CLAREMONT, NC: Third Quarter Highlights --

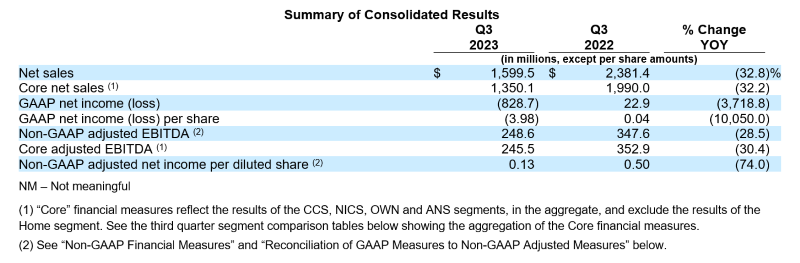

- Net sales of $1.600 billion

- Core net sales of $1.350 billion*

- GAAP net loss of $828.7 million, including asset impairments of $895.1 million

- Non-GAAP adjusted EBITDA of $248.6 million

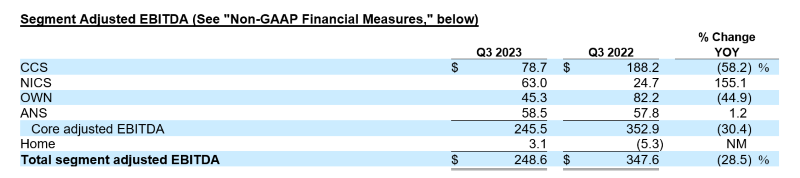

- Core adjusted EBITDA of $245.5 million*

-

Cash flow generated by operations of $138.8 million and non-GAAP adjusted free cash flow of $181.7 million

-

References to certain supplementary “Core” financial measures reflect the results of the Connectivity and Cable Solutions (CCS), Networking, Intelligent Cellular and Security Solutions (NICS), Outdoor Wireless Networks (OWN) and Access Network Solutions segments (ANS), in the aggregate. Core financial measures exclude the results and performance of the Home Networks (Home) segment. See the third quarter segment comparison tables below showing the aggregation of the Core financial measures.

CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, today reported results for the quarter ended September 30, 2023.

“In the third quarter, CommScope net sales declined 33% from the prior year to $1.600 billion and adjusted EBITDA declined 28% to $249 million. As discussed previously, our CCS and OWN businesses have been experiencing lower order rates since the beginning of the year and we have seen no meaningful recovery in the third quarter. In addition to the challenges we have been experiencing in CCS and OWN, we have started to see similar adjustments in ANS. We expect these difficult market conditions to continue over the next few quarters as customers manage inventories and cash. We continue to manage what we can control including costs. We are targeting an additional $100 million cost savings by the end of Q1 2024. Our cost actions this year will better position the Company when demand returns to more normalized levels,” said Chuck Treadway, President and Chief Executive Officer.

“Based on current visibility driven by a weaker demand outlook for the remainder of 2023, we reduced our Core adjusted EBITDA guideposts to a range of $1.00 to $1.05 billion. We continued to de-lever as we repurchased and retired $26 million of our long-term debt for cash consideration of $17 million bringing the total debt repurchases to $111 million since the beginning of the year. We finished the quarter with a net leverage ratio of 6.7x. Liquidity remained strong at more than $1.29 billion including cash at quarter end of $519 million,” said Kyle Lorentzen, Chief Financial Officer.

Impacts of Current Economic Conditions

Macroeconomic factors such as higher interest rates, inflation and concerns about a global economic slow-down have softened demand for CommScope’s products, with certain customers reducing purchases as they right-size their inventories and others pausing capital spending. This has negatively impacted the Company’s net sales in certain segments during the first three quarters of 2023 and may continue to negatively impact net sales during the remainder of 2023 and into the first half of 2024. Conversely, in some of CommScope’s segments, the Company has seen higher demand and favorable pricing impacts that have partially offset the impact of lower demand in its other segments. CommScope is also seeing lower input costs and has proactively implemented cost savings initiatives that have favorably impacted its profitability in 2023.

