Source: Rakuten Group 2023 earnings report slides

- Rakuten Mobile’s numbers all improved in 2023

- It is still losing money, though at a less eye-watering rate

- Japanese operator predicts more substantial customer base growth during 2024

- And expects to be profitable on an EBITDA basis by the end of this year and have up to 10 million customers

- But it will still be a minnow

Rakuten Mobile, the Japanese operator that is trying to muscle its way in as the fourth major mobile service provider in one of the world’s most competitive markets, is slowly improving its financials and its subscriber numbers and, as ever, is still pitching an optimistic outlook to investors. But its 2023 numbers show that the service provider is still about a year away from breaking even and even if it makes the top end of its subscriber growth forecast, it will still only be a minnow with a single-digit market share come 2025.

The operator’s story is well known. It has reported heavy operating losses in recent years as it ploughed billions into its network in order to achieve national coverage via its own infrastructure and more quickly reduce its expensive domestic roaming bills from KDDI. Those losses have weighed heavily on the financials of its parent company, the Rakuten Group, but the digital services giant has stuck firm with its strategy to add mobile services, and the cloud-oriented physical infrastructure underpinning those services, to its broader portfolio, which includes digital banking, e-commerce, travel services and numerous others – you can read more about the long-term group strategy in this article. The Rakuten Group’s aim is to be the provider of a broad range of synergistic digital services that Japanese people rely upon in their daily lives.

The Rakuten Group’s management has always said that heavy losses would be incurred in the short-term before the numbers improved and, indeed, they are getting better, even if the operating losses are still substantial.

For the full year 2023, Rakuten Mobile generated revenues of 224.9bn yen ($1.5bn), up by 17.7% compared with 2022, while its operating loss for the year was 322.5bn yen ($2.14bn), much better than the 460bn yen ($3bn) operating loss recorded for 2022.

Its subscriber base grew to almost 6.1 million by the end of December 2023, but that growth has been slow. Rakuten expects the customer addition rate to increase this year and to have between 8 million and 10 million mobile subscribers by the end of 2024, by which time Rakuten Mobile is expected, due to multiple cost-saving “initiatives”, to achieve profitability (on a monthly basis) at an earnings before interest, tax, depreciation and amortisation (EBITDA) level.

But here’s the challenge for Rakuten: Even if it can offer those customers a broad range of services, it’s still only reaching a small proportion of Japan’s total mobile user base, and even if it hit 10 million customers by the end of this year – which it should do if it can keep up the growth rate it had at the end of last year when it added more than 400,000 customers in December alone – it would still only command a mid-single-digit market share.

To put Rakuten Mobile’s situation into context, it is competing with the likes of NTT Docomo, which ended 2023 with 90 million mobile customers.

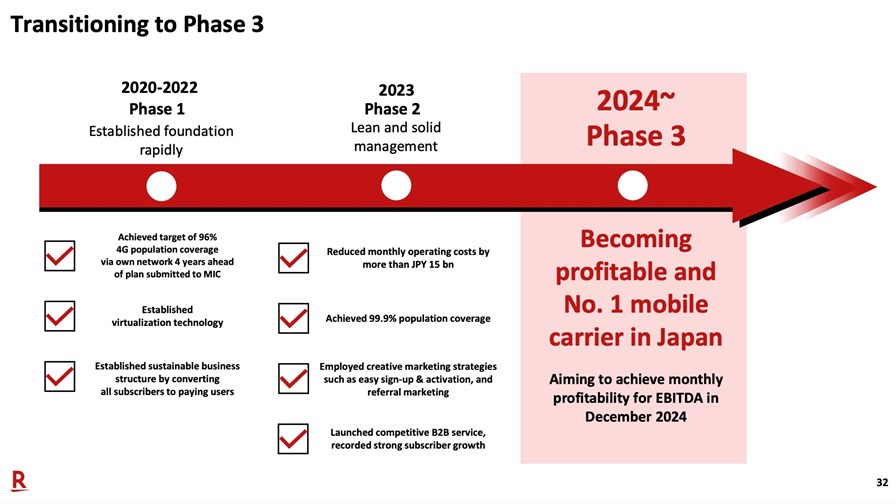

Rakuten is pitching 2024 as Phase 3 of its strategy, when it transitions from being a “lean” company that was investing for the future, to one that becomes profitable and, by some metric, becomes “The No. 1 mobile operator in Japan.” That leadership would not be in customer numbers or revenues, that’s for sure.

The optimism is laudable – this is an aggressive digital service provider (DSP) strategy in action, and it’s commendable that the Rakuten Group has stuck with its vision.

But in the meantime, those Rakuten Mobile numbers are still hurting the group’s top and bottom lines, as this earnings press release shows. Fortunately for all of Rakuten, the other parts of its business are growing and are profitable – the hope for the Japanese digital giant is that it’ll be able to say the same for its entire operations before too long.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.