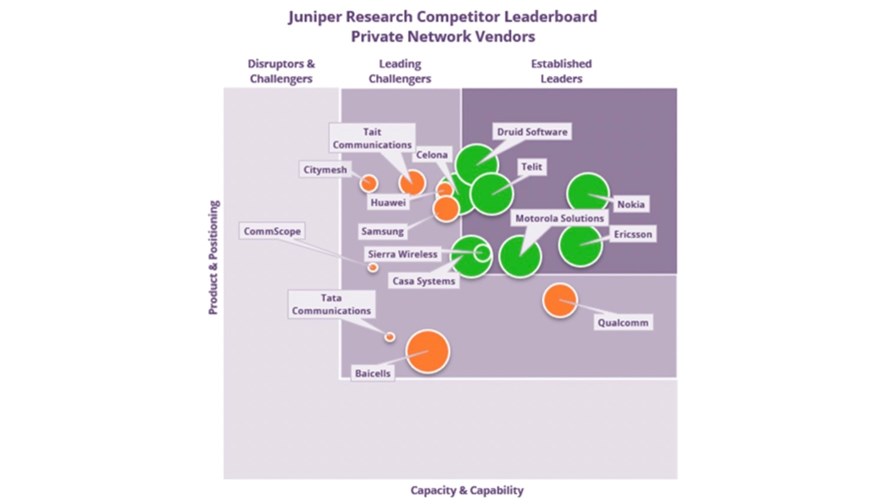

Source: Juniper Research

- Juniper Research has identified the leading private networks vendors

- Nokia and Ericsson lead the way

- But specialists also feature strongly

- Vendors are making the most of operators’ sluggish response to demand

While many of the headlines about private network deployments and agreements right now feature familiar names from the top ranks of the telecoms industry, such as Nokia and Ericsson, the team at Juniper Research has reminded us that there are specialist players in the private wireless networks sector that have strong product sets and the capabilities to deliver them to enterprise users that want a secure cellular communications environment of their own.

The research firm has produced a Competitor Leaderboard for the Private Networks Vendor sector, and names such as Druid Software, Telit and Celona feature in the top five, behind Nokia (which says it has more than 380 private network customers) and Ericsson of course: Both mobile networking giants have proven their strengths in the market in recent days, announcing significant engagements with large car manufacturers. (See Ericsson and Porsche rev up for 5G future and Nokia deploys 5G private wireless network for Volkswagen’s pilot project in Germany.)

But it’s interesting to note and remind ourselves that the private wireless market, which is the focus of a Great Telco Debate session on 8 December, is neither new nor lacking in vendor options: It has certainly gained a new lease of life from the availability of reserved 5G spectrum set aside for enterprises wanting to build their own comms infrastructure, but the option to use unlicensed spectrum and technology advances have also helped light a fire under the market, and some of the players have been developing their specialist solutions for years.

And look at the other big names just outside the top five in Juniper Research’s chart – Motorola Solutions and Samsung are both there, while Casa Systems, one of the vendors taking an Open RAN-enabled route into the market, is also deemed to be a vendor of significance: Its CEO Jerry Guo told TelecomTV last year that “The difference between us and many other players is that we have developed not only the CU/DU portion but also our own radio head [hardware and software]… we have significant expertise in RF and modulation technology such as OFDM/OFDMA – that’s very different from the traditional route of just buying a chip from a chip vendor…”

And lots of other companies are also chipping away at the opportunities, often in a coordinated way. (See Colt, Icade, ADVA, Airspan Networks, Athonet, Accedian and Tibco join forces to deploy enterprise private 5G pilot in France.)

The Juniper Research team believes that the vendor community has stepped in where the mobile operators have failed to identify and seize the opportunity. “The most successful players here are network vendors with equipment channels that they can use as an entry point into the market. The flexible nature of 5G has enabled many non-traditional operators to provide private cellular services, particularly where regulation allows for unlicenced use of 5G spectrum,” notes the research firm.

And James Moar, who has authored a report on the sector, Private Cellular Networks: Spectrum Assessment, Business Models & Forecasts 2021-2026, adds:

“While traditional cellular connectivity is the core of private networks’ benefits, many users will want to maintain other forms of connectivity technology, such as Wi-Fi and low-power wide area networks. If private network players want to move into multiple industries that already use a range of connectivity types, bridging the gap between these technologies will be necessary.”

For more on Juniper Research’s views of this market, see this announcement.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.