spectrum was not used as much as expected. “I am pleased with the court’s decision, which upholds the FCC’s broad authority to manage the nation’s airwaves in the public interest. In the more than two decades since the FCC allocated the 5.9GHz band to support automobile safety, autonomous and connected vehicles have largely moved beyond dedicated, short-range communications technologies to newer, market-driven alternatives”, commented FCC chairwoman Jessica Rosenworcel. The spectrum is now being allowed to “evolve”, so that “we can advance newer safety technologies and grow our wireless economy,” she added.

The value of the contact centre-as-a-service (CCaaS) market is set to soar by 216% over the next five years, from $4.9bn this year to $15.6bn in 2027. This will be “driven by the breadth of services offered within comprehensive subscription-based models, including advanced analytics capabilities, AI-enabled chatbots and personalised video solutions,” according to Juniper Research – read more, here.

With the US Chips and Science Act now passed into law by President Joe Biden, multiple companies are salivating at the prospect of some state greenbacks and have been making major announcements about their planned investments in semiconductor manufacturing facilities in the US. The act provides $52.7bn for R&D, manufacturing and workforce development, including $39bn in manufacturing incentives and $1.5bn for promoting and deploying wireless technologies that use open and interoperable radio access networks (for which, read Open RAN-based systems), so there’s a lot at stake. Intel, which plans to build the world’s largest chip plant in Ohio, has previously been identified as a major potential beneficiary and its CEO, Pat Gelsinger, was at the Biden signing ceremony. “We are thrilled to see funding for the Chips Act enacted into law. Intel is committed to restoring end-to-end leadership, innovation and manufacturing here in the US. We are doing our part and the federal government has now done their part. Thanks to President Biden, Secretary Raimondo, bipartisan leaders in Congress and everybody involved in supporting the semiconductor industry. We look forward to working with the Department of Commerce on the implementation of this important initiative.” Qualcomm also wants a slice of the pie and made a joint announcement with partner GlobalFoundries that the duo are "more than doubling their existing strategic global long-term semiconductor manufacturing agreement” with a specific focus on increased manufacturing processes for 5G transceivers, Wi-Fi, automotive and IoT connectivity chips. Micron, meanwhile, has announced plans to invest $40bn by 2030 to “build leading-edge memory manufacturing in multiple phases in the US. With the anticipated grants and credits made possible by the Chips and Science Act, this investment will enable the world’s most advanced memory manufacturing in America. Micron expects to begin production in the second half of the decade, ramping overall supply in line with industry demand trends.”

- The staff, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.