- Smartphone sales have been significantly affected by global macroeconomics

- The market is believed to have suffered a further decline in shipments during the second quarter of this year

- However, the market’s gloomy days might soon be a thing of the past, according to analysts

After two years of declining sales, the smartphone market finally looks set for some kind of recovery, according to separate market assessments from research houses Canalys and Counterpoint Research.

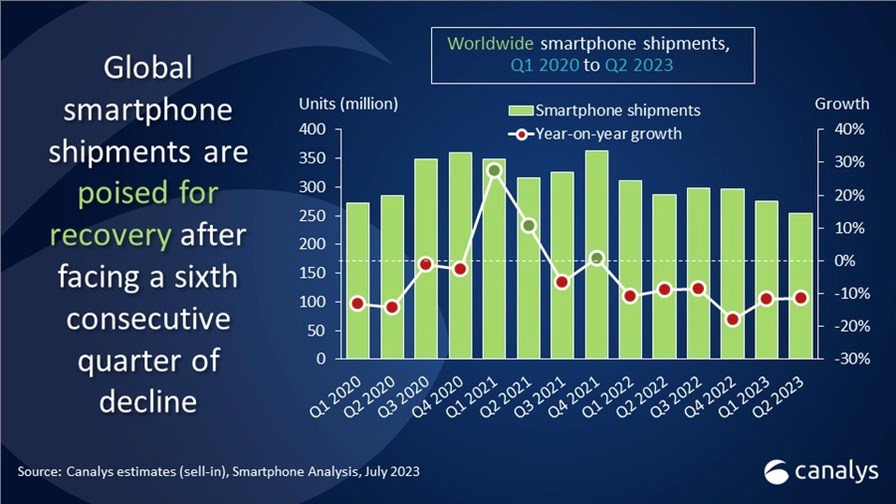

That doesn’t mean an end to the bad news for the mobile handset vendor community, though: The global smartphone market continued to shrink in the second quarter of 2023. Canalys has estimated a year-on-year decline in the volume of shipments of about 11%, and put the total number of devices shipped at around 250 million. That represented the sixth consecutive quarter of year-on-year market contraction.

Source: Canalys

Counterpoint Research’s estimate is that the market suffered an 8% decline in smartphone shipments in the April-to-June quarter, with the research company registering eight consecutive quarters of year-on-year contraction (it doesn’t provide guidance on shipment numbers). The figures vary but the broader picture is clear – and it makes for grim reading.

It has even reached the point where the “gloomy demand” has affected the sector’s leading vendors, such as Samsung and Apple, which had to reduce their ‘sell-in’ (the sale of goods to retail traders prior to public retailing), the analyst team at Canalys explained in its latest smartphone market overview.

Furthermore, all regions have been affected, with sales contracting practically everywhere. Counterpoint Research noted that the largest declines have been witnessed in “relatively more developed markets” such as the US, western Europe and Japan, where smartphone sales have suffered double-digit annual declines.

All is not lost

However, both analyst firms see better times ahead.

Canalys suggested there is a “recovery in sight” and it appears this is not just wishful thinking, as the research firm has seen most vendors’ inventory levels – with the exception of the top two, Samsung and Apple – returning to “healthier levels” while macroeconomic conditions stabilise.

“The smartphone market is sending early signals of recovery after six consecutive quarters of decline since 2022,” noted Canalys analyst Le Xuan Chiew. He added that smartphone inventory “has begun to clear up as smartphone vendors prioritised cutting inventory of old models to make room for new launches.”

Furthermore, in a few key markets, the analyst firm witnessed “growing investments in the channel” in the form of “incentives and targeted marketing campaigns to stimulate consumer demand for new launches, driving channel activity,” Chiew stated.

“There are indications that vendors are preparing for market recovery in the future. They are looking to hedge key component prices to combat potential price hikes, given the present inflationary conditions, leading to the recent increase in component orders. On the other hand, vendors have not stopped investing in manufacturing and have a direct presence in emerging markets like South-east Asia and India, which will be a strong driving force for sustainable growth”, according to the analyst.

Counterpoint Research has come to a similar conclusion, noting that smartphone manufacturer inventory levels have been improving in recent months, giving them the opportunity to “launch and push newer models in the second half [of the year] and attract consumers to upgrade, and accelerate the replacement cycle”.

There is also another sign of recovery – the premium segment (which includes smartphones with a wholesale price upwards of US$600) was identified by Counterpoint Research as the only part of the smartphone sector that witnessed growth during the second quarter, “as the mature consumer is opting for a superior experience, supported by the easy availability of finance options across key geographies.”

The analyst firm estimated that premium devices also made their highest-ever second-quarter contribution to the overall market. Given all this, Counterpoint Research now expects the market to “recover slowly in the coming quarters”.

- Yanitsa Boyadzhieva, Deputy Editor, TelecomTV