Source: GSA

- The GSA has been totting up the numbers and there’s a lot of life left in the old dog yet

- There’s 861 operators serving LTE to around 4 billion users

- While 45 operators have announced the deployment of 5G within their live networks and 17 have announced limited 3GPP 5G launches

The GSA has produced a report entitled ‘Evolution from LTE to 5G - Global Market Status’ on the current ‘market status’ of LTE - in other words, at what stage of maturity is it as 5G start to arrive? Is it still on the way up? On a plateau? Or on the way down? It’s clearly very important for an industry that develops and manufactures all the components required for LTE networks (the industry represented by the GSA which now stands for Global mobile Suppliers Association) to get a good handle on this dynamic since they all need to know how, when and by how much their bit of the market is expanding or contracting and whether it’s likely to be worthwhile investing in R&D and manufacturing capacity to meet the needs of telco clients.

So the big picture is, as you might expect, that LTE is still in fine fettle, despite, or even because of, the onset of 5G in some territories. The GSA says it currently has around 4 billion subscribers and plays a part in connecting around 47% of mobile users worldwide. I say ‘plays a part’ because users usually have more than one connectivity option. Wi-Fi is obviously a big factor in many territories where it was rushed out to support 3G which couldn’t cope with data demand in the early smartphone days. By some estimates Wi-Fi still accounts for the lion’s share of smartphone data consumption in many territories. It arrived to support 2G and 3G and then just stayed.

For that and other reasons the term ‘subscription’ is now slightly misleading. Subscribers now subscribe to a mobile service, not a specific cellular technology, and they are assigned connections which, in the case of 4G smartphones, may episodically involve 3G or even 2G where LTE service is poor. In some cases service may even revert to Wi-Fi if the signal is stronger and the connection better than the cellular service. In other words it is a heterogeneous network and service.

As time goes on and what was a 3G user purchases a new smartphone, he or she tends to adopt whatever the next iteration is, knowingly but also by default. In the early days of the ‘G’, and certainly in the case of 5G, smartphone owners may spend a proportion of their time on the previous ‘G’ as the network is built out, only getting the full benefit some way into their ‘subscription’.

So there has to be a better way of rating the progress of the phased introduction of a new ‘G’ than reverting to the rather binary and antique term ‘subscription’.

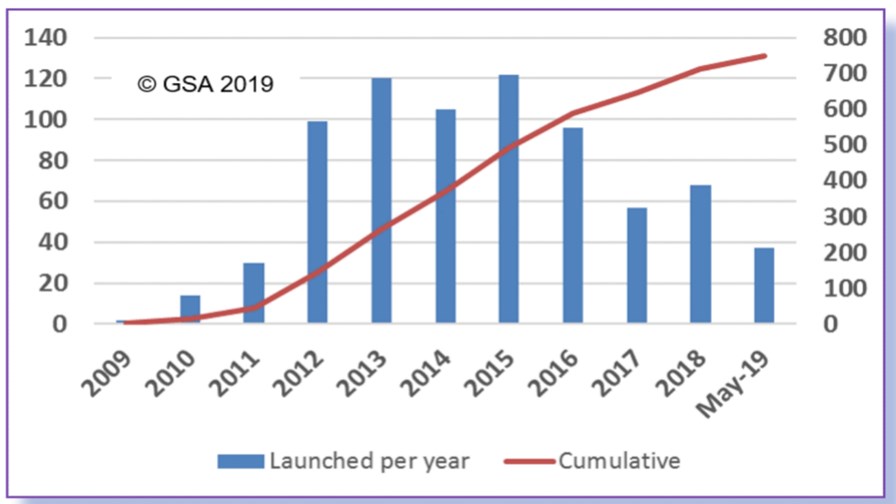

Here is the GSA’s main numbers defining both the demand and supply sides of the LTE industry. Key market facts include:

861 operators actively investing in LTE, including those evaluating/ testing and trialling LTE and those paying for suitable spectrum licences (excludes those using technology neutral licences exclusively for 2G or 3G services).

750 operators running LTE networks providing mobile and/or FWA services in 223 countries worldwide.

188 commercial VoLTE networks in 89 countries and a total of 256 operators investing in VoLTE in 116 countries.

302 launched or launched (limited availability) LTE-Advanced networks in 134 countries. Overall, 333 operators are investing in LTE-Advanced technology in 141 countries.

Ten launched networks that support user equipment (UE) at Cat-18 DL speeds within limited geographic areas.

760–770 anticipated commercially launched LTE networks by end-2019 (GSA forecast).

226 operators with TDD licences and at least 160 operators with launched LTE-TDD networks.

148 operators investing in NB-IoT in 71 countries; of these, 98 NB-IoT networks are deployed/launched in 53 countries. Sixty-two operators are investing in LTE-M/Cat-M1 in 36 countries; of these, 37 LTE-M/CatM1 networks are deployed/commercially launched in 25 countries.

235 operators in 93 countries have launched with limited availability, deployed, demonstrated, are testing or trialling, or have been licensed to conduct field trials of mobile 5G or FWA 5G.

45 operators in 30 countries have announced the deployment of 5G within their live network.

17 operators have announced limited 3GPP 5G service launches.

The full report is available (upon user registration) from the GSA

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.