- Synergy Research stats show shift in enterprise investments

- In 2020, enterprises spent more on cloud services than on data centre tech

- Trend highlights the importance of avoiding any network bottlenecks

- CSPs need to keep an eye on the ‘big picture’ to attract and retain enterprise customers

Synergy Research Group has released enterprise cloud investment data that’s not only very interesting in itself, but which also points to the ever-growing importance of reliable, always-available wide area data networking services that are free of any bottlenecks.

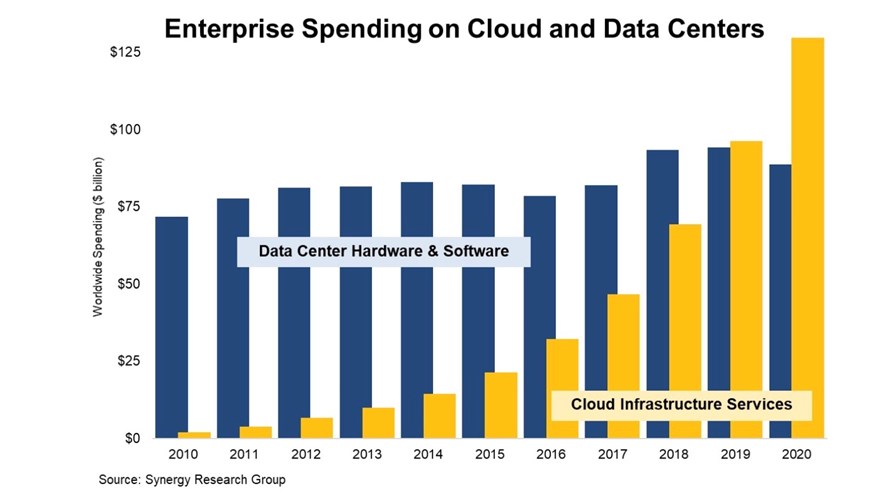

You can see the data in the graph above, which shows that 2020 was the first year during which enterprises invested more cloud infrastructure services than they did on data centre hardware and software.

Driving this is an ongoing and insatiable demand for cloud infrastructure services, as the Synergy research team notes in this announcement.

According to the research company, “enterprise spending on cloud infrastructure services continued to ramp up aggressively in 2020, growing by 35% to reach almost $130 billion. Meanwhile, enterprise spending on data center hardware and software dropped by 6% to under $90 billion. This continued a decade-long trend of explosive growth in cloud and virtual stagnation in the market for enterprise-owned data center equipment…. Over the decade, average annual spending growth for data center was just 2% and for cloud services (IaaS, PaaS and hosted private cloud) was 52%.”

It added: “Within the $130 billion cloud infrastructure services market, the major segments with the highest growth rates over the decade were mainly within PaaS – especially database, IoT and analytics. IaaS share of the total held reasonably steady while managed private cloud service share declined somewhat.”

“Over the last ten years we have seen a dramatic increase in computer capabilities, increasingly sophisticated enterprise applications and an explosion in the amount of data being generated and processed, resulting in an ever-growing need for data center capacity. However, 60% of the servers now being sold are going into cloud providers’ data centers and not those of enterprises,” said John Dinsdale, a Chief Analyst at Synergy Research Group, who added that “companies have been voting with their wallets on what makes the most sense for them. We do not expect to see such a drastic reduction in spending on enterprise data centers over the next five years, but for sure we will continue to see aggressive cloud growth over that period.”

What this means in turn, of course, is that there is ever-increasing demand for wide area data networking capacity to connect enterprise users to data centres, as well as for data centre interconnect capacity (and intra data centre networking capacity too!). That capacity is managed by a range of players, from the hypercsaler giants themselves (they all have massive global data transport networks), to the international subsea network operators, national telcos and all the way down local ISPs, a section of the market that has had to increasingly step up to the mark in the past year as workers have relied on their home broadband connections to tap into their corporate data.

What is key, then, is for service providers to ensure, whether it’s on their own network or that of a partner, there are no bottlenecks that constrain the flow of data, and those bottlenecks can occur at any point in the data journey, from in-building, to access, metro and long-haul. And as more businesses become reliant on real-time data delivery, so avoiding any bottlenecks and ensuring connectivity redundancy becomes increasingly important.

That’s why it’s key to remember in all the discussions about the importance of cloud services and the potential of 5G that it’s not just about data centre access, or a low-latency connection between a device and a cell tower: A next-gen 5G radio access network is pointless unless it’s backed up by a next-gen transport network infrastructure.

In this age of cloud services and X-as-a-service, the benefits will only be realized if the bigger picture is addressed: Optical transport, fibre access, IT resiliency, API access, AI-enabled automation, enhanced BSS functionality – and so much more! – are just as important to a 5G strategy as the new-fangled devices and the souped-up radio access network. Let’s keep our eyes on the big picture.

And given how important the enterprise market is to the success of 5G, communications service providers need to keep on top of all those moving parts if they’re to stand a chance of becoming the successful digital service providers of the 5G era.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.