Dubai – The Middle East and Africa (MEA) personal computing devices (PCD) market, which is made up of desktops, notebooks, workstations, and tablets, declined 7.7% year on year in Q2 2018, according to the latest insights from International Data Corporation (IDC). The global technology research and consulting firm's Quarterly PCD Tracker shows that shipments fell to around 5.4 million units for the three-month period, which represents the lowest quarterly volume recorded for more than seven years.

"While this marks a considerable decline for the overall market, the PC segment actually performed well, with desktops experiencing strong growth and notebooks experiencing only a small decline," explains Fouad Charakla, IDC's senior research manager for client devices in the Middle East, Turkey, and Africa. "However, there was a much more significant decline in tablet shipments, and only the aggressive distribution push of certain Far-Eastern players prevented an even steeper decline."

The biggest decline in PCD shipments was seen in the 'Rest of Middle East' group of countries (which comprises Iran, Iraq, Syria, Yemen, Afghanistan, and Palestine). "Iran accounted for the largest chunk of this decline, with the country's worsening economic situation further weakening the local currency, which in turn caused shipments into the country to become more expensive and demand to decline," says Charakla. "The MEA region's largest single market, Turkey, experienced something similar, with the country's currency weakening to new lows against the U.S. Dollar, causing a significant increase in the cost of imported devices and a corresponding decline in demand."

In stark contrast, South Africa experienced strong year-on-year growth in PCD shipments after the rand reached one of its highest levels against the US dollar in recent times. "Market players operating in the country continued to take advantage of this opportunity throughout Q2 2018, with imported PCs costing far less than previously for both local channels and end users," says Charakla. "Other countries that saw strong year-on-year growth for the quarter were Egypt, Nigeria, Kenya, and Lebanon."

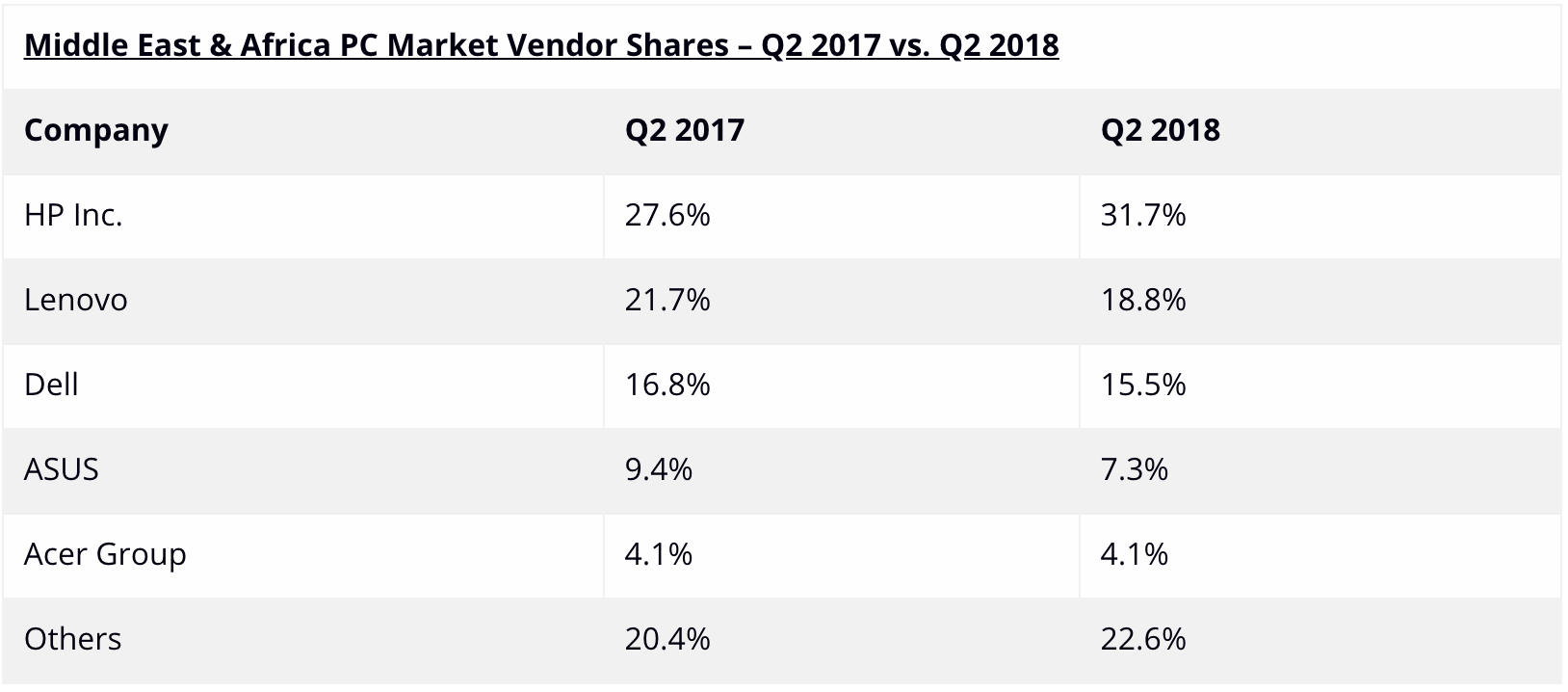

IDC's research shows that the leading PC vendors remained unchanged in Q2 2018, with the top five all occupying the same positions as Q2 2017. While HP experienced a significant year-on-year jump in its share of PC shipments for the quarter, all the other major players saw their shares shrink, with the exception of Acer, which remained flat. It is also worth noting that the top three vendors accounted for more than 80% of the region's commercial PC shipments in Q2 2018.

