Shanghai, Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 22 July 2019

Canalys released its latest consumer IoT market forecasts for China. The analyst firm expects that the installed base of smart assistant devices (either built-in or compatible*) will reach 5.8 billion by 2023. This will make the installed base in China about twice the size of the US market. The total addressable market in China consists of a large population and household base, and consumers that have the means and enthusiasm to adopt emerging trends in IoT.

Devices for the home such as air conditioners, door locks, TVs and refrigerators, which will be able to be operated by a smart assistant via the network, will reach 3.6 billion in 2023.

Canalys predicts that every Chinese household will own an average of seven smart assistant-compatible home devices by 2023. “The large appliance category, which includes refrigerators , washing machines and air conditioners, is expected to contribute the biggest growth ,” said Canalys Research Analyst Cynthia Chen.

“The growing Chinese middle class is relentlessly pursuing a higher standard of living, and smart appliances will play a major part in their vision of the ideal home. Appliance makers Haier, TCL and Hisense are changing their strategies to capture the trend early. Even the retailer Suning and smartphone vendor Xiaomi are aiming to disrupt the market.”

The rise of smart assistants built-in to speakers catalyzed the growth of smart home devices that can be controlled via voice. Unlike compatible-only devices, smartphones, smart speakers, mobile PCs, smartwatches and connected cars have built-in smart assistants that can carry out user commands. The leading smart assistants in China are Xiaodu, Tmall Genie and XiaoAI.

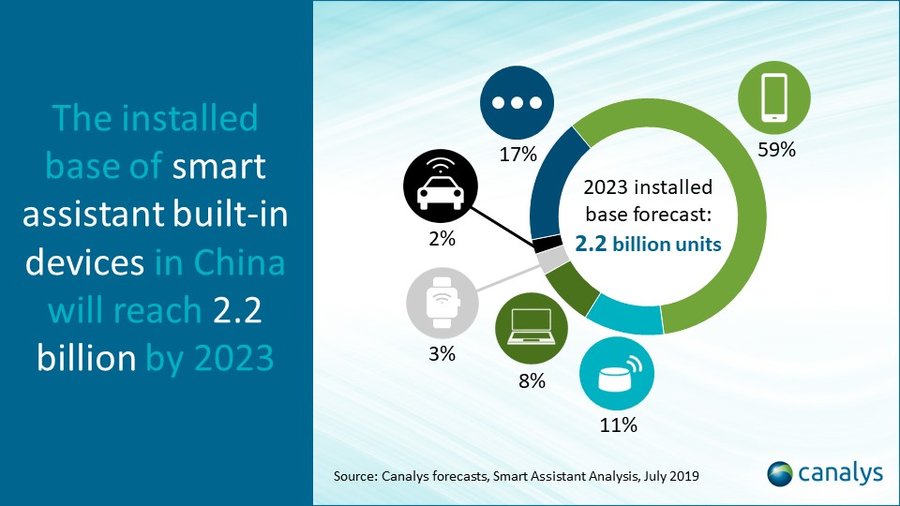

Canalys estimates that the installed base of devices with smart assistants built-in will reach 2.2 billion units in China with a CAGR of 42% between 2018 and 2023. The smartphone will continue to be the main device category for smart assistants in 2023. “Chinese smartphone vendors, such as Huawei, Oppo and Vivo, are shifting their strategies to create IoT ecosystems with smart assistants, especially targeting homes with smart speakers and smart assistant-compatible devices,” said Canalys Senior Analyst Jason Low. “Having such devices work together seamlessly, especially across brands and platforms, to create new intuitive use-cases remains an industry-wide challenge for vendors around the world.”

The Chinese market differs from the trend-setting US. “Trying to copy the successful strategies used in the US market, or elsewhere, in China will not work,” said Chen. “For example, home security is an important area where IoT devices are being adopted. But due to the housing structure and lifestyle habits, devices embraced in China are different. Americans focus more on home surveillance, such as using cameras to check around their houses, while the Chinese are more concerned with using security devices in the home to take care of families. Over the next few years, Canalys predicts that increasing awareness of saving energy and creating a healthier living environment will also be important for the Chinese market.

Smart assistant forecast data is taken from Canalys' Smart Assistant Analysis Service

Definitions

*Smart assistant-compatible device: Devices in a connected network that can be operated independently or with relayed voice commands from an off-site smart assistant built-in device.

Smart assistant built-in device: Devices that have in-built smart assistants with the capability to interpret voice commands, and act on them or relay the commands to off-site-compatible devices.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.