- Chinese vendor is still the telecoms industry giant

- But US sanctions have hit its sales

- Domestic market still fuelling some growth

- EMEA region shows scale of upcoming challenges

Huawei, as expected, still managed to grow its business in 2020 by almost 4%, despite the impact of US sanctions that increasingly disrupted the Chinese vendor’s supply chain. But there are clear signs those sanctions have undermined Huawei’s business and the worst may be yet to come.

Huawei’s annual report, which includes audited numbers, shows full year revenues of RMB891.4 billion, up by 3.8% compared with 2019 and equivalent to US$136.7 billion based on currency conversion rates at the end of 2020. The vendor’s operating profit margin dipped to 8.1% from 9.1% in 2019: Its net profit increased slightly to the equivalent of $9.9 billion – many a company in the communications networking industry would sacrifice a great deal just to have sales at that level, let alone profit.

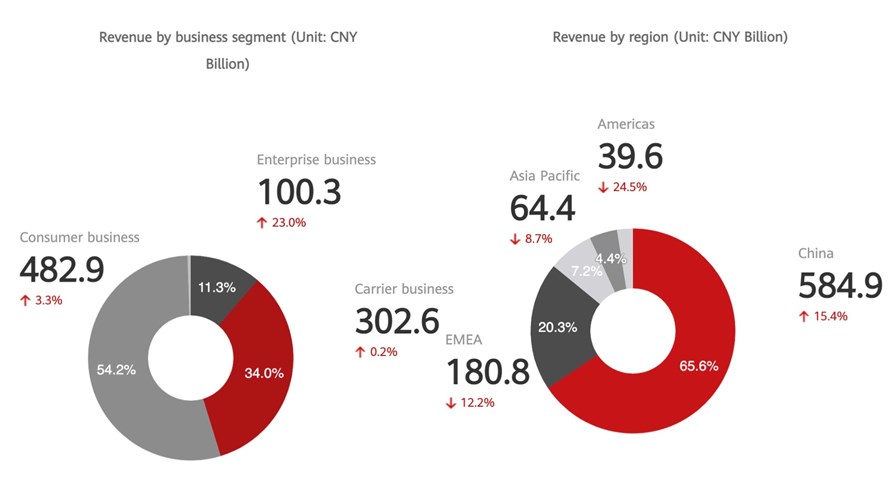

But the business mix shows how the US trade sanctions and the increasing impact of political and regulatory decisions in multiple countries are impacting the Chinese giant’s business. As the diagram below shows, its domestic business was very strong, growing by more than 15% and accounting for almost two thirds of its overall sales, driven by the massive investments in 5G network infrastructure.

Image captured from Huawei website

It’s no surprise to see its revenues from the Americas slump, but that’s a small part of its business anyway.

Most worrying for Huawei will be the 12.2% year-on-year dip in revenues from the EMEA (Europe, Middle East and Africa) region and the 8.7% decline in Asia (not including China).

The vendor attributed these declines mainly to lower sales for its Consumer business unit, which develops and sells smartphones. Overall, the Consumer division managed to grow slightly last year, accounting for 54.2% of total revenues, but with ongoing international pressures and trends it’s hard to see how it won’t shrink this year following the sale of the Honor device business, the ongoing impact on the Huawei brand of negative measures and media messaging and the anticipated crunch in the semiconductor supply chain that Huawei’s smartphone production line relies upon.

Huawei is making more of its Enterprise efforts and marketing these days, but even at impressive growth rates (sales up 23% in 2020), it still accounts for just 11.3% of total sales. The Carrier business is being sustained by domestic 5G revenues currently but that will not last forever: 2022 could be the last year of major 5G infrastructure investments by China’s network operators.

The current pressure on Huawei will continue: Key for the future of the company will be its ability to adapt its supply chain (before its chip stockpiles run out) and maintain its current levels of business, and that’s a challenge that many think will cripple the company during the coming year.

But anyone hoping that Huawei might shrink and die any time soon should think again. It is still active in 170 countries, and has its technology in more than 1,500 carrier networks. It has 197,000 staff, more than half of which are engaged in R&D. Its technology underpins China’s digital economy and its 2020 revenues in China alone were equivalent to $89.7 billion.

That’s an astonishing figure. And to put that into perspective, the combined total global revenues of Ericsson and Nokia came to $53.4 billion in 2020 -- $27.8 billion from Ericsson and $25.6 billion from Nokia.

Will China’s authorities do everything it can to ensure that Huawei survives, whatever the rest of the world throws at it? That’s something I’d put money on.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.