Ciena president and CEO Gary Smith... The opportunity for growth is THIS big!

- Hopes were raised recently that the worst of the tech supply chain issues were over

- But optical networking systems giant Ciena will tell you otherwise

- It has reported a 12.2% slump in fiscal Q3 revenues

- Components shortages and late deliveries hit its ability to deliver finished products

- Demand remains strong, though, and the company, including the CEO, has ridden this rollercoaster before

When Cisco CEO Chuck Robbins noted two weeks ago that technology component supply chain challenges were still impacting the networking technology industry but had “begun to show early signs of easing” during June and July, digital corks were popped, sighs of relief could be heard across the industry, and Cisco’s stock gained almost 6% in value to $49.37. But that was August: Now it’s September and Ciena’s president and CEO, Gary Smith, is here to pop the balloon with commentary on his company’s most recent quarterly financial performance, which includes a 12.2% year on year decline in revenues to $868m.

"Despite continued strong customer demand, our fiscal third quarter financial results were negatively impacted by late delivery and substantially lower-than-committed volume from a small number of suppliers for specific components that are essential for delivering finished goods to our customers," noted Smith during his prepared commentary on the three-months period that ended 30 July. "While these dynamics will continue in our fiscal fourth quarter, we expect improvement as we move into fiscal 2023, providing us increased ability to service this unprecedented demand and continue to gain market share,” he added.

And it seems these challenges came as a bit of a surprise, too, but we’ll come to that later: First, let’s look a bit more at the current financial numbers, because it’s not just that the vendor’s sales dipped steeply compared with the $988.1m of revenues reported during the same period a year ago, they’re also way down from the fiscal second quarter that ended late April, when Ciena generated sales of $949.2m.

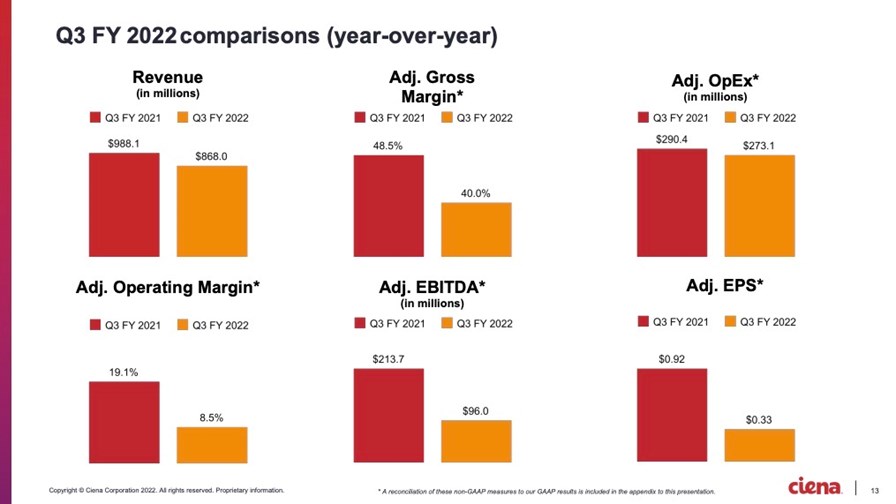

In addition to the slump in sales, Ciena’s gross margin and operating margin numbers were way down from a year ago: The graphic below tells the story.

Source: Ciena

Also heading south is Ciena’s share price: It initially took a 9.2% hit to $46.05 in pre-market trading, but following the company's earnings conference call (more on which below), the hit was less severe, with the vendor's share price trading down by 3.9% at $47.93.

It doesn’t help investors' nerves that, as Smith points out in his earnings press release remarks, the supply chain issues are going to hamper Ciena’s ability to deliver products to its customers during the current quarter too, which ends in late October, before easing after that, so there is further pain to come.

So things might be looking better for Cisco in terms of component sourcing but not so much for Ciena. (It’s worth noting also that Cisco’s share price has taken a tumble in the past couple of weeks since its positive spike off the back of Cisco’s earnings report and Robbins’s comments and is now trading at $44.72.)

