HICKORY, NC:

- ** *Third quarter net sales decreased 3% year-over-year for consolidated company

- ** Core CommScope third quarter net sales increased 6% year-over-year

- ** Momentum builds in Outdoor Wireless Networks and Venue and Campus Networks as net sales increased 31% and 8% year-over-year, respectively **

** Third Quarter Highlights**

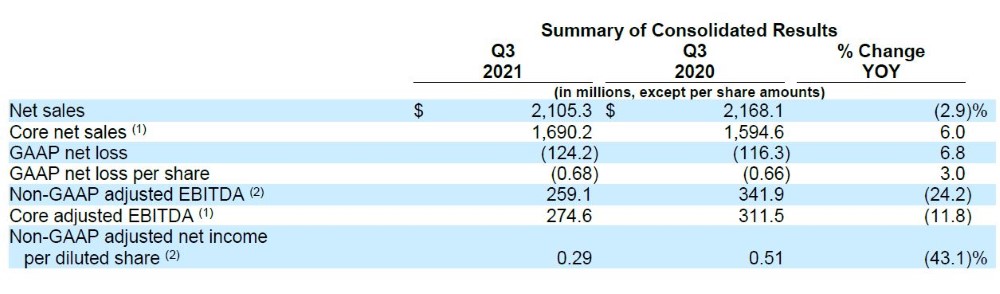

- Net sales of $2.105 billion

- Core net sales of $1.690 billion*

- GAAP net loss of $124.2 million

- Non-GAAP adjusted EBITDA of $259.1 million

- Core adjusted EBITDA of $274.6 million*

-

Cash flow generated by operations of $67.1 million and non-GAAP adjusted free cash flow of $64.3 million

-

References to certain supplementary “Core” financial measures reflect the results of the Broadband Networks, Outdoor Wireless Networks and Venue and Campus Networks segments, in the aggregate. Core financial measures exclude the results and performance of the Home Networks segment. See the third quarter segment comparison tables below showing the aggregation of the Core financial measures.

HICKORY, NC, November 4, 2021 — CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, today reported results for the quarter ended September 30, 2021.

(1) “Core” financial measures reflect the results of the Broadband Networks, Outdoor Wireless Networks and Venue and Campus Networks segments, in the aggregate. Core financial measures exclude the results of the Home Networks segment. See the third quarter segment comparison tables below showing the aggregation of the Core financial measures.

(2) See Description of Non-GAAP Financial Measures and Reconciliation of GAAP Measures to Non-GAAP Adjusted Measures below

“Our third quarter performance and financial results reflect the ongoing challenges associated with the global supply chain disruption, increased costs of materials and freight, and semiconductor chip shortage occurring across our industry and broader economy,” said Chuck Treadway, president and chief executive officer. “While we continue to experience strong demand for CommScope’s products and services, we expect these significant headwinds to persist in the near-term. We are actively and swiftly addressing external pressures and are engaging with our customer base regarding pricing adjustments, as well as operational measures to make up for inflation effects. Our teams remain laser focused on executing on our CommScope NEXT strategy and achieving our goals of incremental growth, cost optimization and shareholder value creation.”

Treadway continued, “I thank our employees for remaining resilient through the continued challenges of the pandemic and operating environment. I am proud of the unwavering support of our team to mitigate these issues and position CommScope for the next level of growth and profitability.”

“While I have only been in my new role as CFO for a week, I am more committed than ever to accelerating the Company’s transformation and driving our success through our CommScope NEXT initiatives,” said Kyle Lorentzen, chief financial officer. “During the third quarter, we continued to make excellent progress on CommScope NEXT, and we now have more than 100 targeted initiatives already underway or ready for implementation. As we continue progressing into the next phase of CommScope NEXT, my priorities will include defining milestone metrics, ensuring CommScope is properly resourced, executing on investment decisions and challenging the team to continue to build upon CommScope NEXT with new, innovative ideas.”

Third Quarter Results and Comparison

In early April 2021, CommScope announced its plan to spin-off the Home Networks business to form a new stand-alone publicly traded company. Also in the second quarter of 2021, management shifted certain product lines from the Company’s Broadband segment to its Home segment to better align with how the business is being managed in light of the planned spin-off of the Home Networks business. All prior period amounts have been recast to reflect these operating segment changes.

In this comparison discussion, reference is made to certain supplementary “Core” financial measures, which reflect the results of the Broadband Networks, Outdoor Wireless Networks and Venue and Campus Networks segments, in the aggregate. Core financial measures exclude the results of the Home Networks segment. These metrics represent the business segments as reported by CommScope. However, the ultimate definition of the Home Networks business that CommScope expects to spin-off may vary, and future results may differ materially.

Reconciliations of the reported GAAP results to non-GAAP adjusted results can be found at https://ir.commscope.com/.

