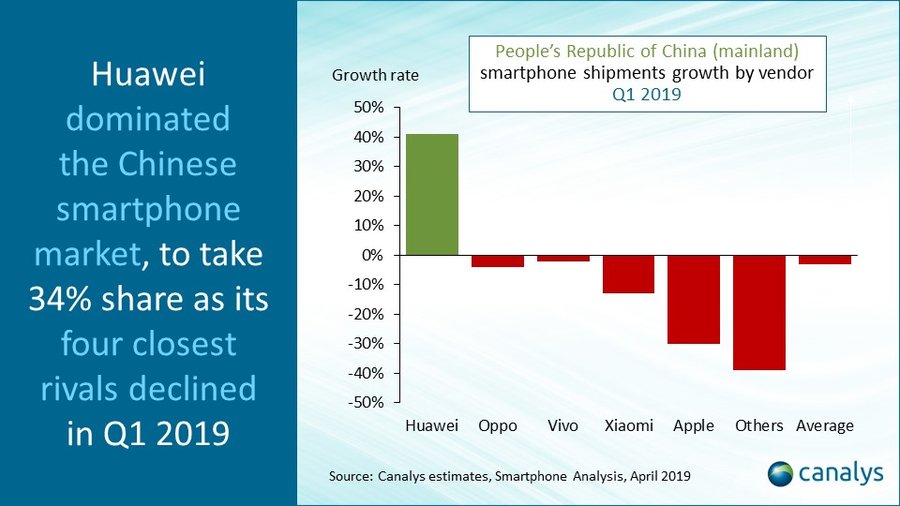

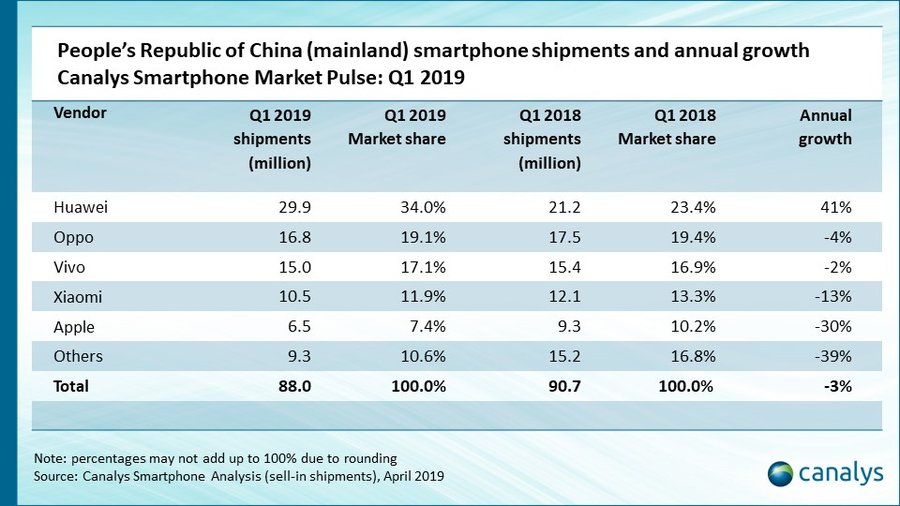

China’s smartphone market contracted 3% to 88.0 million units in Q1 2019, making it the market’s worst performance in six years. Market leader Huawei grew its share to a record 34%, up by more than 10% on the same period last year, making it the only vendor in the top five to report growth in an otherwise declining market. Huawei (including Honor) shipped just under 30 million smartphones. It was followed by Oppo, Vivo, Xiaomi and Apple, which each suffered year-on-year declines.

“China’s decline has softened slightly, which offers some relief after a bad year,” said Canalys Analyst Mo Jia. “Major vendors are gearing up to full speed, releasing new products and spending on marketing, to maintain share in the face of competition from Huawei, which is the strongest it’s ever been.” During the quarter, Huawei increased investments in bricks-and-mortar stores to exploit its size and out-compete smaller vendors. It has penetrated further into China’s rural areas. Moreover, it has upgraded many of its shops’ look and feel and filled them with a wider portfolio of consumer IoT devices and accessories to attract more footfall. “These investments have helped it gain customers from other vendors, such as Oppo and Vivo, which used to enjoy absolute dominance in offline channels over the last few years,” added Jia.

“Oppo and Vivo are both shifting their product strategies to refresh their brands,” said Canalys Research Analyst Yiting Guan. Vivo is going for a bigger product portfolio in China to cover a wider range of consumer demographics than before, and now offers seven product families. Oppo has put a strong emphasis on its new Reno series to renew its appeal in the mid-to-high-end segment. More interestingly, its RealMe spin-off has been brought from India to China to compete at the low end with Xiaomi and Huawei, including Honor.

Xiaomi recorded quarterly growth against its weak Q4 last year as it improved its channel inventory situation, but still suffered a year-on-year decline in both shipments and market share. “Xiaomi’s territory is getting more crowded thanks to the arrival of several large players,” said Guan. “We believe giving Redmi more autonomy to compete at the low end will give Xiaomi new hopes to grow at the high end. Despite the success of Xiaomi’s consumer IoT devices in China, smartphones are still the core of its business. Maintaining smartphone market share growth will translate to a swelling user base, which is vital for Xiaomi’s overall strategy.”

Apple shipped 6.5 million iPhones in the last quarter, suffering its worst decline in two years. “Apple’s performance in China is concerning, given that the worst quarter for iPhone shipments is usually Q2 or Q3, not Q1 when new devices are still fresh. Apple has acted to cut iPhone retail prices, which has largely relieved the pressure from its channel partners,” said Jia. “Despite the iPhone’s installed base in China being well over 300 million, it is vital that Apple prevents users deserting it for Android vendors. Apple faces a challenge in China to localize its software and services offerings as quickly as in Western markets. Its hardware is therefore more exposed to competition in China than elsewhere. Bringing up-to-date features, such as 5G, next year, as well as localized software is vital to prevent demand shrinking further.”

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.