Source: Kearney (based on Omdia and Kearney analysis)

- A new report from management consultancy Kearney analyses a year of 5G progress across 33 countries around the world

- The sector is closer to exploiting the potential and benefits of widespread 5G, but a miss is as good as a mile

- Risk-averse telcos are still struggling to commercialise 5G because they lack the courage to break the old business model

- For operators, 2023 is the first real value-creation opportunity for wireless in many years, but blink and they’ll miss it

What with the welter of 5G reports and statistics that deluge the monkish environs of the editorial scribes suite at the TelecomTV Towers and Pleasure Gardens, it can be difficult to part the pages and peer through the volumes of verdant verbiage to discern the actual shape of things inside the fog of hype. Fortunately, Kearney, the global management consulting organisation, 97-years old this year and still going strong, has been able to whittle things down to a concise and very readable distillation of the readiness of 5G services across the globe and found the US, Singapore and Finland to be the most advanced markets.

The Kearney “5G Readiness Index 2023” analyses just how far countries have come along the sometimes rocky road to 5G and how close they are to realising all the potential and benefits of widespread 5G in the context of the overall maturity of a country’s telecoms market and its socio-economic position. The report covers 33 countries, all of which had launched 5G by the third quarter of 2022. It’s perhaps unsurprising that the US, Singapore and Finland are the world’s 5G-readiest nations, based on Kearney’s methodology (see end of article), followed by Japan and, perhaps a little surprisingly, by Norway.

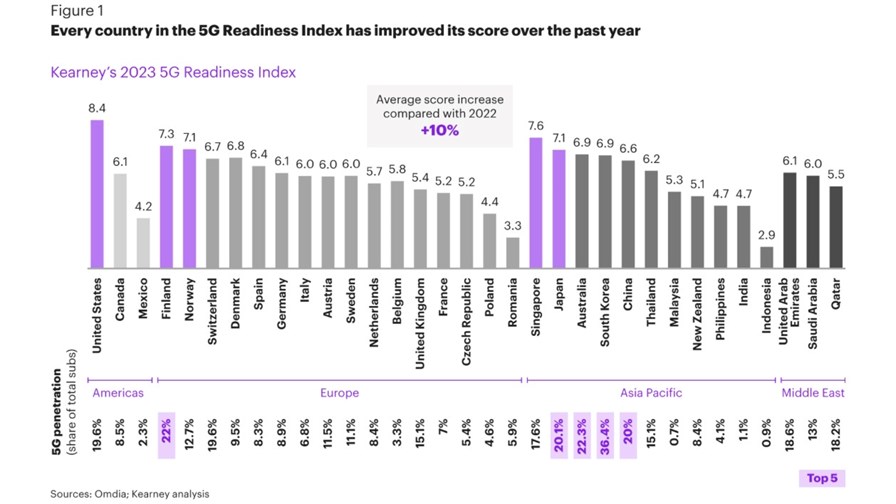

The 2023 5G Readiness Index also shows that all 33 countries included in the survey have increased their average ‘readiness score’ by an average 10% per country since the previous Kearney report in 2022. What's more, 22 of the 33 countries surveyed now have at least one operator with speed-differentiated tariffs.

In general, the US, Northern European and the Asian nations with the highest GDP are getting very close to exploiting 5G technology to its limits, while western Europe is not far behind them. A little further down the field is the Middle East. Eastern Europe and the developing, lower-GDP Asian countries are lagging behind and developing more slowly, but many are striving to catch up with the rest of the world.

Other trends noted in the Kearney report include evidence that more operators are launching standalone networks, with 17 countries now having at least one operator with a standalone 5G core, compared to only 11 in 2022. What’s more, operators in 25 markets now offer 5G private networks or multi-access edge computing, but only the US and Singapore have yet innovated to the point of developing specific 5G-focused application programmable interfaces (APIs) and active ecosystems.

Elsewhere, developments in mmWave development and deployments remain sluggish and limited, in part because of the slow adoption of compatible devices. This year, 14 countries have made mmWave spectrum available to operators, compared to the 11 in 2022: It’s progress, but it is slow.

The speculation is that’s because operators have struggled to commercialise their 5G capabilities and services. Commercialisation of the expensive new technology has been rooted in the attractiveness to businesses and consumers of new products and services but often, far too often, customers have proven resistant to the blandishments of operator’s marcoms and advertising departments.

As the industry’s collective capital expenditure bill has increased by billions of dollars, average revenue per subscriber (ARPU) is either static or in decline but, even so, some operators still seem reluctant to add 5G revenue streams to their offerings: It should be noted here that the industry research team at Ericsson, albeit with a vested interest, has managed to identify a positive correlation between 5G service availability and telco revenue growth – see 5G is boosting mobile operator revenues – Ericsson report.

