Strategy Analytics: tablet market falls 10% as a handful of vendors claim victory in Q3 2018

Huawei and Microsoft grow volume, Apple and Samsung outperform market to grow market share

November 5, 2018

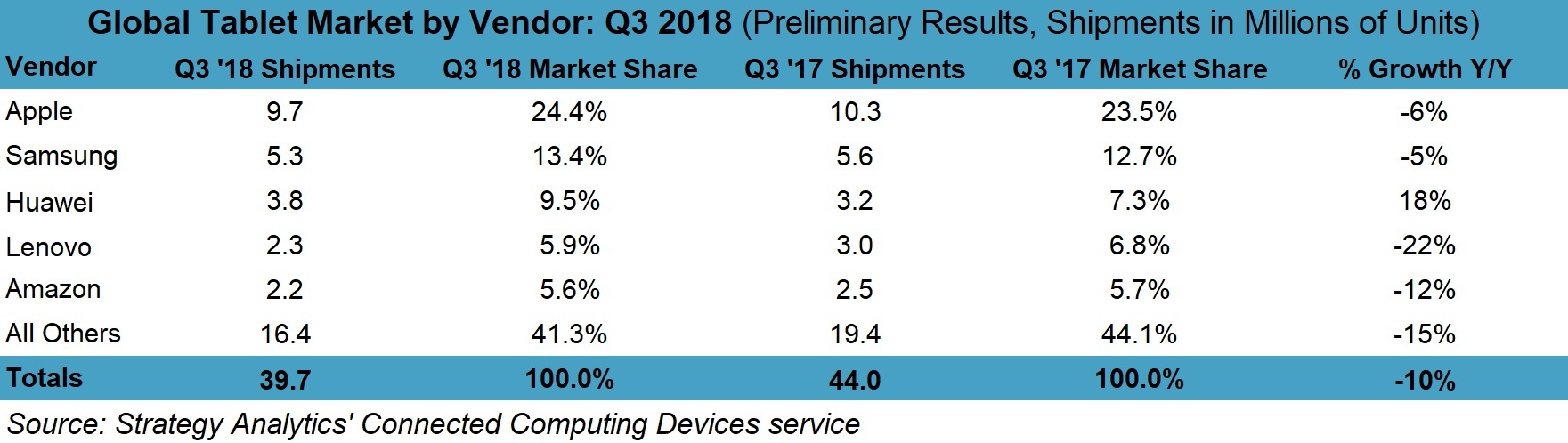

BOSTON--(BUSINESS WIRE)--The latest research from Strategy Analytics indicates that shipment growth may not be achievable for many vendors any longer but several key players grew their market share on their own terms in a down market. Huawei and Microsoft grew year-on-year while Apple and Samsung outperformed the market, gaining market share. The global tablet market declined 10% year-on-year in Q3 2018 and shipments in all three major ecosystems fell.

The full report from Strategy Analytics’ Connected Computing Devices (CCD) service, Preliminary Global Tablet Shipments and Market Share: Q3 2018 Results , can be found here: https://www.strategyanalytics.com/access-services/devices/tablets-and-pcs/connected-computing-devices/market-data/report-detail/preliminary-global-tablet-shipments-and-market-share-q3-2018-results-021118

Eric Smith, Director – Connected Computing said, “Putting aside the quarterly horse race for a moment, Apple has reached an interesting point as it truly aims to reshuffle the entire computing market with very powerful iPad Pros competing directly against its own notebooks and Windows-based ones. In way, this is congruent with what Microsoft and ARM are developing with power-efficient, connected ARM-based notebooks and Detachable 2-in-1s. In the end, this is all about making more money per unit and preparing for future demand for computing devices.”

Chirag Upadhyay, Senior Research Analyst added, “Even though Samsung and Apple shipment volumes fell year-on-year, their market shares grew. It seems that after a strong Q2 2018 and leading up to the release of new iPad Pros in Q4 2018, consumers pulled back a bit and favored the lower-priced iPads for entertainment. Samsung’s long-game has been to make more money regardless of the shipment volume and this quarter could be the start of stabilization on that front as they ready their foldable products for 2019.”

Tablet Market Dynamics by Operating System

- Apple iOS shipments (sell-in) fell 6% year-on-year to 9.7 million units in Q3 2018, pushing its worldwide market share to 24% of the Tablet market. This shipment decline was softer than the overall market, thus Apple gained a point of market share from the prior year. Price remains a key factor in consumer behaviors around PC and Tablet replacement devices and the next several quarters will be interesting as Apple takes a three-tiered approach to iPad Pros alongside the more expensive MacBook lineup.

- Android shipments fell to 24.3 million units worldwide in Q3 2018, down 11% from 27.2 million a year earlier and up 4% sequentially. Market share fell 1 percentage point year-on-year to 61% as many branded Android vendors find it very difficult to compete on price in the wake of Apple lowering its iPad prices. Amazon had lower year-on-year results for the second quarter in a row as last year's Prime Day was much more tablet-heavy than this year. We expect branded vendors to find a comfortable position from which to compete in lower price tiers with high quality tablets but the larger question is how quickly Chrome will become an offsetting factor for Android as users seek more functionality.

- Windows shipments fell 12% year-on-year to 5.7 million units in Q3 2018 from 6.5 million in Q3 2017. Shipments increased 3% from the previous quarter as back-to-school and enterprise demand continued to help this segment. Microsoft has retaken its leadership position in Windows Detachable 2-in-1s with the release of the lower cost Surface Go and a refreshed Surface Pro all in the last three months. This is the third straight quarter of year-on-year shipment and revenue gains for Microsoft but this is not translating to gains for OEM partners in the Windows segment.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.