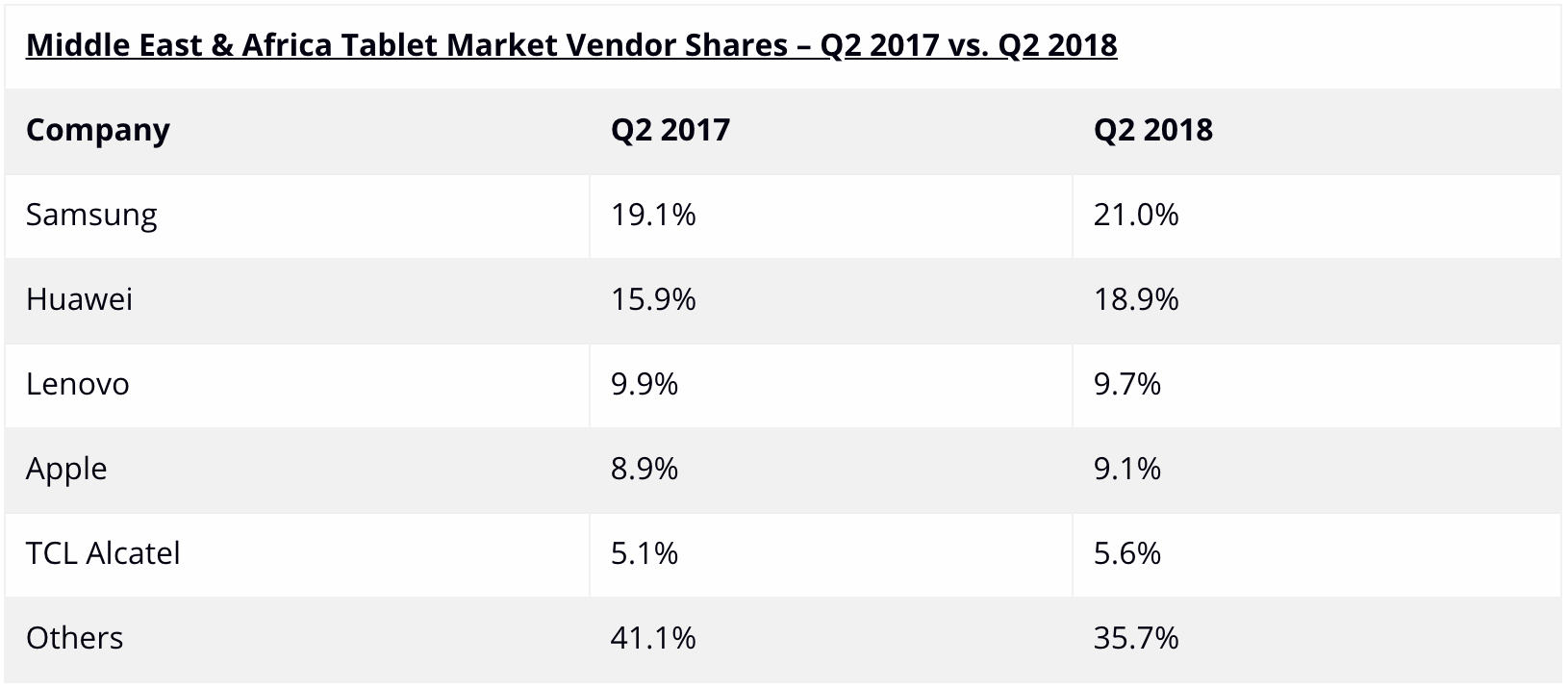

In the tablet segment, Samsung retained its lead in terms of shipments, with most of the major players increasing their shares year on year as the number of vendors active in this space continues to consolidate amid shrinking demand.

Looking ahead, IDC expects overall PCD shipments to the MEA region to total 22,369,321 units for 2018 as a whole. IDC forecasts that this figure will decline at a steady rate over the coming years to total 20,820,235 units in 2022.

"The biggest declines will be seen in the tablet space, as demand for these devices will continue to be cannibalized by the growing use of smartphones," says Charakla. "In terms of country markets, Turkey will experience by far the largest decline in PCD shipments in 2018 as the lira's perilous exchange rate against the dollar is not expected to recover until 2019.

"With demand for tablets falling significantly, the UAE market will see a huge year-on-year decline in PCD shipments during Q3 2018, while cautious end-user sentiment will exacerbate the situation in Saudi Arabia, with the Kingdom's overall PCD market set for a notable decline. Over in Egypt, however, a large-scale education deal is expected to cause a significant rise in PCD shipments during the second half of 2018."

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.