This year’s 5G Readiness Index examines whether operators are selling 5G-enabled business-to-consumer (B2C) offerings, edge services, or private networks and looks at those moving toward advanced 5G services, such as APIs and ecosystem development. The report says, ”Overall, we were disappointed to find that little has changed. More countries have standalone cores, and more operators have expanded their commercial offerings, but few stand out with anything truly innovative. The industry is showing signs of self-awareness about this as stakeholders are getting involved, including through the GSMA Open Gateway initiative and Ericsson’s Global Network Platform Initiative. In the end, the field is still wide open for capturing new 5G revenue streams.” How true.

The report adds, “We believe this is the first real value-creation opportunity for wireless in many years. Yet telcos are averse to the bold moves required to realise it. That doesn’t have to be the case.”

Promised innovation not realised, more sophisticated 5G models are needed – now!

The report also notes that, with commercialisation, “Two-thirds of countries have at least one operator with speed-differentiated tariffs (via smartphone or fixed wireless access). Some already had them on 4G, but it’s a lot easier on 5G and one of the most obvious upsells. Some offered throttled speeds (for unlimited browsing at 10 Mbit/s, for instance) that make even 4G look fast, but this isn’t the innovation that 5G promised. We need more sophisticated models for 5G.”

There is an upside, of course. For example, operators in 25 of the 33 markets covered in the report now offer 5G private networks or multi-access edge computing, a clear sign that some are embracing new revenue opportunities, although the report adds the caveat, “to leverage the maximum potential of 5G, they need a fully developed B2B2x ecosystem model.”

Elsewhere, other companies and organisations across the telecom value chain are now leading initiatives and working with operators to enable the next stage of innovation. For example, many regulators are doing their part: In the US, the Federal Communications Commission (FCC) is freeing the log jam by releasing spectrum, while equipment manufacturers are helping too with, for example, Ericsson offering to act as an aggregator for network APIs via its Global Network Platform.

Meanwhile, industry bodies have their own initiatives to help operators to innovate. In the case of GSMA, its new Open Gateway initiative brings more than 20 of the world’s largest operators together with some pre-eminent big tech players, including Microsoft Azure and Amazon Web Services, to collaborate on providing universal access to operators’ APIs.

In some European countries, 5G penetration has improved markedly over the past 12 months, with Poland, Belgium, and Spain as standout examples. Poland has seen its penetration rate triple to 4.6%. That may not seem much but it’s a big improvement on 2022 – and things look considerably better for 2024 (especially if the regulator finally auctions some mid-band spectrum). Meanwhile, Belgium and Spain have opened up new bands to operators and all three countries now show encouraging signs of nascent 5G commercialisation.

In Japan, Qatar and Canada, 5G fortunes have fared less well since last year. Whilst Japan and Qatar experienced an increase in 5G penetration by 7.4% and 7% respectively, commercialisation in all three countries has been very limited and seems to be going nowhere fast.

The Kearney report concludes that for 5G, “It’s time for boldness – not risk inversion” and makes the very valid point that “the global telecom industry is [in]famously risk-averse, but it’s really risk-inversion. For the past two years, European telcos have foregone making the most of 5G opportunities. By being risk averse, they have actually turned the tables to risk becoming a customer of others’ innovations. This risk continues to hold true for operators around the globe.”

The final takeaway message is that it’s time for telcos around the world to be brave and determined and to innovate now, and the report cites three ways in which that innovation could be fostered. The first is via collaboration and for 5G operators to open their networks to external innovators and third-party developers and to make their API widely available. It further recommends collaborating not with just the usual partners and peer organisations but to search for prospective partners able to bring something new to the party, be that technology, an asset or even a customer.

Secondly, the report exhorts 5G operators not to be afraid of failure and to adopt radical new business models that will expand rather than cannibalise current revenue streams.

Thirdly, the report recommends that 5G operators should accelerate their 5G offerings and, if necessary, go to market with a minimum viable product and iterate from there. And above all, they shouldn't wait for simple pricing differentials and services to pay off but instead “push through to higher monetisation levels”.

Quite, but knowing the prevailing risk-averse ethos of many operators, such advice will probably frighten the living daylights out of them. When in doubt, do nowt.

The Kearney methodology

This is how Kearney outlines its methodology:

“Kearney’s 5G Readiness Index analyses how far a country has come on the 5G journey and how close it is to unlocking all of the benefits.

We base readiness on the following three factors:

— Spectrum availability. Access to 5G in low, mid, and high (mmWave) band classes

— Deployment. The share of operators that have launched 5G services in each band class and those with a standalone 5G core

— Commercialisation. The 5G share of mobile subscriptions, availability of B2C tariffs leveraging 5G capabilities, commercially available mobile edge computing or private network solutions, and advanced 5G APIs

The Index also considers the overall maturity of the telecom market and the socioeconomic context of the countries. We analyse 5G rollouts and commercialisation, including only those operators that clearly state an active commercial offering, rather than trials, or that only list use cases on their website. Information is gathered from public operator sites only.

For 2023, the index expanded from 28 to 33 countries with the inclusion of the Czech Republic, India, Poland, Romania, and Malaysia. To be included, a country must have launched 5G by Q3 2022. The Index does not cover all countries with 5G.”

- Martyn Warwick, Editor in Chief, TelecomTV