Microsoft tops enterprise, CSP tech sales charts, finds Synergy Research

Source: Synergy Research Group

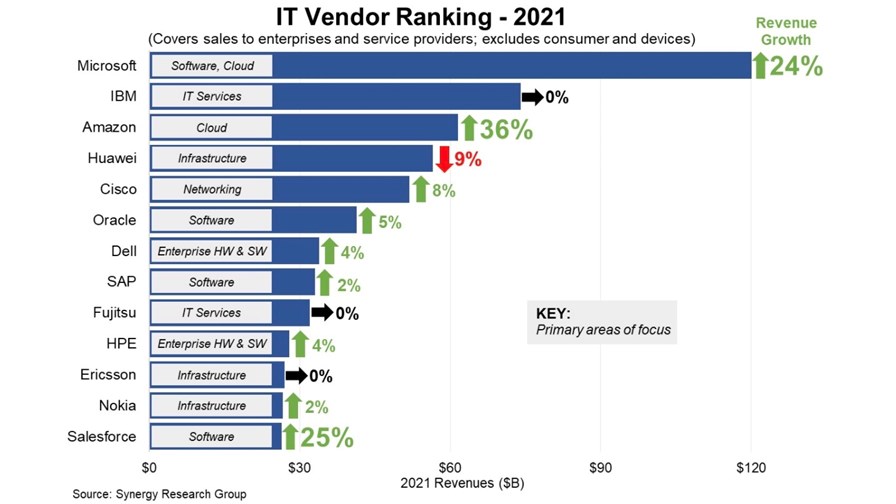

- Synergy Research Group identifies 13 vendors with tech sales to enterprises and network operators that top $25 billion

- Microsoft is the biggest by far, followed by IBM, Amazon and Huawei

- Cisco, Ericsson and Nokia also make the cut

- Only Huawei saw a year-on-year dip in revenues

Microsoft is by far the biggest vendor of technology products and services to enterprises and network operators and also boasts one of the highest levels of sales growth among the world’s tech vendor giants, according to market analysis undertaken by Synergy Research Group.

The research company identified 13 companies that are on course to have annual sales of enterprise and service provider technology in excess of $25 billion this year (excluding consumer tech and devices), with Microsoft, at about $120 billion, by far the largest, followed by IBM, Amazon and Huawei, as the chart above shows. (The data is based on actual revenues for the first three quarters of the year and a forecast for the fourth quarter.)

Of the 13, Huawei is the only one suffering a year-on-year sales dip, with a 9% decrease in revenues from enterprise and service provider customers due to “geopolitical issues and technology supply restrictions,” notes Synergy.

IBM and Ericsson are on course to report flat year-on-year sales, while Nokia’s revenues are expected to edge up slightly by 2%.

At the other end of the growth scale, three companies are set for a leap in revenues well into double figures. “Amazon Web Services, Salesforce and Microsoft have growth rates that far exceed the other 10 vendors,” states Synergy Research Group Chief Analyst John Dinsdale in an email to reporters. “They are benefitting from an IT world that is being driven by cloud and software solutions, rather than more traditional hardware products,” he adds.

The market segments analyzed by Synergy include cloud infrastructure services, collaboration, enterprise software/SaaS, data centre infrastructure, service provider infrastructure and enterprise IT services. The research firm notes that cloud infrastructure services, SaaS, hosted & cloud collaboration, and service provider data centre infrastructure are the segments with the highest sales growth rates.

“Cloud and software-oriented markets were the standout performers, driving stellar growth for AWS, Microsoft and Salesforce. Vendors whose sales are focused primarily on more traditional on-premises products or infrastructure will continue to have a hard time generating exciting levels of growth,” adds Dinsdale.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.