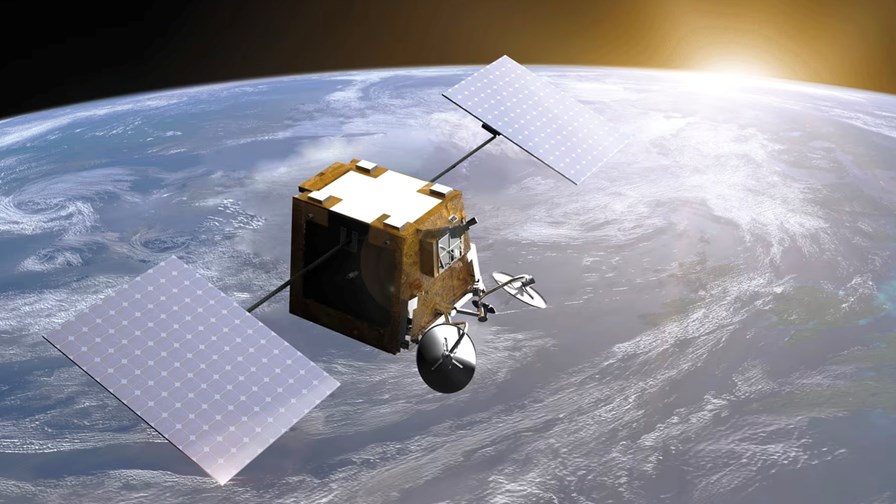

Source: OneWeb

- The satellite communications market’s profile was raised in 2023

- Significant mergers and constellation expansions have created satellite network operators with greater scale, especially in the low-earth orbit (LEO) sector

- Telcos will increasingly rely on satellite coverage to close connectivity gaps in various locations

To hit the ambitious, and extremely challenging, goals of delivering communications and digital services to every corner of the world, there has been an uptick in telcos partnering with satellite operators throughout this year. Low-earth orbit (LEO) coverage has been especially alluring for communications service providers (CSPs), with emerging players in the market promising to bridge the digital gap, especially in hard-to-reach areas (such as mountains, rural locations and at sea).

Here are TelecomTV’s most popular satellite connectivity articles of 2023.

1. Why LEO satellite players are telcos’ new best friends

20 June 2023: The middle of the year marked a highly active period in the satellite communications market, especially in the Asia Pacific region. In one development, Australian telco Telstra partnered with OneWeb – the satellite player that emerged from bankruptcy in 2020 and is now part of the Eutelsat Group – for “one of the world’s largest rollouts” of commercial backhaul connectivity using OneWeb’s LEO constellation. OneWeb has also been making strides in Japan where it was chosen by one of its investors, SoftBank, to provide the satellite element of the latter’s non-terrestrial network (NTN) plans. Other moves in south-east Asia also demonstrated the region’s readiness to adopt satellite technology to help improve connectivity. Read the full story.

2. Vodafone eyes prime role for Amazon’s LEO constellation

5 September 2023: OneWeb was not the only satellite services provider making inroads into deals with telcos for expanded presence and growth. Amazon’s LEO satellite endeavour, dubbed Project Kuiper, was selected by Vodafone and its subsidiary Vodacom, to backhaul data traffic from remote 4G and 5G mobile sites in Africa and Europe. The pair will also offer broadband services to “unserved and underserved communities around the world”, and will explore enterprise-specific options, such as a backup service for unexpected events and connectivity to remote infrastructure. Read the full story.

3. In India, OneWeb scrambles ahead of its rivals

22 November 2023: The satellite broadband service market proved hotter than ever in India, a country of more than 1.4 billion people with a large rural population that is mostly bereft of fixed broadband infrastructure. Multiple players are rushing to offer connectivity services based on various types of satellites, but OneWeb appears to be one step ahead in the race. Towards the end of the year, it claimed to be the first satellite player in the country to have been granted clearance from India’s authorities to launch commercial services. Its last stop before an actual launch is obtaining the necessary spectrum from the government. Read the full story.

4. Viasat’s $7.3bn takeover of Inmarsat gets CMA green light

10 May 2023: The satellite market witnessed a major M&A development this year in the form of US geostationary (GEO) satellite operator Viasat acquiring its British peer Inmarsat in a $7.3bn deal. The takeover was finalised at the end of May after the UK’s Competition and Markets Authority (CMA) gave the go-ahead following an extensive review, which concluded that the merged company would face competitive pressure from other satellite operators in the near future, given that the sector keeps attracting new players, including SpaceX’s Starlink and Intelsat. Read the full story.

5. Eutelsat soars to new heights with OneWeb merger

29 September 2023: Another notable M&A move saw the merger of French satellite player Eutelsat and OneWeb to form the Eutelsat Group. The companies called the new entity “the first fully integrated GEO-LEO satellite operator”, and said it will deliver “global, fully integrated connectivity” powered by a combination of Eutelsat’s 37 GEO satellites. This will offer network density and high throughput, and the “low latency and ubiquity” of OneWeb’s LEO constellation (which consists of more than 600 satellites), the satellite players added. Eutelsat Group is expected to bring in around €2bn in annual revenues by 2027. Read the full story.

- Yanitsa Boyadzhieva, Deputy Editor, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.