CSPs have $100bn+ opportunity in enterprise services – Appledore report

Source: Telecom’s $100B Enterprise Opportunity, Appledore Research.

- Generating revenues from enterprise customers is critical for CSPs

- The value of the potential market is growing, according to Appledore Research

- CSPs could generate annual revenues of $100bn+ from enterprises by 2027

- But it won’t come easily and telcos shouldn’t risk a wait-and-see strategy

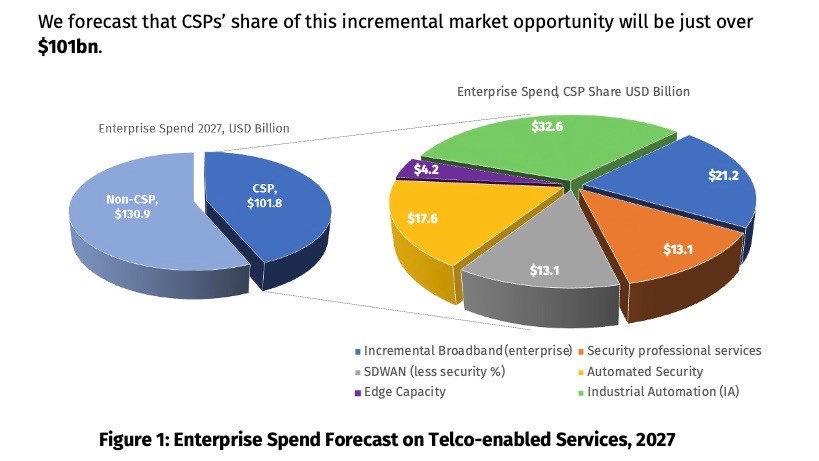

Communications service providers (CSPs) could collectively account for about $101bn, or 43%, of the $232bn that enterprises will spend globally by 2027 on services and solutions, such as security, software-defined WAN (SD-WAN), edge capacity and industrial automation. But capturing that essential revenue opportunity will not come easily, according to a new report, Telecom’s $100B Enterprise Opportunity, from Appledore Research.

The team at the research firm has identified a range of services that enterprises use and are willing to pay for and that current CSPs have a role in delivering – incremental broadband connectivity, SD-WAN without integrated security, edge compute capacity, industrial automation, automated security and security-centric professional services (see chart, above).

It expects that by 2027, CSPs will be capturing some 43% of this enterprise market opportunity, with other “non-CSP” providers (tech services and integrators, vendors, cloud players etc) taking 57% of the business, worth almost $131bn.

The Appledore team believes “today’s telecom operators can secure a unique position in supporting the growing needs of enterprises. The requisite capabilities are certainly available today, and the indicators are already there that having them leads to market success and incremental revenues”, but that “capturing this business is conditional on CSPs making fundamental changes in their operational capabilities and mindset.”

The Appledore team notes that the opportunity in the enterprise sector is “not a single opportunity. Even within a given vertical, enterprises can have widely differing needs. For telecom to go from individual enterprise wins into wider market opportunities will require much greater ability to innovate, automate and, in the era of cloud, orchestrate.”

So having the right set-up to capitalise on the enterprise revenue opportunities is essential, especially as consumer telecom services have been commoditised and provide “a declining return on investment”.

And that setup involves operating more like a cloud services company than a traditional telco. According to Appledore, the CSPs now have the opportunity to deploy sophisticated technologies and then actually reap the benefit of those investments and grab at least some of the action in the enterprise services sector, rather than watch other companies clean up.

But to take advantage, CSPs must leverage the economics of cloud to “make otherwise complex and expensive offerings available (and affordable) to millions more customers”, and enable the “rapid assembly of disparate (cloud-based) components, making innovation itself a much more scalable process – allowing many more niche needs to be served (the “long tail” beloved of internet companies).”

So CSPs have the opportunity to compete in this valuable market, as long as they invest in the new capabilities needed to fulfil their potential. But “the window of opportunity will not stay open forever. In an increasingly internet timescales, both traditional and untraditional rivals are acquiring new skills and capabilities rapidly. Simply waiting is too high risk as a strategy,” concludes the Appledore team in the report.

Appledore’s forecast comes only days after digital platform developer Beyond Now analysed the potential opportunity for CSPs in the small- and medium-sized enterprises/businesses (SME/B) sector.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.