- The SME market has long been coveted by telcos

- It looks tempting but has proven tough to exploit

- A new report suggests there’s a pot of 5G gold to plunder in the SME market

- Could a digital marketplace be a solution? Perhaps, but there are other factors too

For decades, telcos have regarded the small- and medium-sized enterprise (SME) market, which comprises companies with between 10 and 249 employees, as a potential source of new revenues. But it has always been a tough nut to crack and CSPs have repeatedly failed to find a business engagement model that gives those small businesses what they need while also giving the telcos a profitable revenue stream.

It’s no surprise, then, to see a new report – commissioned by BearingPoint//Beyond and researched and produced by Omdia – that suggests the revenue potential of the SME market for 5G services is eye-watering: If the Omdia team’s forecasting machine is accurate, the global SME market for 5G services will be worth $433 billion in 2025. (Note this isn’t the first time these companies have collaborated – Omdia conducted some associated research for the vendor last year: See Telcos failing to fully capitalize on early 5G enterprise opportunity — report.)

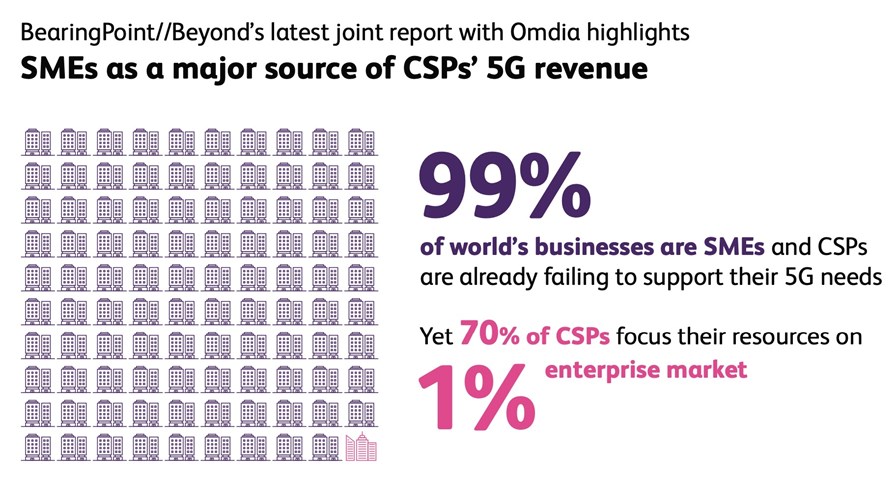

The key findings of this latest report – 5G for SMEs: what does it mean for CSPs? – make sense. Telcos primarily target the large enterprise market, because that’s where most of them see the most potential 5G services value, but the love (lust?) isn’t necessarily reciprocated, because only 28% of large companies regard telcos as their optimum 5G partner: A greater percentage, 34%, reckon they can sort it out themselves, while cloud service providers such as AWS are also regarded as a better 5G strategy partner fit than telcos (a very interesting statistic and one that should make the telcos think again about the way they address the market).

The SME market, despite accounting for 99% of all companies and being relatively keen on the potential use of 5G, is regarded by fewer telcos as being a great potential source of 5G services revenues, but 42% of those companies trust the telcos as their primary 5G partner. So the potential for engagement is certainly there.

The Omdia team has done a great deal of research over the years into the SME market and so is able to provide some interesting insights into the needs of those companies. The full report provides plenty of detail.

The main takeaway from Omdia is that telcos need to better understand the needs of SMEs and build partnership ecosystems that can help deliver to those needs, and the research house team provides examples of telcos, including SK Telecom and Vodafone Spain, that have done just that. “These types of collaborative approaches demonstrate how CSPs can marry 5G capabilities and other assets with ecosystem players to deliver profound value to SMEs,” according to Omdia’s Camille Mendler. (See the press release for full details.)

And there’s no doubt that the telcos themselves are taking a very close look at the SME market, talking up their understanding of the needs of these companies and taking another run at it. (For one example, see Vodafone turns its focus on SMEs, targets 'champion’ status.)

As a supplier of business support system technology, BearingPoint//Beyond has some thoughts of its own. To stand a chance of capitalizing on the demand for 5G-based services from SMEs, “CSPs will have to address… their unique needs and the vertical context. This will mean gradually developing a growing number of solutions with an increasing number of technology partners and vertical specialists. Using a digital marketplace will enable the orchestration of these multi-partner solutions, while also simplifying the complexity for the SME user. This marketplace needs to allow CSPs the speed and the scale to grow from selling a few SME solutions, to selling multiple solutions as more partners and customers come on board,” according to Angus Ward, CEO at BearingPoint//Beyond.

And it’s hard to argue against this view. CSPs have failed to successfully crack the SME market because, in most cases over the years, they have used the same go-to-market strategies as they have for the large enterprise market, with sales teams/reps, or have tried channel partnerships, which are hard to manage.

Now, though, we really are on the cusp of the digital era, with even small companies exploring the potential of cloud services. So, surely, to address the SME market, isn’t a more automated, self-service, digital platform the way to address a very large market with varying needs? For telcos, an online portal that provides multiple, flexible options for customers could be the silver bullet for the SME market and now, more than ever, those potential customers are more likely to buy into that kind of engagement model. Does BearingPoint//Beyond have the best digital market platform for the job? That’s for the CSPs to figure out, of course, and there are others who would put themselves forward as the optimum candidate (Accenture, Amdocs, CSG, Ericsson and Netcracker spring to mind, but there will be plenty of others).

But there’s an extra element to this scenario that’s associated but not often mentioned or cited: How do telcos manage this go-to-market transition internally? Who is responsible for building and maintaining a digital marketplace? How are the services priced and partners managed, particularly when it comes to revenue sharing? Who within the CSP gets rewarded if a digital marketplace approach is successful? Where do the sales commissions go?

Such internal business and cultural considerations are seldom discussed but absolutely vital to the potential success of marketing and sales strategies and there’s plenty of anecdotal evidence to suggest that such issues have been roadblocks in other instances within CSPs (people do not like change and they most certainly don’t like automated processes that replace their roles).

If SMEs see value in 5G and want to engage with the CSPs they perceive as trusted and knowledgeable suppliers/partners, then the market looks ripe for exploitation (in the nicest possible way, of course). Can the service providers engage with the right partners, select and deploy the most appropriate digital platform and revamp their business processes to take full advantage? By 2025, that might be the $433 billion question.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.