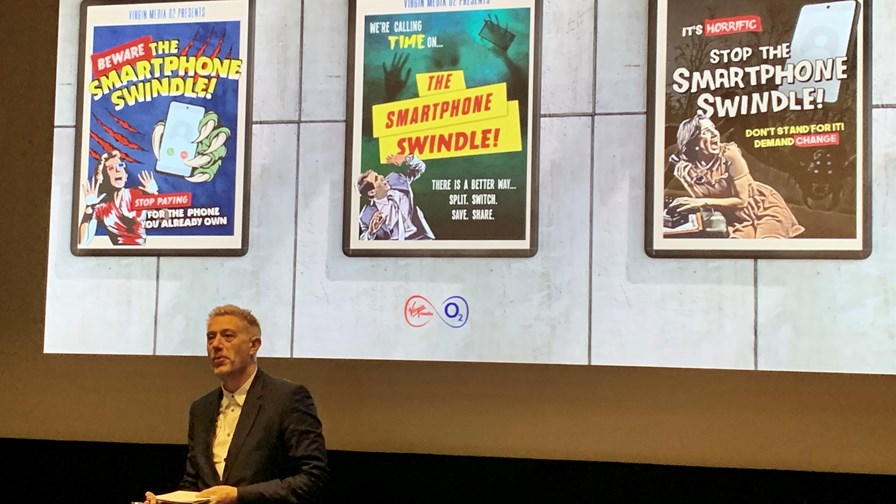

Virgin Media O2 chief commercial officer Gareth Turpin had some natty artwork to help his smartphone swindle pitch.

- UK operator says millions of Brits are paying each month for smartphones they already own

- It accuses rivals EE, Three and Vodafone of ripping off their customers by failing to automatically cancel monthly payments once devices are paid off

- Virgin Media O2 (VMO2) calculates that, overall, UK mobile customers are overpaying by £520m a year

- Virgin Media O2, of course, has been ‘doing the right thing’ by its customers for a decade, it boasts, and is hoping its moral high ground approach will attract new customers

- Rivals are seething at the accusations

UK service provider Virgin Media O2 (VMO2) is on a mission to position itself as a trustworthy consumer champion, and stir up the mobile services market, with a “smartphone swindle” campaign that accuses VMO2’s three main rivals of knowingly overcharging their contract customers by £530m a year for devices that have already been paid off as part of monthly fees.

According to the operator, EE, Three and Vodafone “collectively have millions of customers on traditional phone contracts that bundle together airtime costs for minutes, texts and data with the cost of the handset. The practice of combining these costs can lead to consumers paying extra for their phone because they receive little discount, if any, at the end of their contract and continue to be charged the same amount each month by their provider.”

VMO2’s campaign to highlight this matter began a few weeks ago with this announcement, but today it has unveiled the somewhat staggering £530m figure, which amounts to about £1.4m each day being paid unnecessarily to EE (the consumer division of BT), Three and Vodafone UK.

VMO2’s “Stop the Smartphone Swindle” campaign calls on that trio of rivals to do three things: Introduce split contracts that clearly show the cost of airtime services and the cost of a device, so that customers can see exactly what they are paying for each month, allowing consumers greater choice over their mobile phone bills; automatically roll down customers onto an airtime-only plan at the end of their minimum term to stop handset overpayments; and inform customers once they’ve paid off the cost of the handset at the end of their contracts.

VMO2 says it has had its contract customers on split contracts since 2013, so that if a customer takes out a phone contract that costs £50 for 24 months (£30 for the device and £20 for the airtime), the bill automatically reduces to £20 in month 25, as the device has been paid for and is now owned by the customer. On bundled contracts, which are sold by its rivals, a customer could end up being charged the full amount indefinitely, until the contract is cancelled or the customer switches to a new deal.

VMO2 has conducted UK consumer research (more than 5,300 respondents) that shows 73% of people think it’s unfair to continue paying the same amount after their contract has ended, 80% agree they should be automatically rolled down at the end of their contract, and 85% demand clearer phone contracts from their service provider.

The research also found that those most likely to be paying more than they need to on bundled contracts are the elderly and low-income households, something that has caught the attention of charities such as Age UK and Citizens Advice, which are calling for action as a result of the VMO2 campaign.

“People don’t understand how they are being ripped off by their mobile operators,” stated VMO2 chief commercial officer Gareth Turpin during a briefing for media and analysts in London this week. “It’s not that people don’t care or are lazy – they just don’t understand their [bundled] bill.” And with the UK population currently suffering a cost-of-living crisis as food, energy and other bills soar to eye-watering levels, UK mobile phone users “are being hit hardest when they can least afford it.”

There are more details and background in this announcement. And it’s worth noting that both Three and Vodafone do offer split contract options, but continue to offer, sell and have millions of customers on bundled contracts.

