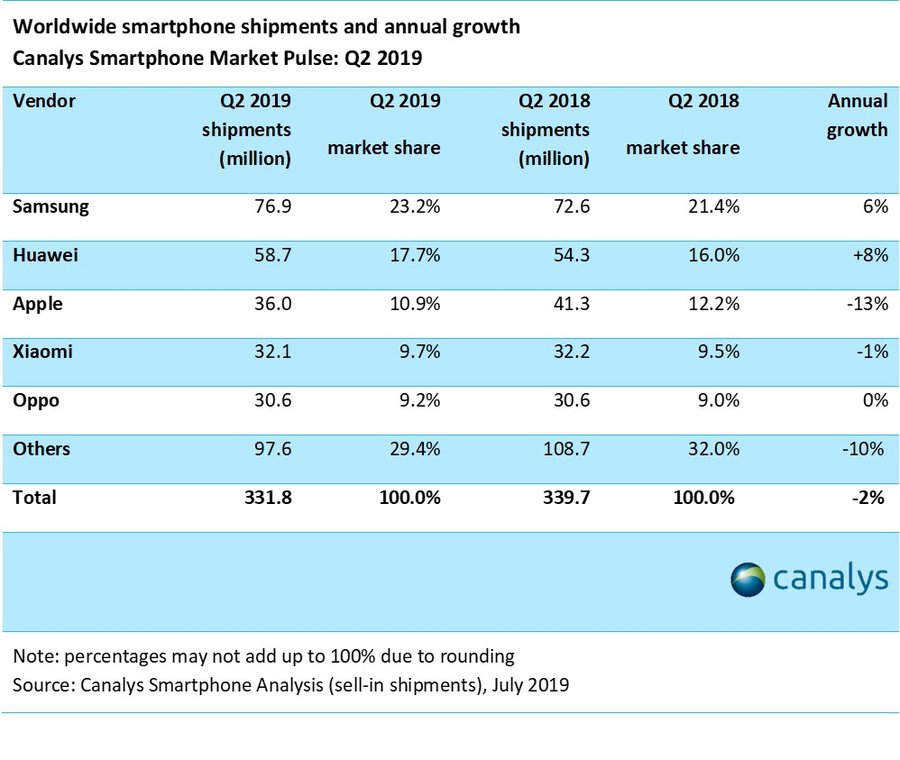

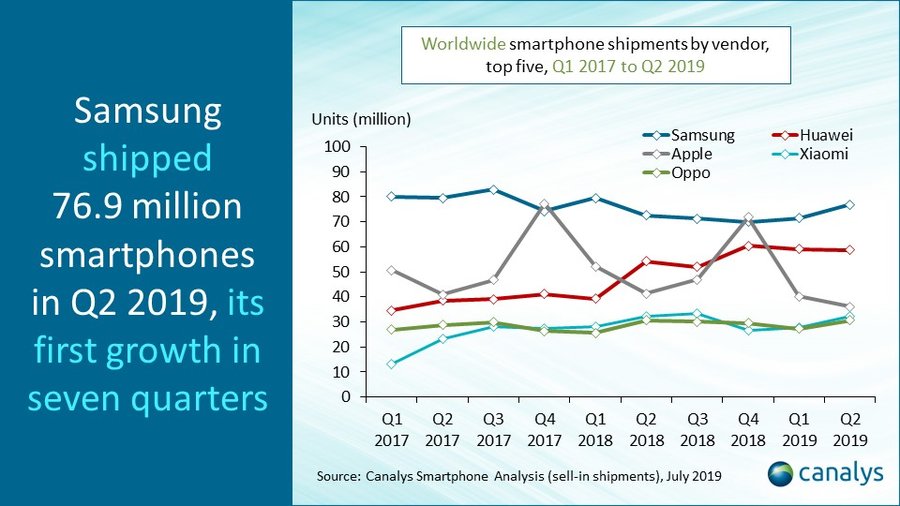

Samsung takes advantage of political tensions to grow against global smartphone decline in Q2 2019

Both Samsung and Huawei grew shipments in Q2 2019, as the global smartphone market fell 2% year on year to 331.8 million units. Samsung remained the market leader, with 76.9 million units, as it started to ship new A-series devices after a huge portfolio overhaul in Q1. Huawei shipped 58.7 million units, though it suffered a significant loss of momentum in overseas markets following the US Entity List ruling. Apple’s shipments fell 13% to 36.0 million units, while Xiaomi and Oppo completed the top five vendors, shipping 32.1 million and 30.6 million units respectively.

**Samsung ** shipped 76.9 million units in Q2 2019, up 6% annually, and 7% sequentially. Samsung has made its biggest portfolio overhaul since it first launched Galaxy smartphones, discontinuing the J series and extending the A series into new price bands, while making the devices more price-competitive. The new devices, from the A10 to the A80, accounted for more than 50% of Samsung’s shipments in Q2, and are expected to drive volume growth for Samsung for the rest of the year,

“Samsung benefited in markets such as Europe in May and June as arch-rival Huawei struggled to reassert its position,” said Canalys Research Director Rushabh Doshi. “Its portfolio refresh was fortunately timed, as it was able to capitalize on the new devices to win back business from operators and retailers in Europe and Asia. Samsung has been slow to respond to the threat from Huawei, Oppo, Vivo and Xiaomi, but it is now primed to win back market share and give the Chinese vendors a run for their money.”

**Huawei ** boosted its shipments by 8%, though this growth is much lower than in previous quarters. Its performance was propped up by China (see “Huawei takes record 38% share in China as market softens before 5G launch”), where it grew 31%, shipping 37.3 million units. But it was heavily affected overseas by its addition to the US Entity List, which has risked its trading relationships with US companies. This led to a 17% fall in its overseas smartphone shipments to 21.4 million units. Customers in key overseas markets, such as Europe, were suddenly worried by uncertainties regarding the security and lifespan of Huawei smartphones.

“Huawei’s major channel partners have been spooked,” said Canalys Senior Analyst Ben Stanton. “Mobile operators decide which smartphones to range at least six months in advance. Many have been forced to explore contingency strategies in case they have to replace Huawei devices in their portfolios by the end of 2019. But at this stage, most major operators are making an exception for Huawei, delaying procurement decisions to await further clarity. But Huawei’s brand has now been damaged outside of China, and it will take time and money to repair.”

**Apple’s ** shipments fell 13% to 36.0 million units in Q2. Its newest suite of devices, the iPhone XR, XS and XS Max, are not differentiated enough to prompt its expanding installed base of customers to upgrade, while recent price cuts and an increased rate of trade-in has not been enough to offset the decline. But the silver lining for Apple was a strong performance from the iPhone XR, relative to its mix, which accounted for 37.5% of its shipments in May. Apple also benefited as some markets, such as the United States and Italy, returned to normal after sluggish shipments in Q1.

“The range of iPhones relative to last year is frustrating its distributors,” said Canalys Research Analyst Vincent Thielke. “Distributors are taking on additional complexity and cost, but not necessarily seeing shipments or revenue growing as a result.”

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.