Global smartphone sales to end-users declined 6.8% in the third quarter of 2021, compared to the same time period in 2020, according to Gartner, Inc. Component shortages disrupted production schedules, leading to lower inventory and delayed product availability, which eventually impacted sales to end-users.

“Despite strong consumer demand, smartphone sales declined due to delayed product launches, longer delivery schedule and insufficient inventory at the channel,” said Anshul Gupta, senior research director at Gartner. “Supply constraints impacted the production schedule of basic and utility smartphones much more than premium smartphones.”

The current shortage of components, such as radio frequency and power management integrated circuits, delayed smartphone production globally. This disrupted the supply-demand equilibrium and end-users were burdened with limited choices at point of sale. Sales of premium smartphones continued to grow even though overall smartphones sales declined in the quarter.

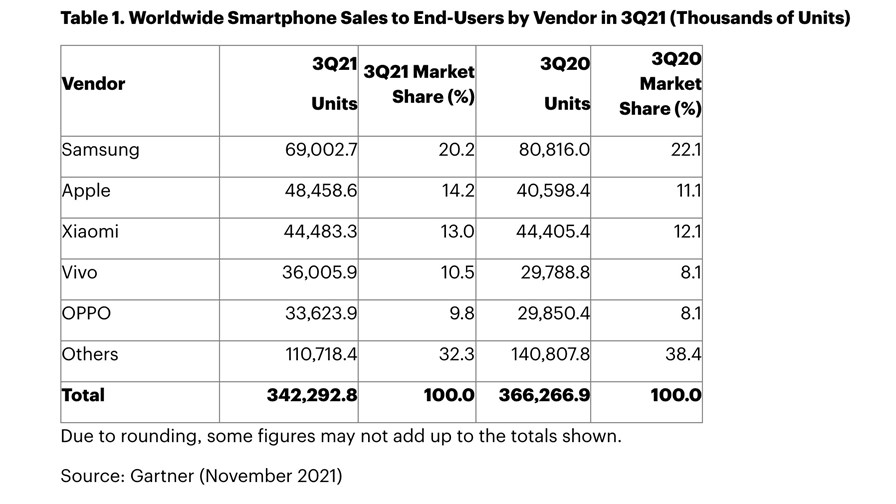

Apple reclaimed the No.2 position in sales to end-users and Xiaomi moved back to No.3 in the third quarter of 2021 (see Table 1). Samsung maintained its overall lead in smartphone sales, though its market share declined 1.9% year-over-year. Even with the overall decline, Samsung experienced growth of its premium smartphones, led by strong demand for revamped foldable smartphones. Chinese smartphone vendors Xiaomi, Vivo and OPPO increased their market share 1%, 2.4% and 1.7% respectively, year-over-year.

Apple continued to experience strong demand for iPhones led by compelling feature upgrades and underpenetrated 5G installed base. Upgraded bionic A15 sensor, improved battery life and camera sensor optimization for improved photography are the leading features that drove iPhone upgrades. Apple continues to revamp its online channel and position trade-in programs to accelerate demand for its 5G iPhones through the rest of 2021.

Xiaomi’s strong online channel-led strategy for market expansion in Europe and the Middle East and partnering with communication service providers (CSPs) in these regions helped the company increase its global smartphone market share in the third quarter of 2021.

Vivo registered the highest year-over-year growth (20.9%) among the top five global smartphone vendors in the third quarter of 2021. The company introduced 13 new smartphones in the quarter to try to gain advantage while entering new markets, including Europe and the Middle East, along with the addition of new offline retailers and experience stores to its strategy.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.