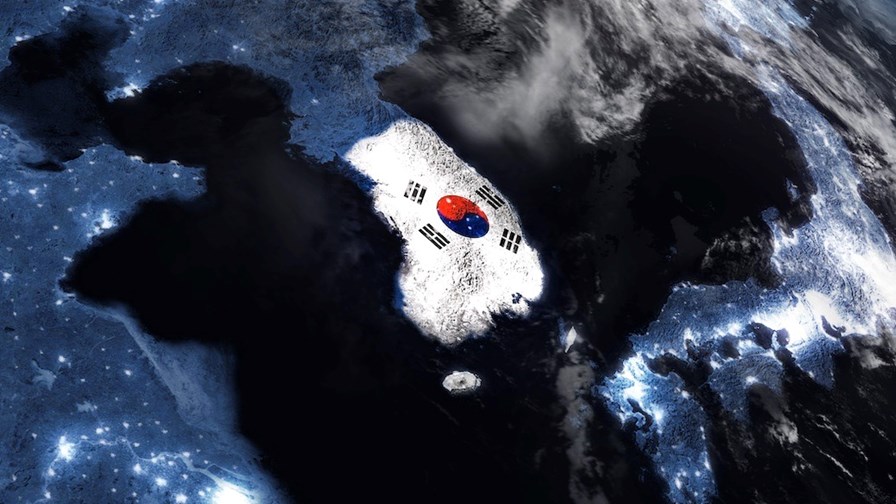

- South Korea is determined to play a larger role in the global semiconductor production sector

- It has unveiled a 20-year, $471bn plan to build the world’s largest chip manufacturing hub

- Samsung and SK Hynix are at the heart of the development

- The aim is to improve self-reliance as well as boost exports

The South Korean government is aiming to win the global semiconductor “war” by helping its domestic chip firms in the development of a giant chip manufacturing hub, the largest in the world, that is set to attract 622 trillion Korean won ($471bn) in investments by major companies, such as Samsung Electronics and SK Hynix, and create about 3.5 million jobs, including 110,000 directly related to the chip production facilities and processes, over the next 20 years.

The hub is to feature 13 new chip fabrication plants (fabs) and three new semiconductor research and development (R&D) centres to add to the existing 21 fabs that are already up and running in a zone that stretches from Pyeongtaek to Yongin, south of the country’s capital city Seoul.

The cluster of chip plants is expected to be the largest in the world, capable of producing 7.7 million wafers monthly by 2030, according to multiple media reports, including this one from the South China Morning Post, which cited a presentation given by South Korean President Yoon Suk Yeol.

As part of its role in the development, Samsung will build new chip foundries that will enable it to make chips for other companies as well as itself as part of a 500bn won investment programme that will run until 2047, while SK Hynix will invest 122bn won in memory chip production plants during the same timeframe.

The aim is to make South Korea self-sufficient in terms of chip production, increase the country’s market share of the global microprocessor production sector from 3% to 10% and boost the country’s semiconductor exports: The Korean government announced late last week that it expects semiconductors to be the country’s number one product export in 2024 (worth an estimated $120bn).

To support the development, the South Korean government is to extend tax credits to companies investing in the country’s chip production sector: The tax credits were first introduced a year ago but were due to expire soon.

Taiwan is currently the leading chip production nation thanks to the scale of Taiwan Semiconductor Manufacturing Company (TSMC), which alone produces almost 60% of the world’s semiconductors, according to data collected by Counterpoint Research. In addition to South Korea, other major chip production nations currently include Japan, the US and China.

South Korea isn’t alone in wanting to boost its chip production capabilities in order to avoid a repeat of the supply chain issues that caused significant disruption to many of the world’s largest industries, including the automotive and telecom sectors, in recent years. The US is seeking to encourage more chip fab investments with the support of state aid under its $52bn Chips for America Act, which has started the process of funding new fabs, while the European Union has done the same, but with a smaller budget, with its own Chips Act.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.