** HICKORY, NC: Fourth Quarter Highlights**

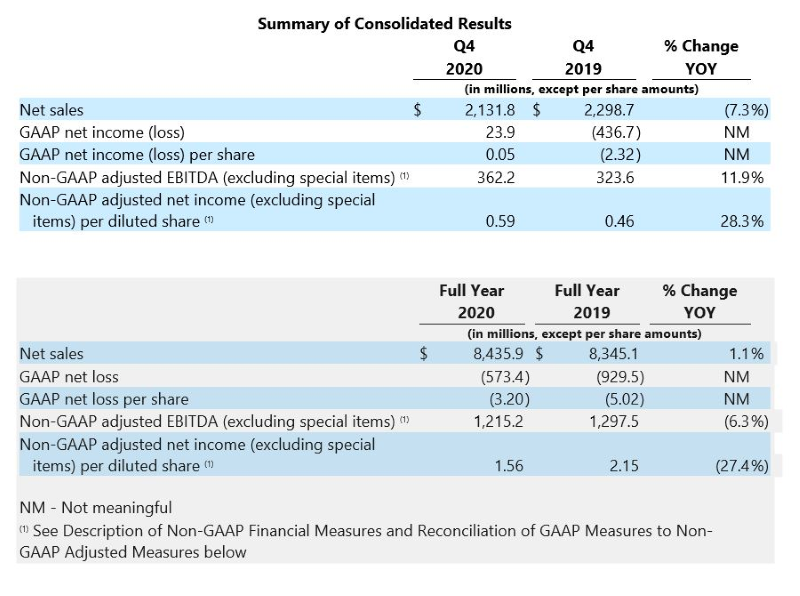

- Net sales of $2.132 billion

- GAAP net income of $23.9 million

- Non-GAAP adjusted EBITDA of $362.2 million

- Cash flow from operations of $97.7 million and non-GAAP adjusted free cash flow of $65.1 million

- Continued debt repayment with $100 million redemption of 6.00% senior notes due 2025 (“the 2025 Notes”)

Full Year Highlights

- Net sales of $8.436 billion

- GAAP net loss of $573.4 million

- Non-GAAP adjusted EBITDA of $1,215.2 million

- Cash flow from operations of $436.2 million and non-GAAP adjusted free cash flow of $415.4 million

- Debt redemptions of $200 million of the 2025 Notes and $100 million of the 5.00% senior notes due 2021 (“the 2021 Notes”)

HICKORY, NC — CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, reported results for the quarter and year ended December 31, 2020.

“We delivered strong results for the fourth quarter despite the continued market uncertainty related to the pandemic,” said Chuck Treadway, president and chief executive officer. “While 2020 was a year of change, our dedicated team, resilient supply chain and agile operations allowed us to quickly adapt and innovate across all aspects of our business, and achieve solid financial results while serving our customers around the world.

“Connectivity has never been more vital to businesses and our society,” Treadway added. “Customers are relying on us to help them build connections that meet today’s needs while planning for tomorrow’s demand. Though our portfolio of solutions and expertise is extensive, we see meaningful opportunities to capitalize on our commitment to customers and take CommScope to the next level of success. With that in mind, this quarter we announced a company-wide initiative, CommScope NEXT, which is a multi-faceted program to drive growth that outpaces the market and drives significant shareholder and stakeholder value. While there is a lot of work ahead, I am inspired by the passion of our CommScope team to build a business that is driven to deliver lasting connectivity for customers and solid results for shareholders.”

Alex Pease, executive vice president and chief financial officer, said, “This past year presented many unexpected challenges for the entire economy, but our agile and resilient business model enabled us to deliver solid bottom-line results. And as we implement CommScope NEXT, we will continue to evaluate opportunities to reduce costs across the business, generate cash flow, reduce our leverage as quickly as possible, and reinvest in core strategic markets and technologies to capitalize on significant growth opportunities. We are dedicated to ensuring that as the economy recovers and as industry tailwinds take shape, CommScope will be well positioned to deliver growth and emerge as a stronger, more streamlined company.”

Fourth Quarter Results and Comparison

Reconciliations of the reported GAAP results to non-GAAP adjusted segment results can be found at https://ir.commscope.com/.

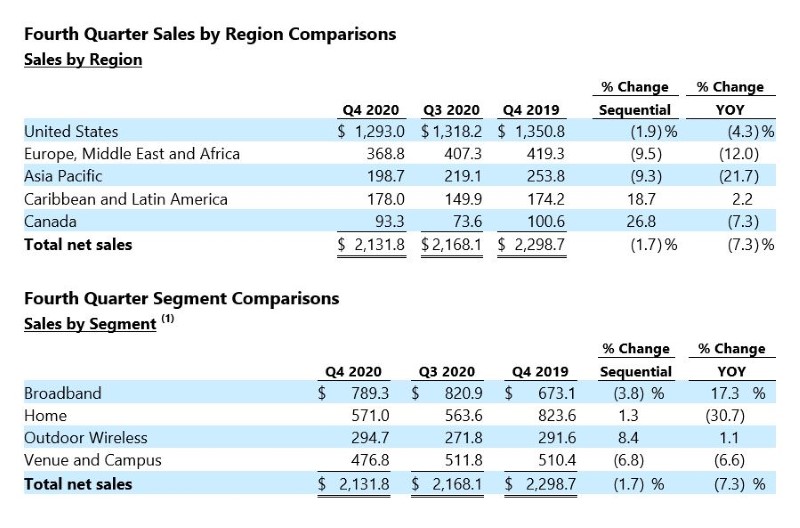

Net sales in the fourth quarter of 2020 decreased 7.3% year over year to $2.13 billion. Net sales declined primarily due to year over year decreases in the Home Networks and Venue and Campus Networks segments.

