Source: Appledore Research

- Investment in network automation software by telcos is growing significantly

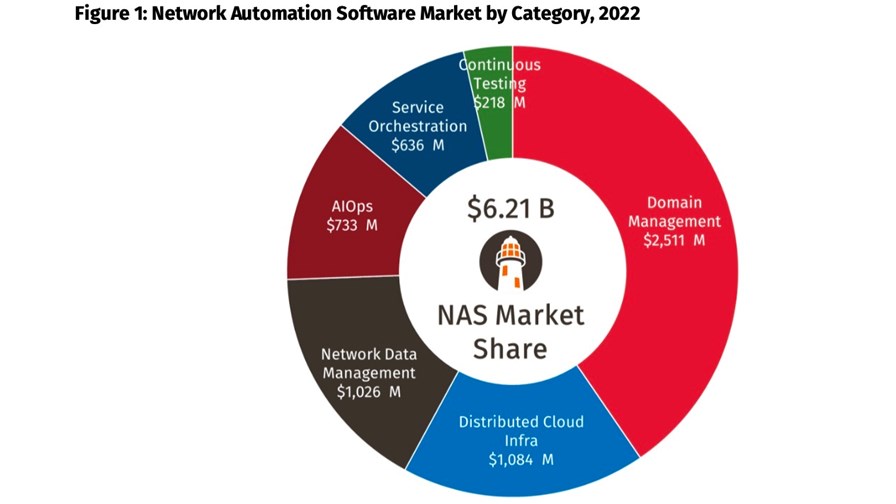

- The market was worth more than $6bn in 2022, according to Appledore Research

- It is a very fragmented market but Nokia and Huawei are the leaders and the only vendors with double-digit market share

- The analyst group has identified network data management as the segment of the market that is growing the quickest

Investments in network automation software by telecom operators grew by more than 42% between 2020 and 2022 to $6.21bn, with network data management identified as the fastest growing segment in the market, according to a new report, Leading Suppliers in Network Automation Software, from Appledore Research.

The market research firm has many experienced telecom software and operations veterans on its team and has been tracking the network automation software (NAS) sector for a number of years in a variety of sub-sectors – AIOps, service orchestration, network data management, domain management, distributed cloud infrastructure management, and continuous testing (previously called lifecycle management).

In 2020, Appledore put the value of the NAS market at $4.36bn while its latest research has pegged the sector at $6.21bn in 2022. The market is highly fragmented, with the traditional network equipment providers (NEPs) prominent in the sector’s supplier ranking: Nokia is the market leader but boasts only a 13% market share, with Huawei just behind with 12% – no other company has a double-digit market share, with Ericsson commanding just 6% of the market.

And the market leaders are getting squeezed, as the many companies (including Amdocs, Cisco, Netcracker, HPE and Oracle) that are pooled together in Appledore’s market share analysis under the category ‘other’ are accounting for a greater portion of the overall investments, up from 37% in 2020 to 55% in 2022.

The report’s authors – Patrick Kelly, Grant Lenahan, Francis Haysom and Robert Curran – note that the likes of Nokia, Huawei and Ericsson, the NEPs, are finding their market shares eroded as the sector grows, reflecting the increasing investment in NAS software tools developed by independent vendors.

The largest tranche of the market is domain management, which comprises “classical network-facing functions”, such as element management tools and network controllers, which together attracted investments worth just more than $2.5bn in 2022, up by about 25% since 2022.

But telco spending on network data management tools – those involved in the collection, storage and presentation of network data of all kinds – grew by a dramatic 139% in two years to be worth more than $1bn in 2022, putting it just behind the distributed cloud infrastructure management segment, which was worth just shy of $1.1bn in 2022, having grown by more than 57% in two years.

“The collection and management of network data is now a distinct, strategically significant area of spend, essential to supporting the goals of automation on a more enterprise-wise basis,” noted the report’s authors.

But while the network data management segment has grown the fastest, “AIOps is perhaps the segment that is seeing the most significant technical developments, with arguably the most profound future impact on CSPs’ current mode of operations,” noted the report.

And, as the Appledore team noted in its NAS market forecast from last year, telco investments in network automation software are set to keep increasing at a significant rate towards the end of the decade.

“Operators are prioritising – and increasing – their spending on automation,” noted the authors, with the NAS sector expected to be worth more than $17bn by 2027 – see Network automation software sector to hit nearly $18 billion by 2027: Report.

- Ray Le Maistre, Editorial Director, TelecomTV