So is this a valid campaign? Or a cynical attempt to trash rivals and claim the moral high ground in a highly competitive sector? VMO2 has UK mobile users on the record talking about how they had unwittingly been paying for smartphones that had already been paid off, and for the very high-end Apple and Samsung devices those additional payments can run to hundreds of pounds within just a few months, so VMO2 does appear to be highlighting a very real issue.

According to CCS Insight director of consumer and connectivity, Kester Mann, “Virgin Media O2 is right to highlight the archaic practice of charging customers for phones they have already paid for, and its campaign is well timed given the escalating cost-of-living concerns. The Stop the Smartphone Swindle campaign will put most pressure on EE, as it is the only UK network that does not yet offer split contracts, and the move builds on O2’s positioning around fairness and transparency as it seeks to boost loyalty and customer satisfaction. It follows other initiatives like O2 Refresh, Custom Plans, Switch Up and inclusive roaming.”

And here’s a somewhat damning comment: “It is unsurprising that the industry has moved slowly to split airtime and handset plans. Customers who continue paying for phones after their contract has expired are among an operator’s most lucrative. It is also a considerable task to rework accounting, connection, and customer service procedures to make it happen.” That might be a good look for mobile operator top and bottom lines but not a good look for companies that all claim to have their customers’ best interests at heart.

PP Foresight analyst Paolo Pescatore also praised the move by VMO2. “It’s refreshing to see a shift towards championing fairness for consumers. Overall, this feels like a campaign to disrupt, make noise and grab consumers’ attention at a time when it is challenging to get their awareness. Rivals will probably be aggrieved and feel they are transparent with their customers, whether that be with out-of-contract notifications or not charging for handsets once they are paid off. Undoubtedly the industry as a whole could do more for consumers,” he said.

And rivals are indeed aggrieved.

An EE spokesperson noted: “We find these claims from Virgin Media O2 to be misleading and unnecessary – designed to chase headlines, at a time when consumers need confidence that the industry is clear and straightforward. This also comes at a time when VMO2 themselves increase broadband customer’s prices by as much as 50% when going out of contract.”

EE claims to offer split contracts too. “Like VMO2, we offer split contracts with EE Flex Pay, while providing all customers with clear end-of-contract notifications, including the best offer for them based on their usage. With EE Flex Pay, once the handset is paid off, no further charges are applied. We don’t position this as a discount because it isn’t – the handset is owned by the customer,” though a quick check on a few standard contracts on the EE website found no mention of Flex Pay or promotion of that option, so it’s not exactly easy to find.

Vodafone UK is also seething. “We’re disappointed to see VMO2 confusing consumers with incorrect information and sensationalist headlines at a time when, as an industry, we all need to be providing consumers with greater clarity to enable them to make the best choices for their needs,” stated a spokesperson. “It is a regulatory requirement for us all to be transparent with our customers, to provide end-of-contract notifications and annual best tariff recommendations based on a customers’ needs, a requirement we take extremely seriously at Vodafone. Like VMO2, Vodafone customers on split contracts with Vodafone EVO will not see any further handset charges once their 0% finance deal ends and will, therefore, never overpay for a phone. All handset customers on legacy contracts are contacted repeatedly when their contract comes to an end, and after three months – if they haven’t moved onto a new contract already – we automatically apply a monthly £5 discount. We believe in offering our customers choice and always encourage them to make sure they are on the best deal for their needs,” the operator said in a statement issued to the media.

VMO2’s point, though, is that bundled deals are still a key offer and most current customers of the other operators are on those bundled deals that require proactive customer action to avoid paying extra for a device that is already paid off and owned. “The vast majority of customers finishing a contract today with EE, Vodafone and Three will continue paying for a phone they own, and that’s a problem,” noted a VMO2 spokesperson.

But while VMO2 is quick to take the high ground on the matter of mobile contracts, it has some work to do elsewhere in terms of charges and costs. As mentioned, EE is calling out VMO2’s broadband pricing strategy, which is certainly not customer friendly, and its bills for its fixed bundles are challenging.

And, along with the other operators, it recently increased its prices, which will be piling the pressure on UK households during this cost-of-living crisis – monthly broadband bills have increased on average by £18.50 and mobile phone payments by £9.50 following April’s price rises, according to new research from Uswitch.com, the comparison and switching service.

And analyst Pescatore notes that VMO2’s posturing is “ironic, given all the price rises across fixed and mobile contracts by all telcos.”

VMO2’s chief commercial officer Turpin was asked about these price rises during the briefing session and pleaded that such rises are necessary at a time when the network operators “are suffering huge inflationary pressures” too, particularly in terms of the energy costs of running a national network, which he said will rise to £300m this year for VMO2 from £129m in 2022. “We believe the price changes are customer centric in terms of the value it offers to customers,” he added.

But as the price rises were above the rate of inflation, that is not a convincing argument or position for a company that is calling out its rivals for overcharging their users. VMO2 might have something of a case in the mobile contract sector, but it has work to do to sort out its broader business if it really wants to be the true customers’ champion.

- Ray Le Maistre, Editorial Director, TelecomTV