Atlanta, Georgia – KORE Group Holdings, Inc. (NYSE: KORE) (“KORE” or the “Company”), is providing this press release to correct clerical errors in tables contained in the press release filed on April 11, 2024 regarding (i) previously reported Average Total Connections for fiscal year 2022, (ii) previously reported revenue for fiscal year 2022, (iii) reported change in fair value of warrant liability, loss on debt extinguishment and integration-related restructuring costs for the quarter and fiscal year ended December 31, 2023 and (iv) reported Adjusted EBITDA for the quarter ended December 31, 2023. The updated release reads:

KORE Group Holdings, Inc. (NYSE: KORE) (“KORE” or the “Company”), the global pure-play Internet of Things (“IoT”) hyperscaler, and provider of IoT Connectivity, Solutions and Analytics, today reported financial and operational results for the quarter and full year ended December 31, 2023.

KORE: Company Highlights

- The Company is providing 2024 revenue guidance in the range of $300 to $305 million and Adjusted EBITDA, a non-GAAP metric1, guidance in a range of $64 to $66 million, reflecting a re-acceleration in IoT Connectivity growth. IoT Connectivity is projected to grow at 20% in 2024. Streamlined operating costs and a strong start to Q1 bolster KORE's confidence in meeting its 2024 outlook. With its five-year transformation complete, KORE will no longer be adjusting one-time transformational investments starting in 2024. On a comparable basis, without these one-time adjustments, which were made in 2023, the Company anticipates full year-over-year Adjusted EBITDA growth of approximately 33% at the midpoint of its guidance range.

- The Company delivered $72.4 million in revenue in the fourth quarter of 2023, which represented 16% growth year-over-year, powered by a 27% increase in IoT Connectivity revenue, partially offset by the deferrals in its IoT Solutions business. Net loss for the fourth quarter was $33.7 million, a decrease in loss of 52% year-over-year. The Company’s Adjusted EBITDA of $13.8 million was down 12% year-over-year.

- The Company generated an incremental closed-won Total Contract Value (TCV)2 of $28 million in the fourth quarter of 2023, bringing the total closed-won TCV for the year to $115 million. This represents the fifth straight year of closed-won TCV growth.

- KORE landed its first major Connected Health pre-configured solution win. The Connected Health Telemetry Solution (CHTS) customer is a global healthcare enterprise, and in the first quarter of 2024, the Company finalized this deal with a TCV of $26 million. For this engagement, the Company will be supporting a global home respiratory therapy program for over 65,000 patients, with the customer utilizing KORE's CHTS gateway, device management and configuration, cloud platform and a temporary data repository cloud service.

- KORE has demonstrated its industry leadership and commitment to innovation by securing its position as a Leader in Gartner’s Magic Quadrant for Managed IoT Connectivity Services Worldwide for the fifth consecutive time and receiving the 2023 IoT Excellence Award from TMC and Crossfire Media for its CaaS offerings, including Super SIM, which guarantees optimal coverage, quality, and cost in wireless connectivity. Additionally, KORE is one of six managed IoT connectivity vendors consistently included in Gartner’s Peer Insights across all three regions analyzed.

1 See “Non-GAAP Financial Measures” and “Reconciliation of Net Loss to EBITDA to Adjusted EBITDA” below for more information.

2 “Key Metrics” below for definitions

“Although 2023 was a challenging year characterized by inventory corrections and fluctuating macroeconomic conditions, I am incredibly proud of everything KORE accomplished over the year. We expanded our connectivity portfolio, strengthened our balance sheet, and streamlined operating costs. While we experienced additional order deferrals in Q4, including from our largest customer, KORE has retained these customers, and we are well-positioned to take advantage of a de-risked 2024. We expect our core connectivity business to grow by double digits organically and by over 20% year-over-year. As our organic growth accelerates, we will remain cost-disciplined, focusing on profitability and EBITDA. With the 2G/3G sunsets and much macro uncertainty behind us, KORE has never been better positioned to capture the opportunity that the decade of IoT brings," said Romil Bahl, President and CEO of KORE.

Financial Performance for the Fourth Quarter of 2023, Compared to the Same Period of 2022:

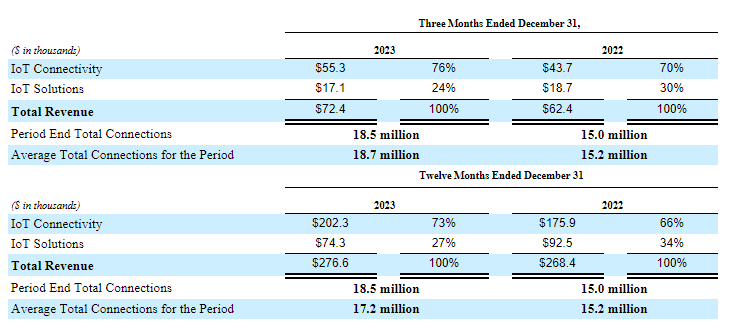

- Total revenue increased by 16% to $72.4 million, compared to $62.4 million in the fourth quarter of 2022.

- IoT Connectivity revenue of $55.3 million increased by 27%, compared to $43.7 million in the fourth quarter of 2022. On an organic basis, IoT Connectivity revenue growth was in the mid-single digits.

- IoT Solutions revenue declined by 9% to $17.1 million, compared to $18.7 million for the same period one year ago. The decline in IoT Solutions reflects significant deferrals from KORE’s top customer, with no shipments in the quarter.

- Net loss decreased 52% year-over-year to $33.7 million, compared to $68.8 million for the same period one year ago.

- Adjusted EBITDA decreased 12% year-over-year to $13.8 million from $15.7 million in the fourth quarter of 2022.

