Courtesy of GSMA Intelligence

- IoT connectivity revenues are growing and set to be worth $48 billion by 2025

- But it’s still just a fraction of the overall IoT market

- Operators need to expand their overall offer to be IoT partners to enterprise users

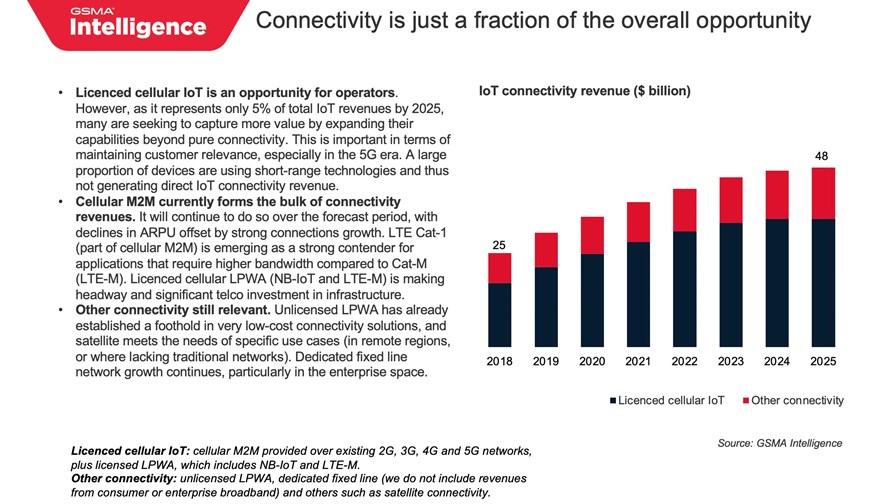

The IoT connectivity services market is set to grow steadily during the next few years to be worth an estimated $48 billion by 2025, according to a new report from GSMA Intelligence. That sounds like a healthy chunk of change, but it represents only a fraction of the overall IoT market opportunity and mobile operators need to get smarter if they’re to capture a bigger share of the pie.

That’s the view of Sylwia Kechiche, Principal Analyst, IoT and Enterprise, at GSMA Intelligence, author of the report, IoT revenue: state of the market 2020.

She notes that if operators want to be considered as IoT partners by enterprises, they will need to develop vertical-specific partnerships and engage with applications developers to develop broader solutions (including, but not limited to, connectivity) that will meet the digital transformation and strategic needs of enterprise users. “Enterprises think in terms of outcomes,” notes Kechiche, and that’s how operators will need to pitch their IoT propositions – how they can help enterprises achieve specific goals, boost productivity, cut costs, increase efficiency, and so on.

If they can do that, then the potential market and revenue opportunity will expand for operators. According to Kechiche’s forecast, overall IoT revenues will be worth $906 billion in 2025, with connectivity accounting for just short of 5% of that total: Applications, platforms and services are due to account for 67% of the overall market, while professional services will make up the remaining 28%.

That overall value has been revised down by Kechiche, from a previous overall value of about $1.1 trillion, with the impact of Covid-19 on enterprise plans and expenditures the main cause of the contraction. (See Kechiche's blog for more insight on the revised forecast.)

But the analyst notes that the majority of enterprises are deploying IoT as part of a broader digital transformation effort, and not as a standalone effort, so while the total market value might be lower than previously expected, it’s still set to grow significantly, from less than $400 billion this year.

That downwards revision also impact the expected revenues in 2025 from IoT connectivity, to $48 billion from $51 billion previously. That still represents healthy growth compared with 2018, as the chart above shows, but the potential opportunity is bigger.

So how can mobile operators pick up a bigger piece of the overall pie? As well as addressing the specific needs of enterprises within their vertical sectors, operators need to make sure their propositions are as simple as possible and address what Kechiche says are the three main challenges for enterprises – integration, security and privacy, and cost.

Some operators are leading the way and showing what can be achieved. Kechiche highlights the IoT strategies of Verizon and Vodafone, which have been developing partnerships that help to make them a more attractive partner to enterprise users, while Telia’s ‘Division X’ has been successful in deriving about a third of its IoT revenues from non-connectivity offerings.

But these appear to be the exceptions: Enterprises do not regard mobile operators as their primary choice of IoT partner (less than 10%, according to GSMA Intelligence research), so as with other potential revenue opportunities that coulddevelop further in the 5G era (private networks being an example), it seems CSPs have a lot of relationship development work to do to win the hearts, minds and wallets of the enterprise community.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.