Source: Analysys Mason

- 5G-related spending to take a hit this year

- Research firm expects rebound in 2021

- Rebound dependent on two critical factors

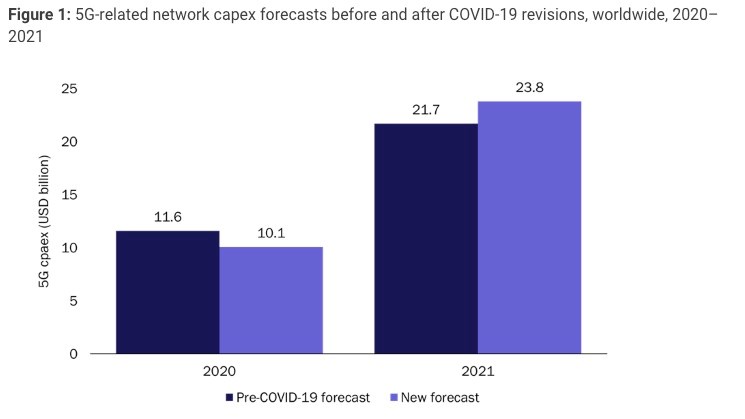

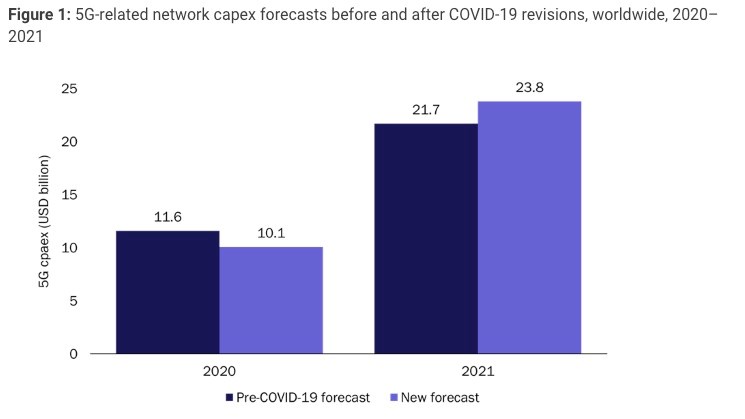

Research firm Analysys Mason expects global 5G-related capex to total $10.1 billion this year, down from the $11.6 billion it had forecast pre-pandemic, due to “disruption to network deployment and weaker demand from consumers and businesses in the middle quarters of 2020.”

Analyst Caroline Gabriel added in this report that “the reduced demand is likely to persist for a longer period than the network disruption and will drive operators to intensify the focus of their 5G strategies on cost reduction rather than new, enterprise-driven revenue streams.”

So far, so bad. But there’s light at the end of the tunnel, as Gabriel expects a bounce back in 5G-related spending in 2021, when 5G-related capex is expected to total $23.8 billion, almost 10% greater than the $21.7 billion previously expected, as the chart below shows.

Source: Analysys Mason

Vendors shouldn’t get too excited, though, as Analysy Mason believes that “mobile capex overall will decline more sharply, and some non-5G investment will be permanently lost as operators intensify their efforts to capitalise on their existing assets.”

And there are caveats related to the 5G capex spike next year, as this will be dependent on two factors: That “governments around the world emulate the Chinese government and include 5G in their stimulus funding and other recovery programmes”; and that “demand for 5G services recovers to somewhere close to the levels anticipated before COVID-19 (at least during 2021),” which might be a tough call especially in the enterprise sector as “future plans for services such as private networks, smart manufacturing and IoT are now likely to be put on hold.”

The competition for those stimulus funds will be tough but, as we learned during the recent DSP Leaders World Forum session on Connectivity and the Resurgence of Telecoms in the Global Economy, there is a new-found respect for the vital role that communications network operators play in the overall economy, and that role is only likely to become even more important if working patters change in the long-term, as is expected.

As for the demand for 5G services, that’s impossible to predict – there are too many moving parts. From this editor’s point of view, a significant uptick in enterprise 5G services for mobile operators from specific, vertical-friendly 5G services would have been a bit further off than 2021 even without the impact of Covid-19, so hopefully that won’t be too much of a factor.

The hope across the whole industry, of course, is that any delays or shifts are not so severe that we start to see companies that were relying on 5G-related capital investments going out of business, or that operators find themselves so cash-constrained that capex becomes squeezed for the next few years.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.