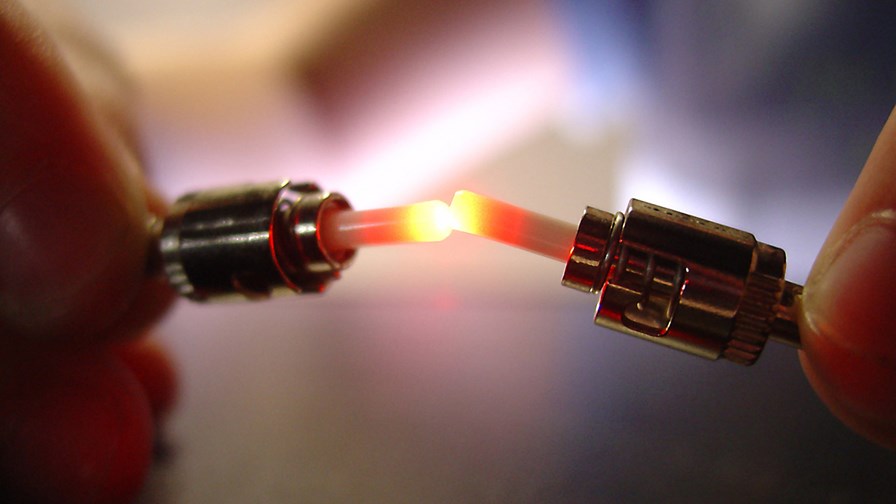

© Flickr/CC-licence/Barta IV

- We’re still at the ‘talks’ stage, but a significant new fibre build is apparently in the offing

- Reports say Liberty Global and Sky may co-invest in a UK fibre network

- If it comes to pass we’ll gladly upgrade the pace to ‘gallop’

Fibre network enthusiasm seems to be breaking out in the UK with the news that Sky may be in talks with Liberty Global about the pair jointly investing in a fibre network build. According to the Financial Times, the idea is to target the vast tier 2 UK hinterland outside the main centres and in doing so throw down a hefty gauntlet to BT Openreach which is also embarking on a full-fibre build.

Suddenly it seems that after years of procrastination, UK fibre building has become a crowded and energised field with pioneers like CityFibre and Hyperoptic also using partnerships to make their various business cases stack up and accelerate their build-outs.

The move towards converged fixed/mobile infrastructure (more on this tomorrow, stay tuned) and services has seen Vodafone hook up with CityFibre, not just - as you might have confidently predicted - to help it fibre up its cellular network in preparation for added data demand with the arrival of 5G, but also as part of an overarching strategy to support both fixed and wireless broadband because that’s what it thinks will prove to be the suburban future. It is following a similar dual strategy in the rest of Europe.

While many of the industry’s equipment vendors still confidently expect 5G to sweep all before it, especially in the business market (at least that’s the drumbeat), the actual 5G operators (including BT and Vodafone) are ramping up their fibre-to-the-home builds, a trend which seems to push in the opposite direction. In the UK, Three remains the only ‘pure play’ mobile operator.

Meanwhile satellite content delivery is similarly adjusting itself to the reality of FTTH with increased use of ‘OTT’ as an alternative to satellite. For that reason Sky is in talks to participate in Liberty Global’s network so it can eventually transition much of its customer base to fixed without being gouged by high wholesale prices. At present it relies on its relationship with Openreach.

According to the FT, Liberty Global has lined up an investment bank to fund a new joint venture company tasked to build its network with Virgin Media (owned, of course by Liberty Global and already the second biggest network operator in the UK) as the anchor tenant. The hunt is on to find more partners for the venture and this is where Sky comes in as both investor and potential customer (according to the FT’s sources).

Sky may also be able to come to a wholesale deal to use Virgin Media’s existing Hybrid Fibre-Coax cable network, which covers getting on for half the UK already.

France too, is experiencing fibre success. As we recently reported, Free has just chalked up a market-leading number of FTTH additions and the French fibre market is now actually galloping away. Incumbent Orange recorded 162,000 net fibre customer additions in Q2, while Bouygues Telecom added 82,000 FTTH customers during the same period and Altice-owned SFR added 64,000. Again, the fostering of multiple competing players seems to be doing the trick, with half a million new fibre customers in France added in a three-month period.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.