CommScope generated net income of $23.9 million, or $0.05 per share, in the fourth quarter of 2020, compared to the prior year period's net loss of $(436.7) million, or $(2.32) per share. Non-GAAP adjusted net income for the fourth quarter of 2020 was $143.8 million, or $0.59 per share, versus $106.6 million, or $0.46 per share, in the fourth quarter of 2019.

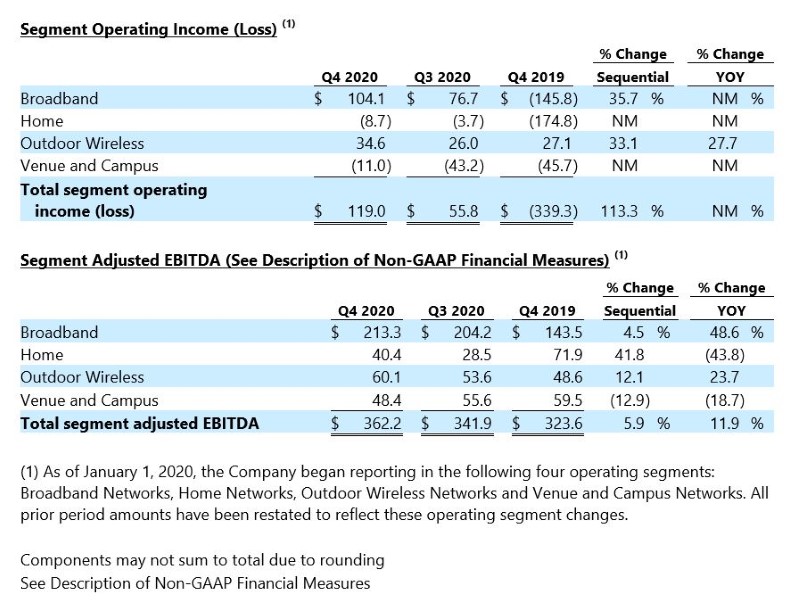

Non-GAAP adjusted EBITDA increased 11.9% to $362.2 million in the fourth quarter of 2020 compared to the same period last year. Non-GAAP adjusted EBITDA improved to 17.0% of net sales in the fourth quarter of 2020 compared to 14.1% of net sales in the same prior year period. The Company estimates that fourth-quarter 2020 non-GAAP adjusted EBITDA was negatively impacted by approximately $10 million related to COVID-19 incremental costs.

- Net sales of $789.3 million, increased 17.3% from prior year driven by growth in both Network Cable & Connectivity and Network & Cloud.

- Net sales of $571.0 million, down 30.7% from prior year driven by declines in Home Media Solutions, partially offset by growth in Broadband Connectivity Devices.

- Net sales of $294.7 million, increased slightly by 1.1% from prior year driven by growth in Macro Tower Solutions, while partially offset by declines in Metro Cell Solutions.

- Net sales of $476.8 million, down 6.6% from prior year primarily driven by declines in Indoor Copper Enterprise and a moderate decline in RUCKUS Networks. Results were partially offset by growth in Indoor Fiber Enterprise and DAS and Small Cell.

Full Year Results and Comparison

For comparisons described below on a combined company basis, the 2019 comparison period includes the historical ARRIS business results, with certain classification changes to align to CommScope’s presentation, from January 1, 2019 through the date of the acquisition, April 4, 2019. Reconciliations of the combined company amounts and reported GAAP results to non-GAAP adjusted results are included below.

Net sales in 2020 increased 1.1% year over year to $8.44 billion primarily due to a year over year increase in the Broadband Networks segment. On a combined company basis, net sales decreased 13.5% year over year primarily due to decreases in the Home Networks, Outdoor Wireless Networks and Venue and Campus Networks segments.

CommScope generated a net loss of $(573.4) million, or $(3.20) per share, in 2020, compared to the prior year net loss of $(929.5) million, or $(5.02) per share. Non-GAAP adjusted net income for 2020 was $371.0 million, or $1.56 per share, versus $479.4 million, or $2.15 per share, in 2019.

Non-GAAP adjusted EBITDA decreased 6.3% to $1,215.2 million compared to the prior year. On a combined company basis, non-GAAP adjusted EBITDA decreased 11.2% and represented 14.4% of net sales compared to 14.0% of net sales in 2019. The Company estimates that 2020 non-GAAP adjusted EBITDA was negatively impacted by approximately $70 million related to COVID-19 supply chain disruptions and certain other incremental costs.

Cash Flow and Balance Sheet

- GAAP cash flow from operations of $436.2 million.

- Non-GAAP adjusted free cash flow was $415.4 million after adjusting operating cash flow for $121.2 million of additions to property, plant and equipment, $78.7 million of cash paid for restructuring costs and $21.7 million of cash paid for transaction and integration costs.

- Ended the year with $521.9 million in cash and cash equivalents.

- As of December 31, 2020, the Company had no outstanding borrowings under its asset-based revolving credit facility and had availability of $735.1 million, after giving effect to borrowing base limitations and outstanding letters of credit. The Company ended the year with total liquidity of approximately $1.26 billion.

- Redeemed $200 million aggregate principal amount of the 2025 Notes and $100 million aggregate principal of the 2021 Notes during the year.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.