And, of course, Cisco and Ciena do not have the same portfolios, even though they are rivals in the optical and packet router markets: Cisco’s main business is in routing and it’s notable that Ciena’s sales slump was in its converged packet optical product line, while its routing and switching unit reported a 70% year on year increase in sales to $109.2m, so the component challenges appear to limited to particular parts of the technology supply chain.

But these are all short-term challenges – what about the bigger, long-term picture?

Well, as they say in sports, “form is temporary, class is permanent”. When Smith references “unprecedented demand”, it’s not without reason: Ciena is highly regarded for its optical networking technology and is second in the global market only to Huawei, which has the distinct advantage of having much of the massive Chinese market sewn up.

In addition, Ciena has proven itself not only in the telco sector but also in the demanding hyperscaler market (which generates 20% of its revenues) as well as with large cable network operators, governments and large enterprises. The expertise needed to meet the demands of all these markets isn’t developed overnight and doesn’t appear to be on the wane: Therefore it seems highly unlikely that Ciena will lose customers and much business because of its current supply chain issues, as long as it can appease those customers and deliver on its assurances that the situation will improve soon. On the company’s earnings conference call today, Smith made it clear that Ciena is not seeing any contract cancellations and that orders continue to come in. He also claimed that Ciena is shipping more gear right now than any of its direct rivals in the optical marketing sector.

And he pressed home the point that demand from customers is still incredibly strong. Here’s what Smith had to say:

“Despite supply chain challenges and elongated lead times, strong secular demand trends show no signs of abating. And we remain confident that the fundamental macro drivers propelling this demand are durable over the long term… These include 5G, cloud and automation, in addition to infrastructure spending, residential broadband funding, and opportunities to displace Huawei. Combination of the secular drivers and our market leadership, including our technology, investment capacity and global scale, is driving continued robust demand from customers in both absolute and relative measures. In fact, we had nearly 60% order growth in our last four quarters versus the same prior four quarter period. In Q3, specifically, orders outpaced revenue by more than 30% and we continue to grow our backlog, which is now well over $4 billion, and we project further growth in our backlog… As we convert this large backlog to revenue and continue to win new business and a strong demand environment, we have confidence in continuing to gain market share [as] the supply chain challenges ameliorate.”

And what about the supply chain challenges?

“Challenging supply chain conditions persist… At a high level, the majority of our suppliers are delivering to their promises, albeit [with] extended lead times, and we are also starting to see higher volumes, and this is consistent with recent market commentary that pointed to some signs of improvement in the overall supply environment. However, we have recently been challenged by the unpredictable performance of specific vendors and their associated componentry. When we spoke to you after our second quarter, our outlook for the remainder of the year reflected commitments made to us by our suppliers in early June, which a very small number of them did not need. Specifically, in the second half of our Q3, we experienced substantial delays and lower than expected component deliveries from this very small group of suppliers… primarily [impacting] certain integrated circuit components that represent a very small fraction of our overall materials. However, these delays and decommits impede our ability to build and deliver finished goods and systems, such as modems for our customers… this relatively small number of low-cost, low-value components is holding up a disproportionate amount of revenue, primarily for our optical modems… [some] of the supply dynamics have continued into our fiscal fourth quarter and are expected to negatively impact our current quarters results... We remain very focused on our investments and actions to minimise the impact of these challenges on our customers,” added Smith.

So the issues persist and customers are frustrated, understandably so, because it has a knock-on effect on their deployment and service plans.

But those customers are dealing with a trusted and consistent management team at Ciena. Smith has been the company’s CEO for more than 21 years and there’s a reason for that. Over the years, he has presided over shifting market conditions and has consistently called out the challenging times, communicating how and why Ciena can come out the other side in a positive way, and time and time again he has been proven right. That’s why he’s still the CEO (and a very well paid one at that).

One of the things Smith often points out, as he did again today, is that the demand drivers for what Ciena offers are not going away: Data traffic volumes are still increasing at a mind-boggling pace and, ultimately, those data packets need to be moved around the world’s networks, and that happens over high-capacity optical transport networks. The need for what Ciena does isn’t going away and while it can continue to be a class act and very competitive with its main rivals – Huawei, Nokia, ZTE, Infinera, Cisco, Fujitsu, ADVA and more – the industry can expect to see Ciena’s sales numbers and share price to go up again in the near future.

Smith has been on this rollercoaster before…

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.