Source: IDC

- IDC has published its latest telecom services tracker

- Worldwide telecoms and pay-TV services sector held its value in 2020 at $1.53 trillion

- Research house expects a very slight increase in value this year

- And the forecast offers little hope of significant service revenue increases in the coming years

Anyone hoping the 5G era would help telcos ramp their service revenues and enter a new era of financial prosperity should take a look at the latest global telecom services forecast from IDC and temper their expectations, because the research house expects the overall worldwide market to grow during the next five years, but not by much.

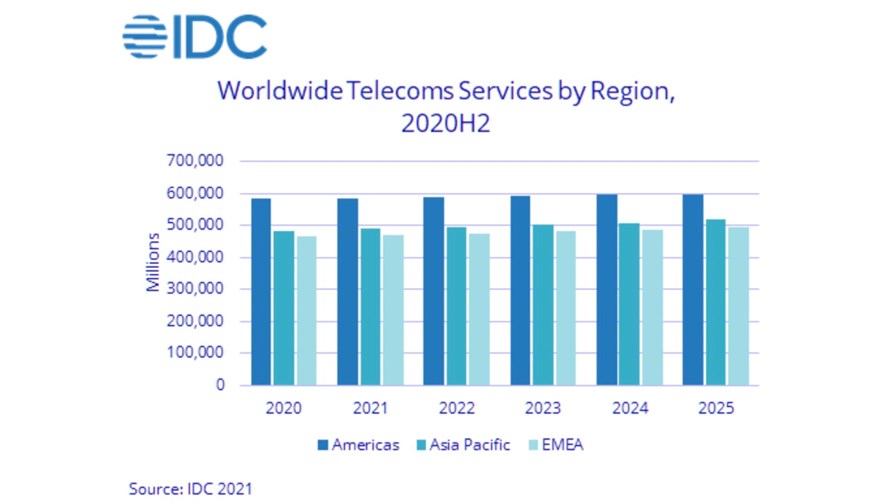

According to IDC, the worldwide market for telecoms and pay-TV services experienced a recovery during the second half of 2020, following the turbulent first half of the year as Covid-19 changed everyone’s lives: That recovery meant the global services market was worth $1.53 trillion last year, the same as in 2019, with the Americas the largest region, accounting for $583 billion in services revenues, 38% of the total market. Asia-Pacific telcos generated $482 billion from services (more than 31% of the total), while those in EMEA generated services sales valued at $471 billion (almost 31% of the total).

For 2021, IDC expects the worldwide market to grow slightly, by 0.7%, to $1.54 trillion, with slight growth during each of the next four years to take the market over the $1.6 trillion mark by 2025. (See the chart above.)

IDC puts a positive spin on this “stable growth” trend. "The COVID-19 pandemic demonstrates the resilience and value of the telecoms industry," noted Chris Barnard, vice president, European Infrastructure and Telecoms, at IDC. "New ways of working will persist beyond the pandemic, shaping future revenue opportunities, while the network-centricity of consumers will drive bandwidth requirements in that segment as well," he added in this press release.

But while on the face of it this isn’t bad news – the market isn’t expected to shrink, at least – is this enough to give the network operators the confidence to invest suitably in their networks, systems, human resources and processes?

There are two ways to look at this, using ‘5G’ as the lens (which is a valid perspective given the industry focus in terms of stated service potential and investment focus).

The first is the ‘glass half full’ view, that service providers are managing to at least grow and that without the benefits of enhanced mobile and fixed broadband services they’d be shrinking and in trouble.

The second (glass half empty) perspective is that a very small level of annual growth in a global market that underpins the strategies of pretty every other vertical sector, enables high-value enterprise and consumer services and now has 5G as a new value creator following significant levels of investment (that are ongoing) should be generating much greater returns on investment and sales growth – if IDC is right, the market is little better than ‘flat’, which isn’t much to get excited about.

So is IDC being too pessimistic? Or realistic? Or even too positive about the service revenue trends of the telcos? The world is now revolving around digital services, yet the traditional suppliers of communications services don’t appear to be the ones that will financially benefit, no matter how much time, effort and money they pump into 5G.

Let’s hope the sector can prove IDC wrong by generating higher levels of services revenue growth and giving some credence to the idea that 5G might actually be a catalyst for new service revenue potential.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.