Source: Zoom fiscal 2021 Q4 earnings slide deck

- Company reports 326% rise in annual revenues to $2.65 billion

- Expects further sales growth, more than 40%, this year

- Key to its aspiration is the Zoom Phone VoIP service

Video communications giant Zoom just had an amazing year, and now it’s expecting another, with telephony key to its growth: It’s good to talk, right?

As remote working and a reliance on cloud-enabled multimedia interaction continued to be the norm for hundreds of millions of workers during the global pandemic, more companies signed up for Zoom’s paid services: On 31 January, the end of Zoom’s fiscal year, about 467,100 customers with more than 10 employees were buying Zoom services, up approximately 470% year-on-year.

As a result, the company’s sales went through the roof. Late on Monday Zoom announced fiscal fourth quarter revenuesof $882.5 million and adjusted earnings per share of $1.22, much better than expected. And for the full fiscal year, Zoom generated revenues of $2.65 billion, up by 326%, and adjusted earnings per share of $3.34, compared with $0.35 in the previous year.

But the big news from the company’s fiscal year report is that Zoom expects even further growth in the coming year, a forecast that suggests many of its enterprise customers won’t be changing their working habits much in the coming 12 months even if some workers no longer need to work from home.

Zoom forecasts revenues of $3.76-3.78 billion, which represents growth of 42-43%, and earnings per share of between $3.59 and $3.65 for the current financial year ending in January 2022.

Eric Yuan, founder and CEO, noted on the company’s earnings call: “As the world emerges from the pandemic, our work has only begun. The future is here with the rise of remote and work-from-anywhere trends. We recognize this new reality and are helping to empower our own employees and those of our customers to work and thrive in a distributed manner.”

With Zoom now a household name and respected for the quality of its services, the company is now seeking to embed itself into the paying enterprise customer market with new services, particularly Zoom Phone, its VoIP service that supports local phone numbers and PSTN access via relationships with local telcos. Launched initially in January 2019, the service has attracted some large users, including the University of Southern California (21,000 Zoom Phone users) and Equinix, which recently added Zoom Phone to its existing Zoom Meetings and Zoom Room services.

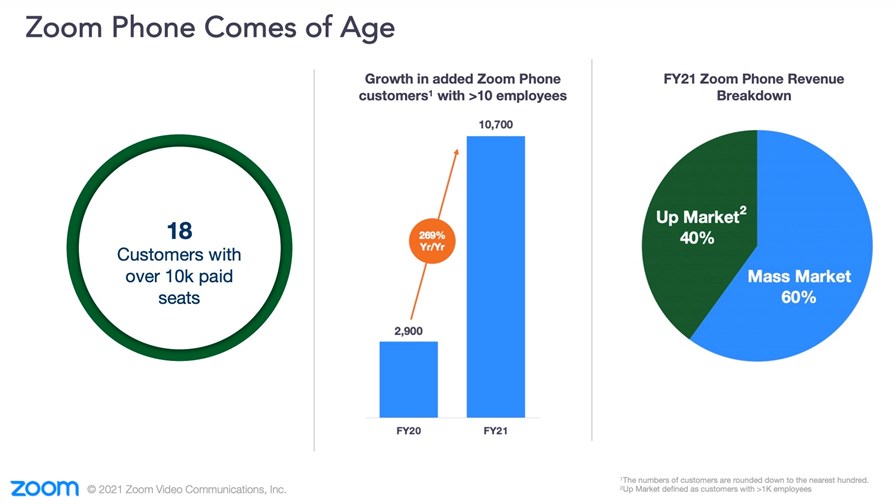

At the end of January, Zoom Phone was available in 42 countries and had 10,700 customers with more than 10 employees (up 269%) and 18 customers with more than 10,000 paid ‘seats’. (See chart above.)

Those are impressive numbers, but considering that the company currently has 467,000 overall paying customers with more than 10 employees, there’s a lot of opportunity for growth via ‘upselling’ to existing customers.

The market, of course, is very competitive: In addition to key rival Microsoft Teams, Zoom is competing with established VoIP service providers such as 8x8, BlueJeans (now owned by Verizon), GoToMeeting, RingCentral, Vonage and more.

But it’s a big market still: According to IDC, the global market for telephony services is set to be worth more than $23 billion by 2024.

And VoIP isn’t Zoom’s only growth opportunity: The company is looking to expand its services portfolio and revenue opportunities into new areas to spread the net wider and give itself greater security should the market flip, with CFO Kelly Steckelberg noting that “we are constantly looking for opportunities for other interesting companies, potentially M&A activity, that could add either to our talent or our technology… we just haven't quite found the right match yet, but we keep looking.”

And as Zoom CIO Advisor Magnus Falk told TelecomTV recently, the company is also seeking to engage further with the app developer community to add extra functionality to the company’s services, a move that would boost customer retention and drive revenues. (See How Zoom evolved in the pandemic era.)

Steckelberg did, though, strike a note of caution about Zoom’s financial forecast: “Although we remain optimistic on Zoom's outlook, please note the impact and extent of the COVID-19 pandemic and people returning to in-person contact still remain largely unknown. Our outlook is based on our current assessment of the business environment.”

With rolling contracts and commitments from enterprise customers in view, and the uptake of the Zoom Phone service currently gaining momentum, the. next 12 months looks solid for Zoom, providing it with a great opportunity to secure its medium-term financial future. But what might 2022 and beyond bring in terms of communications services trends? That’s the big unknown.

In the meantime, investors are hungry for Zoom’s stock. The company’s share price had already risen by almost 10% to $409.66 during NASDAQ trading hours on Monday in expectation of a strong end to last year, but following the very bullish forecast shared after the markets had closed in the US the stock jumped a further 8.3% to $443.70 in after-hours trading, giving the company an overnight market valuation of more than $130 billion.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.