© Ofcom

- UK regulator commences first 5G spectrum auction

- 40MHz of 2.3GHz and 150MHz of 3.4GHz available

- List of bidders now just the four incumbents plus one other

- Further auctions to follow in 2019

For a country in the throes of complex Brexit negotiations, the promise of 5G is hugely exciting to politicians fearful of any detrimental effect that leaving the European Union may have on the UK’s economy. Not only has it established the excellent 5GUK to create a supporting structure for new 5G industry testbeds, but it has also shuffled the Scrabble tiles and just announced the UK5G innovation network. What will happen when these two organisation meet is anyone’s guess, but we are hoping for a palindrome singularity event that will rock the world.

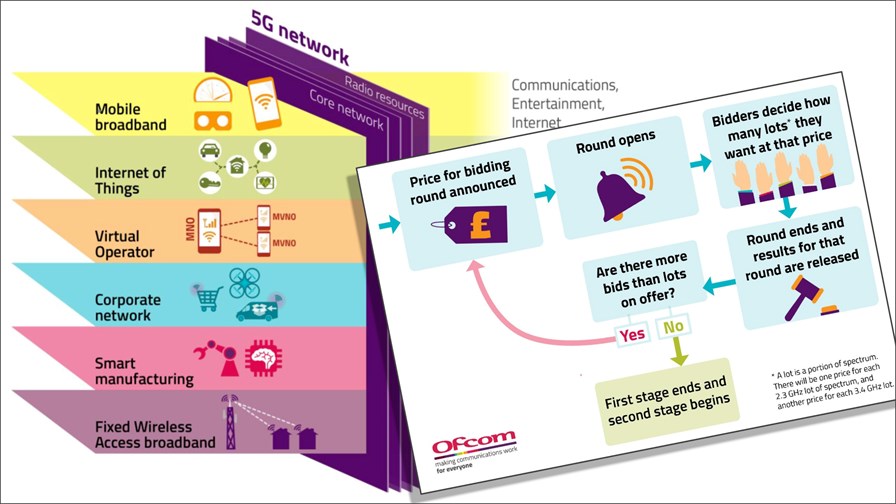

Also doing its bit to bang the drum and wave the flag, the UK’s telecoms regulator Ofcom has this morning announced that bidding will begin today in the spectrum auction for 2.3GHz and 3.5GHz licences. The 2.3GHz band will be used by mobile operators as soon as it is released, to increase mobile broadband capacity for today’s users, with 40MHz available. The 3.4GHz band will be allocated for 5G services, when supporting network and device technology begins commercially available, with 150MHz available.

“Our job is to release these airwaves quickly and efficiently, and we want to see them in use as soon as possible,” said Philip Marnick, Ofcom’s Spectrum Group Director, emphasising that (unlike the infamous 4G auctions) the regulator’s priority is ensuring spectrum efficiently, rather than to maximise the financial return to the Treasury. “We are glad the auction is now underway. This spectrum will help improve people’s experience of using mobile broadband today, and also help companies prepare for future 5G services.”

The five companies that have been approved to bid in the auction are:

- Airspan Spectrum Holdings

- EE (owned by BT)

- Hutchison 3G UK

- Telefonica UK (owner of the O2 brand)

- Vodafone

A sixth company, Connexin, was also approved back in February, but the company withdrew from the process at the end of last week. Connexin is a fixed wireless access ISP that operates broadband networks mainly in the Hull region of East Yorkshire. No word from the company as to what went wrong, but when you see a webpage for its Leadership Team with the words “Coming soon” you suspect that all is not well in the UK City of Culture 2017. Also of note, Airspan Spectrum Holdings (the only remaining bidder not an existing UK operator) is a subsidiary of US-based Airspan, which is a vendor of small cells and backhaul technologies.

Ofcom has placed two caps on the spectrum any one operator can hold, to protect competition in the market – which led to various spats, legal threats and general dummy-out-of-the-pram moments in the run-up to the auction. The first cap means that EE, which currently holds the most spectrum in the UK, will not be able to bid for any spectrum in the 2.3GHz band.

The second is an overall cap on how much a single company can hold after the auction. This is pegged at 340MHz on the overall amount of mobile spectrum a single operator can hold as a result of the auction. It was calculated to correspond to 37 per cent of all the mobile spectrum expected to be useable in 2020 (including the 700MHz band). Taken together, Ofcom says the effect of the caps will be to reduce BT/EE’s overall share of mobile spectrum.

During the auction, companies will bid for ‘lots’ of spectrum over a series of rounds, which are likely to run for several weeks. Finally, there will be two stages to the auction – the principal stage will determine how much spectrum each company secures, while the assignment stage then determines where spectrum won by each bidder is located within the overall band. Spectrum auctions are never simple.

Incidentally, Ofcom is planning to auction spectrum in the 700MHz band in 2019, as well as the 3.6-3.8GHz band It will likely auction spectrum in the mmWave 26GHz band at a later date and has identified the 66-71GHz range as a potential band for 5G licence exempt use.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.