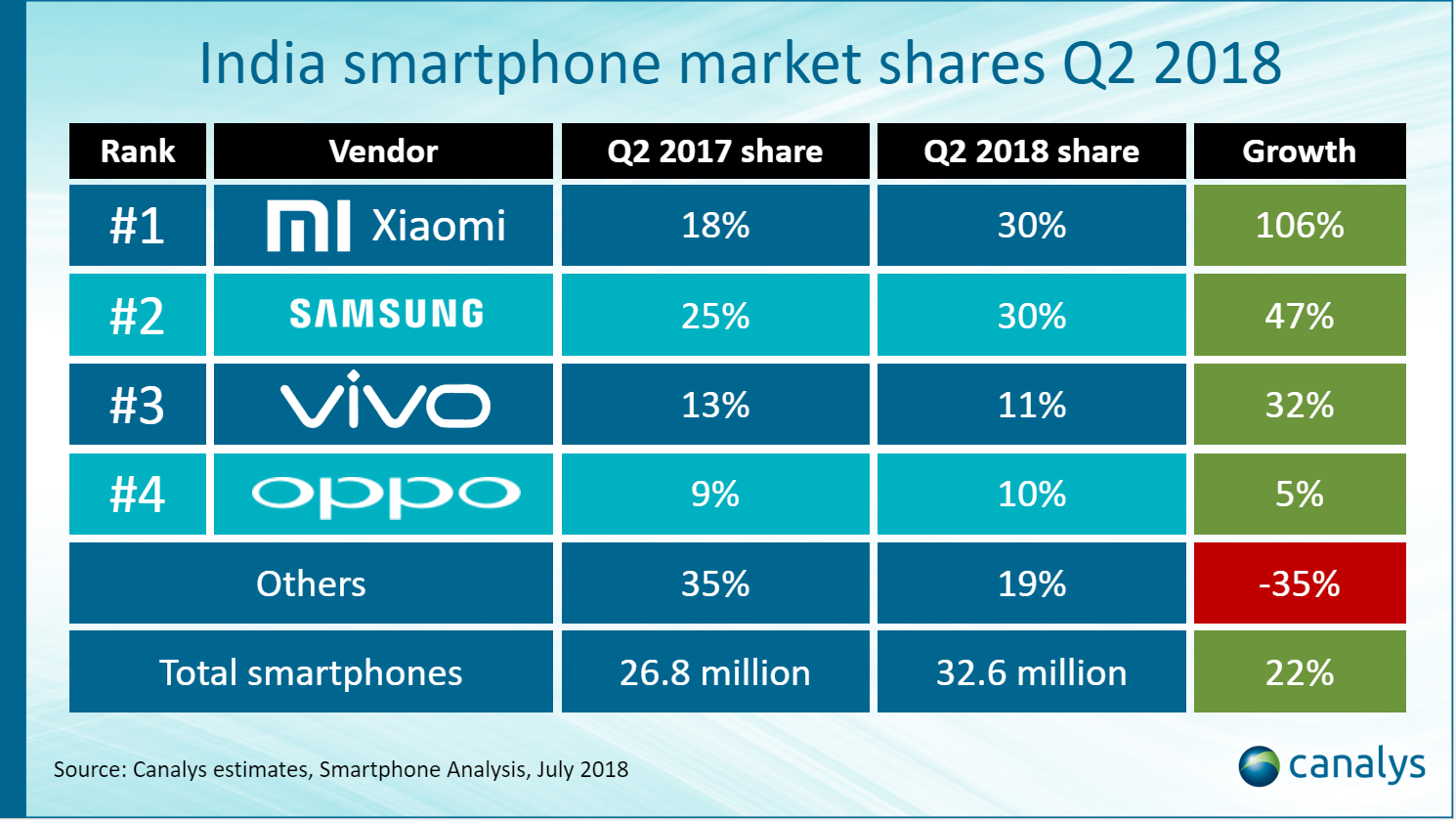

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, July 7 2018: Samsung and Xiaomi each shipped 9.9 million smartphones to India last quarter. This is the best quarter either vendor has had in the country. Together, the two companies now account for 60% of total shipments in India, up from 43% a year ago. Xiaomi more than doubled its shipments, albeit from a modest base, just putting it in first place. Samsung’s annual growth rate, at nearly 50%, was the best it’s been since Q4 2015, leaving it hair’s breadth behind Xiaomi in second place. Vivo took third place while Oppo came fourth, with shipments of 3.6 million and 3.1 million respectively. In line with these spectacular performances, overall shipments grew by 22%, to just under 33 million units.

“Samsung is hitting back,” said Canalys Analyst TuanAnh Nguyen. “It has launched devices pitted directly against Xiaomi’s portfolio and is focusing on its cameras and imaging capabilities with Portrait Dolly and Background Blur Shape functions.” Based on Canalys’ smartphone sell-in estimates, the J2 Pro was Samsung’s top model in Q2 2018, with 2.3 million units shipped in India. In comparison, Xiaomi shipped 3.3 million of its Redmi 5A. “Despite Xiaomi’s growing popularity in India, Samsung will remain the first choice for consumers. Its technological prowess and supply chain mastery will continue to give it an edge over Xiaomi for the foreseeable future.”

Despite ongoing consolidation at the top, smaller vendors are not giving up and continue to rewrite their business strategies with a view to long-term sustainability and profitability. Asus recently flipped its India strategy on its head and moved from a distributor-driven go-to-market model to a single partner, online-first strategy with Flipkart. Asus’ shipments almost tripled since the previous quarter. Oppo, which saw shipments fall to a low of 2.2 million in Q4 2017, has launched an online-only brand, Realme, challenging Xiaomi with value-for-money products.

“Volume is not the only strategy in India,” said Canalys Research Manager Rushabh Doshi. “Samsung and Xiaomi often distract from the opportunities that India has to offer smaller and leaner smartphone vendors looking for additional business opportunities. The climate is right for businesses to realign and re-enter the market. Apple’s iPhone shipments to India fell by about 50% in Q2 2018. But Apple’s paring back of distributor partners and move to a ‘brand-first, volume-next’ strategy will reap rewards as it will ensure better margin per device. Getting priorities right will be important to smartphone vendors, and it will be a choice between profitability and volume growth.”

Smartphone quarterly estimate and forecast data is taken from Canalys’ Smartphone Analysis service.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.