Allison Kirkby, Chief Executive, commenting on the results, said:

“BT continues to deliver on its strategy – building and connecting the UK to the best next-generation networks at record pace, while accelerating our transformation. Our network leadership strengthened further in the quarter, with full fibre broadband now reaching more than 21 million homes and businesses, and our 5G+ network accessible to 69% of the population. Openreach achieved record full fibre connections and our Consumer division again added customers in broadband, mobile and TV, as we make the most of all our brilliant brands – EE, BT and Plusnet.

“Customer satisfaction reached an all-time high this quarter, and with our transformation building momentum, we are delivering ahead of plan. We remain on track for our financial outlook and guidance metrics for this year, our cash flow inflection to c.£2.0bn next year, and to c.£3.0bn by the end of the decade."

Delivering on our strategy:

-

More than 1m premises passed with FTTP for an eighth consecutive quarter, continuing the fastest build any company has achieved in Europe; FTTP footprint at 21.4m premises, of which 5.9m in rural locations; on track to achieve up to 5m this fiscal year and reach 25m by December 2026

-

Record customer demand for Openreach FTTP with net adds of 571k, up 21% year-on-year; total premises connected 8.2m, increasing our market-leading take up rate to over 38%; Openreach broadband ARPU grew 4% to £16.8, driven by higher FTTP take-up, speed mix and price increases

-

Openreach broadband lines fell 210k, down quarter-on-quarter and at a similar rate to last year; we now expect full year losses at c.850k for the year, better than our previous estimate

-

Retail FTTP base grew 32% year-on-year to 4.2m, of which Consumer 3.9m and Business 0.3m

-

UK's best mobile network for a record 11th consecutive year as awarded by Umlaut Connect, extending EE's lead over the second placed network; Opensignal placed EE first in 11 of 15 categories in its January report and yesterday RootMetrics named EE the UK's best network for the 25th time; 5G base reached 14.3m, up 10% year-on-year; 5G+ coverage at 69%

-

All Consumer customer bases grew for a fourth consecutive quarter in broadband, up 8k, a third consecutive quarter in postpaid mobile, up 55k, and a sixth consecutive quarter in TV, up 22k

-

Consumer service revenue was flat year-on-year and remains on track for growth in H2; Consumer broadband ARPU was down 1% year-on-year to £41.8 and postpaid mobile ARPU was down 1% to £19.2; Consumer fixed and mobile convergence grew to 26.2% from 25.9% last quarter

-

Business continues to make progress on its transformation; Q3 year-on-year performance was impacted by contract milestones, mainly in the financial and public sectors and wholesale, as well as the phasing of costs across quarters

-

All five targeted disposals in International are now complete with the last, BT Radianz, closing on 1 February; disposals reduced International revenue in the quarter by £45m

-

Cost transformation delivered efficiencies across all units, offsetting higher employer costs of National Living Wage and National Insurance; the year to date energy usage in our networks was down 6%, total labour resource was down 7% to 108k and Openreach repair volumes were down 18%

-

Record BT Group NPS of 31.4, up 2.1pts year-on-year, demonstrating further improving customer experience

On track to achieve full year guidance:

-

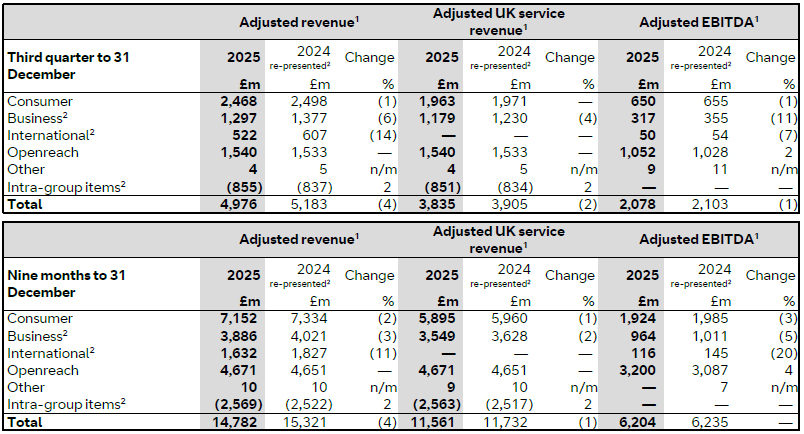

Q3 reported and adjusted revenue1 £5.0bn, down 4% year-on-year due to service revenue declines, lower equipment revenue, primarily handset trading, in Consumer and Business and the impact of divestments; Q3 adjusted UK service revenue1 £3.8bn, down 2%, due to the ongoing drag from legacy voice of over one percentage point as well as the phasing of trading in the prior year

-

Q3 adjusted EBITDA1 £2.1bn, down 1% and broadly flat excluding the impact of prior year one-off other operating income, with lower revenue offset by continued strong cost transformation

-

Q3 reported profit before tax of £183m, down £244m, driven by a £214m share of losses from the Sports JV

-

We remain on track for our financial outlook and guidance metrics, including our cash flow inflection to c.£2.0bn next year, and to c.£3.0bn by the end of the decade

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.