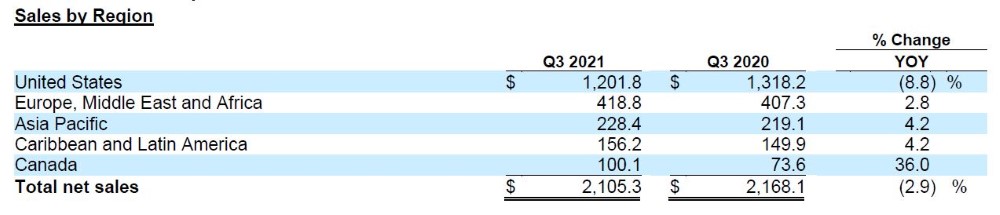

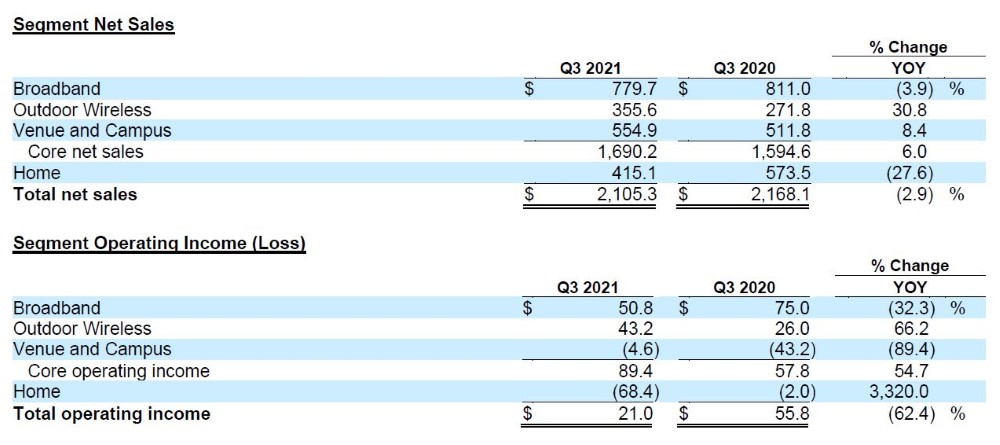

Net sales in the third quarter of 2021 decreased 2.9% year over year to $2.11 billion. Core net sales increased 6.0% year over year primarily due to higher net sales in the Outdoor Wireless Networks and Venue and Campus Networks segments.

Net loss of $(124.2) million, or $(0.68) per share, in the third quarter of 2021, increased 6.8% compared to the prior year period's net loss of $(116.3) million, or $(0.66) per share. Non-GAAP adjusted net income for the third quarter of 2021 was $72.2 million, or $0.29 per share, versus $123.1 million, or $0.51 per share, in the third quarter of 2020.

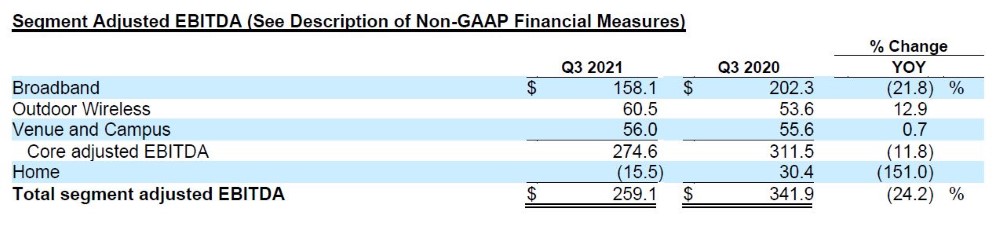

Non-GAAP adjusted EBITDA decreased 24.2% to $259.1 million in the third quarter of 2021 compared to the same period last year. Non-GAAP adjusted EBITDA decreased to 12.3% of net sales in the third quarter of 2021 compared to 15.8% of net sales in the same prior year period. Core segment adjusted EBITDA decreased 11.8% in the third quarter of 2021 and decreased to 16.2% of net sales compared to 19.5% of net sales in the prior year period. The negative impact of COVID-19 on our financial performance has eased somewhat during 2021, with network strain driving increased demand for certain of our Broadband segment products although net sales of these products have been tempered by capacity constraints. The recovery in demand has also had unfavorable business impacts, including commodity inflation (primarily copper and resins), logistics cost increases, extended lead times and certain component part shortages. All of the Company’s segments experienced supply shortages and extended lead times for certain materials that negatively affected our ability to meet customer demand for our products. We expect certain of these unfavorable impacts to continue for the remainder of 2021 and into 2022.

Third Quarter Comparisons

- Net sales of $779.7 million, decreased 3.9% from prior year driven by declines in Access Technologies and Converged Network Solutions, partially offset by growth in Network Cable & Connectivity.

- Net sales of $355.6 million, increased 30.8% from prior year driven by growth in Macro Tower Solutions.

- Net sales of $554.9 million, increased 8.4% from prior year primarily driven by growth in Indoor Copper Enterprise and Indoor Fiber Enterprise, offset by declines in RUCKUS Networks and DAS and Small Cell.

- Net sales of $415.1 million, decreased 27.6% from prior year driven by declines in Home Media Solutions and Broadband Connectivity Devices.

** Cash Flow and Balance Sheet**

-

GAAP cash flow from operations was $67.1 million.

-

Non-GAAP adjusted free cash flow was $64.3 million after adjusting operating cash flow for $36.0 million of additions to property, plant and equipment, $6.9 million of cash paid for restructuring costs and $26.3 million of cash paid for transaction, transformation and integration costs.

-

Ended the quarter with $411.5 million in cash and cash equivalents.

-

As of September 30, 2021, the Company had no outstanding borrowings under its asset-based revolving credit facility and had availability of $686.4 million, after giving effect to borrowing base limitations and outstanding letters of credit. The Company ended the quarter with total liquidity of approximately $1.098 billion.

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.