Continental thrift: Mobile money services enjoy a pandemic growth spurt

Source: GSMA

- The GSMA’s mobile money programme (also supported by the Bill and Melinda Gates Foundation) has been doing well on the global social responsibility front, providing an entry point to the financial system for the otherwise ‘unbanked

- Not only is it responsible for shepherding money from governments and family members out to where it’s needed in difficult times, but its agents have been distributing aid in kind, such as PPE.

The GSMA has just completed a state of the industry report on ‘mobile money’ which reveals that these services have been doing well despite, or perhaps because of, the pandemic. The year saw a big jump in the number of mobile money accounts out there (up by 13% in 2020) while the value of transactions actually quadrupled through the year - partly as a result of governments electronically providing Covid relief and partly because of a rise in remittances (where family members working away send back money to help those struggling at home). The GSMA says that for the first time, more than $1 billion in remittances was sent globally every month via mobile money.

Feet on ladders

In both cases the year offered a great example of how mobile money can help to lift underserved communities up and into the money economy. Not surprisingly the GSMA found that the pandemic, far from weakening the penetration of mobile money, actually “gave fresh urgency to the need for regulatory change to foster greater digitalisation.” It says that in many markets, transaction limits were increased to allow more funds to flow through mobile money. Additionally, as demand rose for non-physical payments, some regulators classified mobile money agents and their supply chains as essential services.

“The value of government-to-person payments quadrupled during the pandemic, with the mobile money industry working hand-in-hand with administrations and NGOs to distribute social protection and humanitarian payments efficiently to those in need,” says the GSMA, which points out that the services don’t simply deal in cash but also provide ‘in kind’ support for things like PPE and hand sanitising gel via mobile money agents.

The mobile money industry is also a change agent when it comes to female representation in emerging economies. The GSMA claims it can be a powerful tool for financial inclusion in low and middle income countries where there is a considerable gender gap with women 33 per cent less likely than men to have a mobile money account.

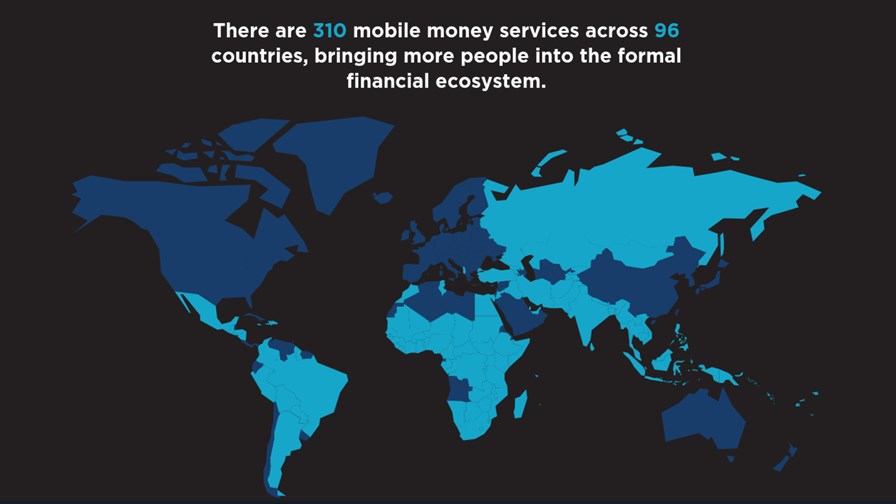

A regulatory safe space has been cleared for mobile money in emerging economies, but that comes with its own T&Cs and this explains why large chunks of the globe (see above) are almost entirely untouched by the mobile money services - at least, untouched by services that fall within the GSMA’s, and, presumably the Bill and Melinda Gates Foundation’s, definition of a mobile money service.

Which is:

- The service has to be transacted on a mobile phone and it has to be available to the unbanked - defined as people who don’t have a regular bank account at a financial institution.

- The other side of that coin is that mobile banking options attached to traditional banking products are not included, neither are payment services linked to debit or credit cards, such as Apple Pay, Google Pay and so on.

Mobile money services are designed to remain resolutely small scale and more or less run by and for its customers; they must offer multiple physical transaction points run by agents, and the agent network must be larger than the service’s formal outlets. The intention is to ensure that once a mobile money service reaches an attractive size or becomes a threat to incumbent banking businesses, it isn’t simply absorbed and its original ethos discarded.

To access more detail on the state of mobile money click on this link for further resources and some rather fetching animated infographics

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.