- The global used smartphone market is growing fast and is expected to be worth $110bn by 2027 and to register 431 million unit sales that year, predicts IDC

- The increasingly important sector would grow even faster if more second-hand inventory was available

- Inventory of used smartphones depends on consumer uptake of new, premium models developed by the likes of Apple, Samsung and others

- It’s simple really – in times of inflation and economic uncertainty, consumers hang on to their old smartphones for longer than they would in better times

How things have changed. Back in the late 1990s, when mobile phones were in their relative infancy and a luxury for most people, every tech journalist worth his or her salt had a desk drawer crammed full of mobile handsets of every size, shape, colour, bell, whistle and varying utility from just about every manufacturer on the planet. We could either use them ourselves – even review them – or hand them out to those less fortunate.

Those days of freebie delights are over but now, with mobile devices ubiquitous, very large numbers of people have numerous, perfectly good but discarded cell phones stashed away at work and at home. As a result, a huge and lucrative global market in second-hand smartphones has developed, including those that have been “officially” refurbished by the likes of Apple and Samsung as consumers splash out on something newer and shinier.

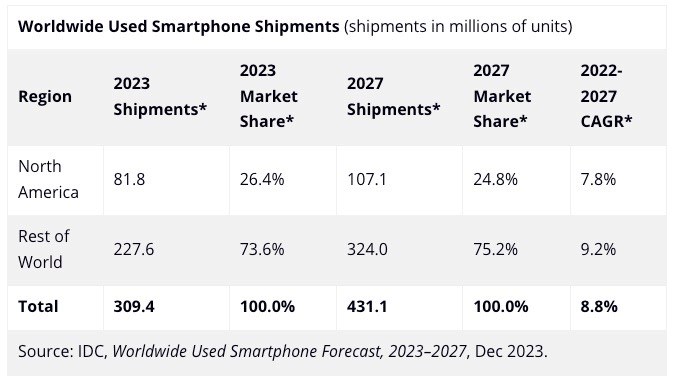

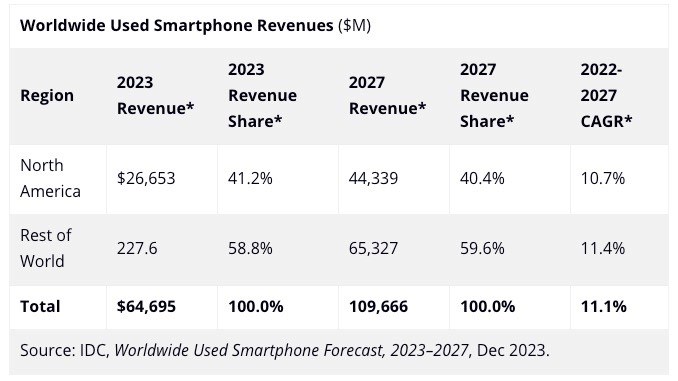

According to research house IDC, that “used smartphone” market was already worth $64.7bn in 2023 and it predicts that the market will grow rapidly to be worth $109.7bn in 2027 (see chart, below). The number of used smartphones shipped in 2023 was 309.4 million, up from about 282 million in 2022, and will reach 431.1 million units in 2027, representing a compound annual growth rate (CAGR) of 8.8% over the five years between 2022 and 2027.

Of course, the supply of available used smartphones is, perforce, as variable as the ever-changing fortunes and strategies of the makers of new ones. Recently, global geopolitical problems have had a major impact on the global mobile device sector, as have supply chain difficulties and interruptions, increasing prices and intensifying consumer resistance to the pressure exerted by manufacturers to upgrade to the latest shiny device. Consumers’ purse strings are tight and they are now hanging onto their old smartphones for longer: Refresh rates for new smartphones “in most developed markets have extended past 40 months, which has caused a shortage of available inventory for the secondary market,” noted the IDC team.

What is certain, though, is that demand for used and refurbished smartphones is growing and will continue to do so for the foreseeable future.

However, the reality is that there aren’t enough used smartphones available to meet demand. Sales of new smartphones have been declining as consumers and enterprises tighten their belts, inflation bites and geopolitical relations continue to worsen – IDC noted recently that it expects global smartphone shipment numbers to have shrunk by about 3.2% year on year to 1.17 billion in 2023.

Given those factors, it is not surprising then that sales of used smartphones were up by almost 10% last year. Trade-in deals keep the sector turning-over but at a slower rate than was the case a couple of years ago and that can only make up a small portion of the total inventory for used smartphones: The result is scarcity.

As Anthony Scarsella, research manager with IDC's Worldwide Quarterly Mobile Phone Tracker, noted: “Despite the near 10% growth, the secondary market is showing signs of slowdown due to a genuine lack of inventory. With refresh rates extending in most mature markets, acquiring inventory remains the biggest challenge for resellers. Secondary phone retailers are hungry for inventory as the high end of the market continues to be scarce due to customers just holding on to their devices. This lengthening can also be witnessed in the new market where shipments declined 3.5% for 2023.”

According to IDC's classification scheme, a refurbished smartphone “is a device that has been used and disposed of at a collection point by its owner. Once the device has been examined and classified as suitable for refurbishment, it is sent off to a facility for reconditioning and is eventually sold via a secondary market channel. A refurbished smartphone is not a ‘hand-me-down’ or gained due to a person-to-person sale or trade.”

As to the future? Well, all things considered, it seems clear that smartphones will continue to evolve and be with us in their instantly recognisable format for many years yet. Currently indispensable, nothing much will change until they are eventually replaced by wearable displays, AI apps and ambient interfaces that will emerge as time goes by. And as long as smartphones get incrementally better and more compelling, the longer the market for trade-in used, second-hand and refurbished devices will grow and prosper. At least a decade, and probably longer, seems to be the industry consensus.

– Martyn Warwick, Editor in Chief, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.