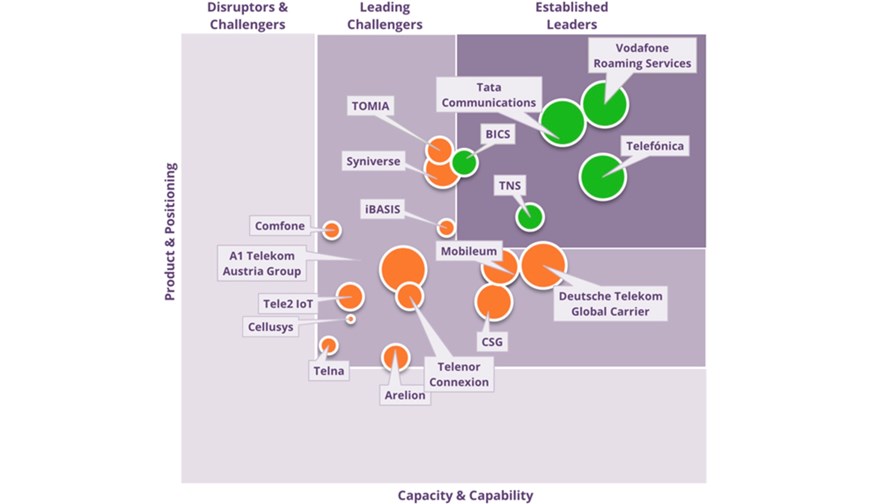

Juniper Research Competitor Leaderboard - IoT Roaming Vendors 2023. Source: Juniper Research

- Vodafone is still the king of the internet of things (IoT) roaming sector, according to Juniper Research

- But Telefónica has made great strides in the past year

- The segment is set to grow significantly, with operator revenue expected to more than double over the next five years to $1.5bn

- Telcos are urged to innovate if they are to stand a chance of capitalising fully on market expansion

Vodafone has retained its leadership position in the steadily growing internet of things (IoT) roaming market, but faces increasing competition from Telefónica, according to new research from Juniper Research.

In its study of the growing sector, the analyst house assessed “the comprehensiveness of offerings” from 18 IoT roaming service providers, as well as their progress in terms of innovation and prospects. It found that Vodafone is still the IoT roaming market leader – having also been identified as the top service provider in the area in 2022 – due to the “continued expansion” of its global IoT roaming network, investments in the deployment of new networks, such as narrowband internet of things (NB-IoT) and LTE-M, as well as the development and improvement of its IoT management solutions for operators and enterprises.

“Its comprehensive portfolio of IoT management solutions and significant coverage places Vodafone Roaming Services as the leading IoT vendor to enable operators to maximise future inbound roaming revenue,” explained Juniper Research in its report.

But the telco faces serious competition, as the report identified Telefónica as “the big mover” in 2023, climbing up six places in the analyst house’s chart to reach number two in the market ranking.

“Crucial in driving Telefónica’s progress in the IoT roaming market over the last year has been its innovation with solutions that simplify the roaming monetisation process,” noted the report, citing examples of Telefónica’s innovative approach to billing and charging evolution (BCE), as well as services that assist operators in managing different roaming regulations.

The top five is completed by Tata Communications, TNS (Transaction Network Services) and BICS (a subsidiary of Proximus).

Opportunities in the blooming IoT roaming market

As per Juniper Research’s estimations, roaming IoT connections will rise from 145 million in 2023 to 595 million by 2028. This figure represents an increase of more than 900% compared to the market level in 2020 when there were 62.7 million IoT roaming connections. The Far East, China and North America are expected to account for 23% of this market growth, as they have “advanced IoT markets with operators investing significantly in establishing and expanding key infrastructure”.

With the expected rise in the market, the analyst team stressed the need for new roaming standards to be implemented to detect and monetise IoT roaming. It pinpointed BCE as “a critical technology” that will enable operators to identify new roaming connections and “fully maximise inbound roaming revenue”.

If they manage to tick these boxes, the future is bright for operators, who “will be able to grow their revenue significantly over the next five years” given that total operator IoT roaming revenue will rise from $690m in 2023 to $1.5bn in 2028, an increase of 117% over the forecast period, according to the report.

- Yanitsa Boyadzhieva, Deputy Editor, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.