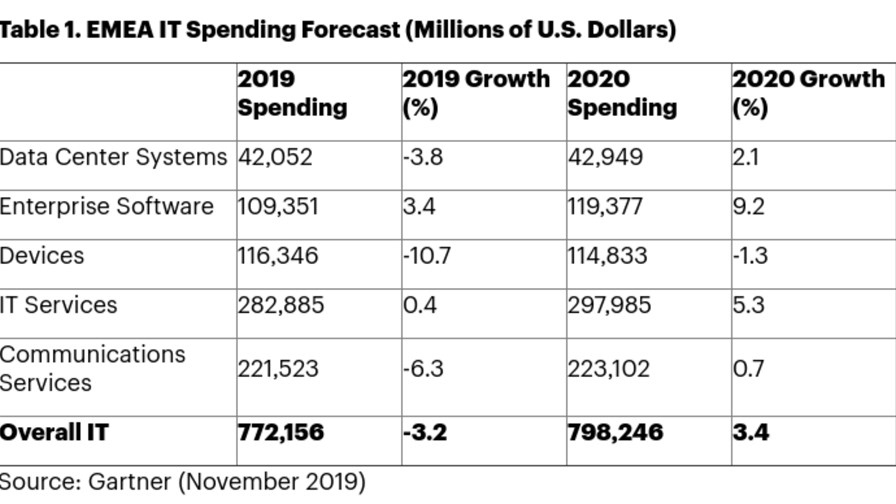

“2020 will be a recovery year for IT spending in EMEA after three consecutive years of decline,” said John Lovelock, research vice president at Gartner. “This year declines in the Euro and the British Pound against the U.S. Dollar, at least partially due to Brexit concerns, pushed some IT spending down and caused a rise in local prices for technology hardware. However, 2020 will be a rebound year as Brexit is expected to be resolved and the pressure on currency rates relieved.”

Gartner analysts are discussing the macroeconomic trends affecting the IT spending market in EMEA this week during Gartner IT Symposium/Xpo, which is taking place in Barcelona until today.

Spending on Devices Still Down While Enterprise Software Spending Keeps Rising

In 2019, EMEA spending on devices (including PCs, tablets and mobile phones) is set to decline 10.7% (see Table 1). Higher prices — partly due to currency declines and a lack of new “must have” features in mobile phones — have allowed consumers to defer upgrades for another year. Devices spending will not rebound in 2020, but instead fall by 1.3%, as both businesses and consumers move away from spending on PCs and tablets.

After 2019, the communications services segment will achieve long-term growth despite fixed-line services in both the consumer and business spaces declining every year through 2023. While mobile voice spending is flat — mainly due to price declines — mobile data spending increases 3% to 4% per year, which is keeping the overall communications services market growing in 2020.

Enterprise software will remain the fastest-growing market segment in 2020. EMEA spending for enterprise software will increase 3.4% and 9.2% in 2019 and 2020, respectively. Software as a service (SaaS) will achieve 14.1% growth in 2019 and 17.7% in 2020.

Source: Gartner

The complex geopolitical environment across EMEA has pushed regulatory compliance to the top of the priority list for many organizations. EMEA spending on security will grow 9.3% in 2019 and rise by 8.9% in 2020.

“Globally, security spending is increasing and being driven by the need to be compliant with tariffs, trade policies and intellectual property rights. In EMEA, privacy and compliance concerns, further driven by GDPR, take precedence,” said Mr. Lovelock.

The U.S. is leading cloud adoption and accounts for over half of global spending on cloud, which will total $140.4 billion in 2020, up 15.5% from 2019. In terms of cloud spending, the U.K. holds the No. 2 position behind the U.S. The U.K. spends 8% of IT spending on public cloud services, which will total $US 16.6 billion in 2020, up 13.2% from 2019. In EMEA, the overall spending on public cloud services will reach $57.7 billion in 2020, up from $50 billion in 2019.

Gartner predicts that organizations with a high percentage of IT spending dedicated to the cloud will become the recognized digital leaders in the future.

“Organizations in Europe, regardless of industry, are shifting their balance from traditional to digital — moving toward “techquilibrium,” a technological balancing point that defines how digital an enterprise needs to be to compete or lead,” said Mr. Lovelock. “Not every company needs to be digital in the same way or to the same extent. This move towards rebalancing the traditional and digital is clearly visible amongst EMEA companies."

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.