Financial Performance for Fiscal Year Ending December 31, 2023, Compared to the Same Period of 2022:

- Revenue increased by 3% to $276.6 million, compared to $268.4 million.

- IoT Connectivity revenue increased 15% to $202.3 million, compared to $175.9 million.

- IoT Solutions revenue decreased by 25% to $74.3 million, compared to $92.5 million. The revenue decline in the year was driven by a large deferral in the fourth quarter from KORE’s top customer and the LTE transition project completed in the second quarter of 2022.

- Net loss increased to $167.0 million, compared to $106.2 million in 2022. The Company’s annual net loss increased due to higher interest expenses, increased costs due to the acquisition of the Twilio IoT business, a mark-to-market charge on the fair value of certain of the Company’s warrants, and one-time costs associated with the Company’s debt refinancing.

- Adjusted EBITDA declined by 11% to $55.6 million, compared to $62.8 million in the comparable period. The decline was due to increases in headcount-related costs, including those from the acquired Twilio IoT business, and higher professional services fees associated with the Company’s audit.

The tables below summarize our revenue and specific key metrics:

Fourth Quarter 2023 Key Metrics and Business Successes

- KORE's Total Connections3 were approximately 18.5 million as of December 31, 2023, a decline of over 400,000 from the third quarter of 2023 and an increase of 3.5 million from the same period in 2022. The decline in the quarter-over-quarter Total Connections reflects the deactivation of low-revenue SIMs from a single Connectivity Enablement as a Service (CEaaS) customer that was acquired and is being integrated into the acquiring company’s in-house platform. KORE is assisting that customer with the transition. CEaaS is a line of business the Company is de-emphasizing going forward.

- DBNER4 was 96% for the twelve months ending December 31, 2023, compared to 92% for the twelve months ending December 31, 2022. Excluding the Company’s largest customer, DBNER was 101% vs. 103%.

- KORE’s new business sales funnel now includes almost 1,600 opportunities, with an estimated potential TCV of approximately $545 million as of December 31, 2023, compared to $740 million and $434 million as of September 30, 2023 and December 31, 2022, respectively. This funnel has been de-risked by removing most deals that include low-margin hardware and has further refinements at the end of the year to ensure the Company is focused on the highest quality, highest probability potential deals.

- KORE and Medical Guardian collaborated on a pioneering eSIM-Powered Medical Alert Device. This revolutionary technology is designed to overcome the challenges of limited carrier flexibility and coverage, enabling network switching to optimize connectivity across different regions and operational phases and enabling optimal 24/7 connectivity.

- KORE had several notable new business wins in the fourth quarter, including:

- Cross-selling IoT Solutions with the KORE One-Stop-Shop: KORE won a contract with one of the largest privately held homebuilders in the U.S. to cross-sell Pre-Configured Solutions with Managed Services alongside Connectivity. KORE achieved this after demonstrating how its high-bandwidth Pre-Configured Solutions could enhance operations, quicken the time-to-market, and improve the customer experience, which, along with Connectivity, optimized the customer's entire connectivity system.

- Increasing Share of Wallet: A leading high-performance software and solutions provider for the real estate industry is adding 15,000 units to its single-and-multi-family home portfolio, signaling confidence in KORE’s one API approach and top-tier customer support, as well as generating an estimated $2 million in TCV.

- International Opportunities / Global Deployments: A leader in IoT asset tracking and vehicle telematics is launching a new Buy-Here Pay-Here product leveraging KORE OmniSIM. This product will target the subprime vehicle loan market and is worth $1.6 million of TCV.

- Upsell / Land and Expand: A rapidly growing management network increased its spending with KORE after choosing the Company for its primary and failover solutions in the U.S., with further potential significant European expansion opportunities.

3 See “Key Metrics” below for definitions.

4 See “Key Metrics” below for definitions.

2024 Financial Outlook

For the twelve months ending December 31, 2024, the Company expects the following:

- Revenue in the range of $300 million to $305 million; and

- Adjusted EBITDA in the range of $64 million to $66 million, and an Adjusted EBITDA margin of approximately 22% at the midpoint of revenue and Adjusted EBITDA guidance.

Bahl concluded, “KORE is entering 2024 in a position of strength. Our sales momentum continues to grow, having delivered a fifth straight year of TCV growth, and our ecosystem partnerships have never been stronger, as evidenced by our Cradlepoint announcement. We expect to grow higher margin IoT Connectivity business by approximately 20% in 2024, driven by our largest end-markets rebounding, the end of the 2G and 3G sunsets, and stabilizing ARPU. As we grow our top line in 2024 and beyond, KORE will remain focused on profitability, as evidenced by our decision to de-emphasize low-margin hardware revenue. Our goal is to build back to 25% EBITDA margins.”

Conference Call Details

KORE management will hold a conference call today at 8:00 a.m. Eastern time (5:00 a.m. Pacific time) to discuss its financial results, business highlights, and outlook. President and CEO Romil Bahl and CFO Paul Holtz will host the call, followed by a question-and-answer session.

Webcast: Link

U.S. dial-in: (877) 407-3039

International dial-in: (215) 268-9922

Conference ID: 13744718

The conference call and a supplemental slide presentation to accompany management’s prepared remarks will be available via the webcast link and for download via the investor relations section of the Company’s website, ir.korewireless.com.

For the conference call, please dial in 5-10 minutes prior to the start time, and an operator will register your name and organization, or you may register here. If you have difficulty with the conference call, please contact KORE investor relations at (678) 392-2386. A replay of the conference call will be available approximately three hours after the conference call ends. It will remain on the investor relations section of the Company’s website for 90 days. An audio replay of the conference call may be accessed by calling (877)-660-6853 or (201)-612-7415 using access code 13744718.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.