© O2, TTV

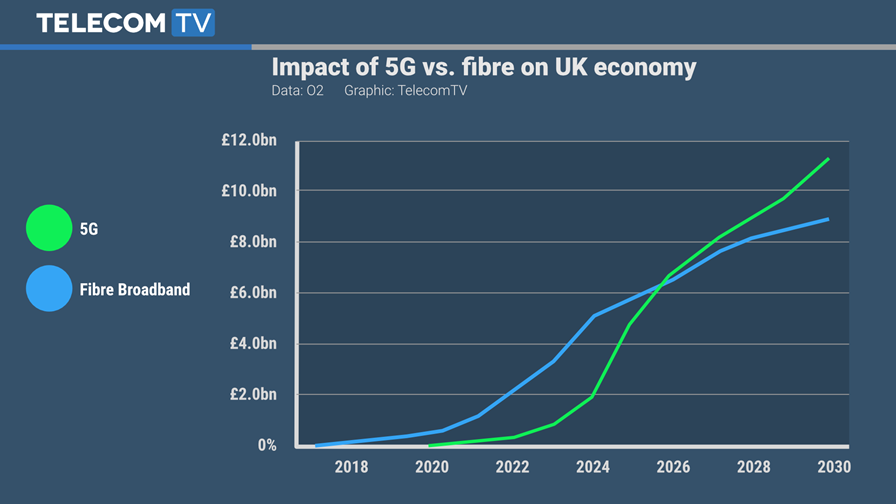

- By 2026, the direct economic benefits of 5G rollout will exceed that of fibre

- 5G infrastructure to directly contribute an additional £7bn a year to UK economy

- An extra £3bn a year through secondary supply chain impacts

- 5G will deliver this economic impact almost twice as quickly as fibre broadband.

UK mobile O2, still owned by the Telefonica group, believes a mobile-only future is perfectly viable, and that not having a fixed broadband service won’t be detrimental in the decade to come. That’s the general gist of a new report O2 commissioned from independent research consultancy Development Economics. Measuring the impact of 5G on the nation’s economic growth, the study concludes that the UK’s 5G infrastructure will outstrip the economic benefits of fibre broadband by 2026.

The full report is yet to be made public, so we are having to base our analysis on what O2 has chosen to release to the media. However, we have requested sight of the report when and if it becomes public and will update and revise accordingly.

The report suggests that as the UK aims to boost up its economy, post-Brexit, accelerating investment in 5G infrastructure will unlock opportunities to sustain growth, boost productivity and allow the UK to compete on a global stage. It calculates that there will be £7 billion of direct economic value through businesses using 5G, plus there will also be a “ripple effect” through the supply chain that will also see it indirectly boost the nation’s productivity by an extra £3 billion a year.

The report believes that the added value of 5G mobile connectivity to the UK economy will also become apparent almost twice as quickly as fibre broadband. Despite rollout of fibre broadband already taking place and 5G rollout not scheduled until 2020, it calculates that 5G will achieve the same economic benefits as fibre by the “tipping point” year of 2026. In fact, add in the contribution of LTE and O2 says the combined value of 4G and 5G connectivity will add £18.5 billion to the economy in less than a decade, compared to just £17.5 billion for broadband overall.

“Mobile is the invisible infrastructure that can drive the economy of post-Brexit Britain,” said Mark Evans, CEO of O2. “The future of 5G promises a much quicker return on investment than fibre broadband, and a range of unprecedented benefits: from telecare health applications to smarter cities to more seamless public services.”

So far, so good, but here’s the rub: “We need a sophisticated spectrum auction that encourages the quickest and fairest deployment of mobile spectrum,” added Evans, “with a regulatory environment that delivers a level playing field for businesses and supports a competitive market for customers.”

No surprise that UK regulator Ofcom will launch its latest mobile spectrum auction later this year, with 190MHz of spectrum in the 2.3GHz and 5G-friendly 3.4GHz bands to be auctioned. This should increase the total UK licensed cellular spectrum allocation by about a third. Whilst Ofcom has proposed that BT/EE cannot bid for the immediately usable spectrum band (i.e. 2.3Ghz), on the grounds that it already holds the largest proportion of useable spectrum, at 45 per cent, O2 says that’s not enough. In order to encourage a fully competitive market, it has called for Vodafone (which holds the second largest proportion of spectrum with 28 per cent) to be restricted to acquiring no more than half of this new 2.3GHz spectrum.

Pre-emptive strike on spectrum auction

The truth of the matter is that EE and Vodafone became the largest holders of spectrum by spending more than the other operators (in Vodafone’s case) and also benefiting from some judicious mergers and acquisitions (with EE having been created from a merger of Orange and T-Mobile).

For example, during 2013’s LTE spectrum auction, Vodafone splashed out £790 million on 85MHz of spectrum, with EE next highest with £588 million for 80MHz. O2 placed third with £550 million for just 20MHz and 3 followed with £225 million for 10MHz. Deep pockets invariably means more spectrum, and in O2’s current position and speculation about its future, it is unlikely to assume that Telefonica will be overly generous with the cheque book.

One other aspect to note from the 2013 auction. At the time, Ofcom placed an estimate on the economic benefits of 4G services to UK consumers. It predicted that over the next ten years to 2023, this benefit would equate to “at least £20 billion”. Now this isn’t exactly the same as the new O2 report on the economic benefits to UK plc from 5G infrastructure, but it’s a useful comparison.

It’s also worth citing another economic survey, this one by Capital Economics (not to be confused with Development Economics) that was produced for EE in November 2014. It calculated that the eventual productivity gains from LTE mobile broadband could be in the order of up to 0.7 per cent of gross domestic product, or £12 billion annually.

So why do we now think 5G will contribute £10 billion? What happened to the £12 billion – an over-estimation of the potential of LTE?

Incidentally, EE set up a website back in 2013 to promote the benefits of LTE. Called 4GBritain.org, the site now appears to have been taken over by an interior design firm, offering “tips and tricks to beautify your surroundings”… What that says about LTE remains a mystery.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.