- Country has "compelling 5G momentum"

- Thanks to "government support and Huawei's ambitions"

- Pandemic will have only a "short-term impact"

- Cheaper 5G handsets on the way before the end of the year

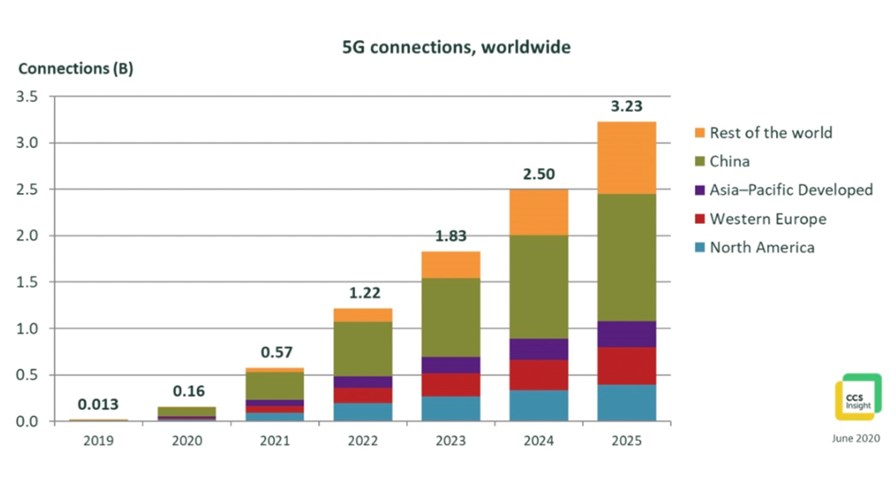

An optimistic new report on the deployment and uptake of 5G concludes that connections of the new technology will exceed 1 billion by 2022, the pandemic notwithstanding. CCS Insight, the research and analysis house, predicts there will be more than 3.2 billion 5G connections by 2025.

Furthermore, despite what CCS Insight delicately refers to as the "disruptions" that occurred in Q1 of the Year of the Plague, the company has revised upwards its forecast for 5G connections in China and concludes that the "compelling 5G momentum" in the PRC is the result of "continued government support, Huawei’s 5G ambitions and the availability of 5G handsets." As a result, it’s expected there will be 100 million 5G connections in China by the end of this year and that will grow to exceed 1 billion in 2024.

The report is very upbeat, and whilst acknowledging that the current health crisis and the resulting global economic uncertainty will have "short-term impacts on 5G adoption, the future for 5G remains bright." Indeed, by 2025, one in every four mobile connections across the planet will be 5G – apparently.

The new paper also has it that the current health crisis "will have only a moderate and short-term effect on adoption, caused by relatively minor delays in the roll-out of 5G networks and sale of spectrum as well as macroeconomic uncertainty after governments lift lockdowns." However, these factors will be ameliorated in part by the increasingly widespread availability of 5G smartphones and the mass uptake of 5G in China.

Currently, 40% of handsets bought in China are "5G enabled." Meanwhile, the introduction of new chipsets and increased competition will result in the early availability of (somewhat) cheaper smartphones, perhaps by as soon as the end of 2020. According to Marina Koytcheva, the Vice President of Forecasting at CCS Insight, "We are going to see prices of supporting devices tumble below US$400 faster than previously expected, a trend that will be instrumental in 5G becoming more accessible to a much wider demographic."

CCS Insight does concede that "the short-term disruption in the first half of 2020… will have some ripple effect in the rest of the year and in 2021" but as it is increasingly evident that mobile comms are a critical part of national infrastructure (who'd have thought it?), 5G investment will power ahead for years to come as telcos complete their metamorphoses and acquire the network capacity and efficiency to become DSPs.

China seen as the driving force behind 5G uptake

CCS Insight obviously regards the Chinese market as the main engine behind 5G and places great store in the country's potential have a massive global impact – hence the upgrading of its forecast for 5G connections within the PRC for 2020, even though Covid-19 originated there.

The director of CCS Insight's consumer and connectivity research, Kester Mann, commented: "Strong desire from local operators to make up for delays caused by Covid-19 in the first quarter, combined with enthusiastic support from the government, wide availability of more-affordable 5G handsets and the unrelenting ambition of local network equipment and handset manufacturer Huawei, will spur demand."

The Trump administration won't like the sound of that. It will like even less that, as a direct result of the escalating trade war between the US and China, Huawei and other companies are spending huge sums on designing and making their own 5G chips with the intent to make themselves independent of western technology. Simultaneously, the PRC has a plan to deploy 1 million 5G base stations across the country before the end of the year, and that's just the start of the rollout.

On the IoT front, the report reckons there will be 270 million IoT devices connected to 5G networks by 2025, but adoption of the technology across the industrial IoT will not reach the dizzying heights that were forecast before the pandemic struck, not least because whilst the future for telecoms is very bright, other industries will face major problems as they struggle to recover and restructure once the virus is beaten. As the report notes, the industrial IoT "including smart cities will stall as governments and businesses focus on shorter-term priorities," although China, again, will be "a notable exception."

Elsewhere, take-up of 5G remains strong in South Korea – there are now 6 million connections there just a year after the networks went live. Over in Japan the country's three main network operators have all launched 5G services, but considerably later than had been planned and expected. In Europe, 5G networks are now operating, in one form or another, in 17 countries including Belgium, the Netherlands, Norway, Poland and Sweden, all of which launched commercially during their pandemic lockdowns.

The thesis of the CCS Insight report is that the world mobile telecoms sector will make a full recovery to its traditional rude health by 2022. Given that overarching assumption, the paper is overwhelmingly positive, and heaven knows we all need some optimism in our lives in these dark days. However, dotted here and there throughout the paper, like little slices of sour plum in a strawberry soufflé, are some necessary and sobering caveats.

The report points out that global uncertainty resulting from the pandemic means that the forecast "carries significant risk". Potential downsides include: A slower than expected recovery of the mobile market; a prolonged global recession; reluctance of consumers to splash out on new handsets while their existing 3G and 4G devices provide perfectly adequate coverage, services and apps; the post-pandemic restructuring of businesses and businesses practices; and escalations in the trade wars that are exacerbating geopolitical tensions.

Any or all of those factors could come into play, but telecoms is a resilient industry of great inventiveness and huge resources, so we can all hope that it will weather the current storm and sail on through intact, afloat and ready to continue the voyage of discovery.

“First star to the left and straight on till morning…”

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.