Picture by Gage Skidmore from flickr (https://www.flickr.com/photos/gageskidmore/)

- The US has already hampered China’s technology capabilities with its trade sanctions

- Huawei was one of the companies most severely affected

- Now the Biden administration is going further as China ramps up its domestic chip production

- Trade bans are being placed on a broad range of products and enabling technologies

- Security is cited as the chief reason but the moves will also thwart China’s domestic semiconductor production efforts

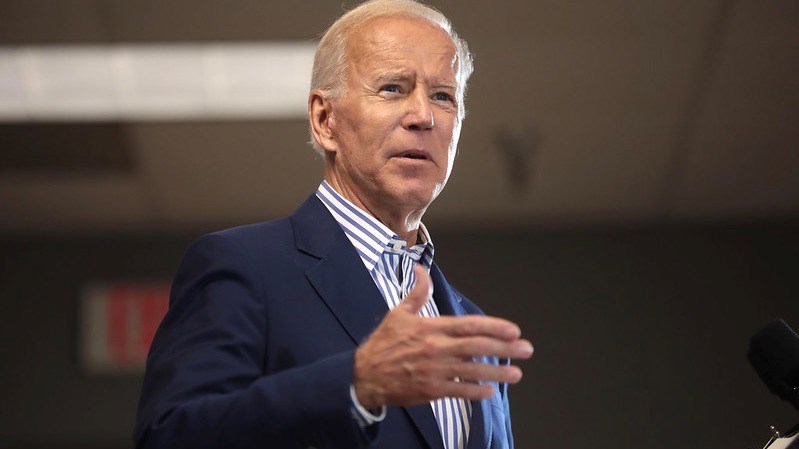

Having already hampered China digital communications sector with previous trade sanctions that crippled multiple companies, most notable Huawei Technologies, President Joe Biden’s administration, via the US Commerce Department, is doubling down by expanding the range of restrictions to block China’s access to technology vital to semiconductor manufacturing as well as to artificial intelligence chipsets from the likes of Nvidia and AMD, with the new rules set to come into effect from 21 October.

The headline reason for such moves, which are currently under review and awaiting feedback from US companies and organisations that will be affected, is to prevent China from gaining access to advanced technology that would enable the People’s Liberation Army (PLA) to become an even bigger security threat (through the use of cybersecurity tools and military weaponry) than it already is. One of the main accusations levelled at Huawei in recent years by successive US administrations is that it is a tool of the PLA and needed to be barred from the US and from having access to US technology because it posed a threat to US national security.

But what’s also happening here is that the US is doing all it can to stunt any potential growth in China’s domestic chip manufacturing sector which, if it grows quickly over the next five to ten years, could not only supply Chinese companies with cutting-edge semiconductor technology but also start to influence the global sector. China’s chip sector is currently tiny, but the country is doing all it can to accelerate domestic research and development (R&D) and chip-plant developments so it can, at least in some small way, be self-sufficient and secure a supply chain for its efforts in communications, robotics, automated technologies, the metaverse and more.

But building a chip manufacturing sector from almost nothing takes many years and China knows that. So, given that Taiwan is the world’s leading market for chip manufacturing, courtesy of giants such as TSMC (Taiwan Semiconductor Manufacturing Co), this also helps to explain why there is so much sabre-rattling and political posturing over the future fate of the island nation, which China regards as part of its Republic but which is currently self-governing and keen on securing independence. If China took control of Taiwan it could wield enormous power over the rest of the world’s technology supply chain, as well as fuel its own ambitions easier and faster.

But that’s the political angle. In terms of current enabling technology, “much of [the] highest-quality chip manufacturing equipment is made by three US companies – KLA, Applied Materials and Lam Research – and cutting off China’s access to their tools has the potential to damage the country’s ambitions to become a chipmaking powerhouse,” the team at US technology-focused media outlet Protocol noted.

Such moves by the US don’t come without domestic pain, however. As happened previously with the first round of sanctions that affected the likes of Huawei, US companies are adversely impacted because existing, and often significant, lines of business are suddenly cut off: US Commerce Department officials say they are aiming to minimise the impact of the rule changes on US firms, but a negative is unavoidable.

And if the impact on Huawei had not been heavy enough already, the new restrictions are set to cause the Chinese vendor even more pain, according to investment analyst Richard Windsor in his latest Radio Free Mobile blog. He points out that the new restrictions will mean any hope the vendor had of returning to the smartphone sector in any meaningful way have just been quashed – read what Windsor has to say to find out why.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.