Third Quarter Results and Comparisons

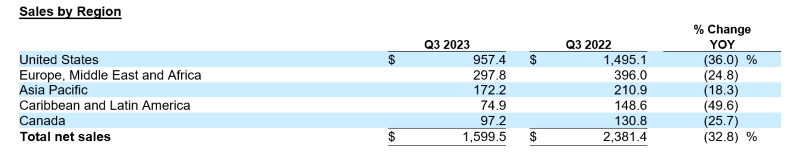

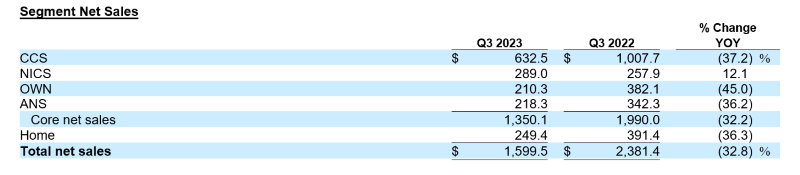

Net sales in the third quarter of 2023 decreased 32.8% year-over-year to $1.600 billion. Core net sales decreased 32.2% year-over-year due to lower net sales in the CCS, OWN and ANS segments, partially offset by stronger sales in the NICS segment. Net sales decreased across all regions in the third quarter of 2023.

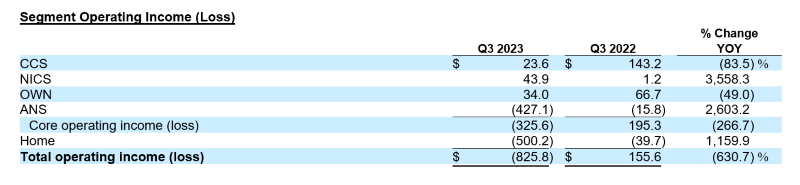

Net loss attributable to common stockholders of $844.2 million, or $(3.98) per share, in the third quarter of 2023, decreased compared to the prior year period's net income attributable to common stockholders of $8.0 million, or $0.04 per share. In the third quarter of 2023, the Company recorded a goodwill impairment charge of $425.9 million related to the ANS reporting unit in the ANS segment and an intangible assets impairment charge of $469.2 million related to the Home segment. Asset impairment charges are not reflected in non-GAAP adjusted results. Non-GAAP adjusted net income for the third quarter of 2023 was $34.0 million, or $0.13 per share, versus $124.6 million, or $0.50 per share, in the third quarter of 2022.

Non-GAAP adjusted EBITDA decreased 28.5% to $248.6 million in the third quarter of 2023 compared to the same period last year. Non-GAAP adjusted EBITDA as a percentage of net sales increased to 15.5% in the third quarter of 2023 compared to 14.6% in the same prior year period. Core segment adjusted EBITDA decreased 30.4% to $245.5 million in the third quarter of 2023 compared to the same prior year period. Core segment adjusted EBITDA as a percentage of net sales increased to 18.2% in the third quarter of 2023 compared to 17.7% in the same prior year period.

Reconciliations of the reported GAAP results to non-GAAP adjusted results are included below.

Third Quarter Comparisons

**

**

**

- CCS - Net sales of $632.5 million decreased 37.2% from the prior year period primarily driven by declines in Network Cable and Connectivity and Building and Data Center Connectivity.

- NICS - Net sales of $289.0 million increased 12.1% from the prior year period primarily driven by growth in Ruckus and Intelligent Cellular Networks.

- OWN - Net sales of $210.3 million decreased 0% from the prior year period primarily driven by declines in Base Station Antennas and HELIAX product sales.

- ANS - Net sales of $218.3 million decreased 36.2% from the prior year period primarily driven by declines in Access Technologies and Converged Network Systems.

- Home - Net sales of $249.4 million decreased 36.3% from the prior year period driven by declines in Broadband Home Solutions and Home Media Solutions. As previously announced, on October 2, 2023, CommScope signed an agreement with Vantiva SA to divest of its Home segment. The transaction is expected to close in the first quarter of 2024.

Cash Flow and Balance Sheet

- GAAP cash flow generated by operations was $138.8 million.

- Non-GAAP adjusted free cash flow was $181.7 million after adjusting operating cash flow for $8.7 million of additions to property, plant and equipment, $40.1 million of cash paid for restructuring costs and $11.5 million of cash paid for transaction, transformation and integration costs.

- The Company ended the quarter with $518.9 million in cash and cash equivalents.

- As of September 30, 2023, the Company had no outstanding borrowings under its asset-based revolving credit facility and had availability of $771.4 million, after giving effect to borrowing base limitations and outstanding letters of credit. The Company ended the quarter with total liquidity of approximately $1,290.3 million.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.